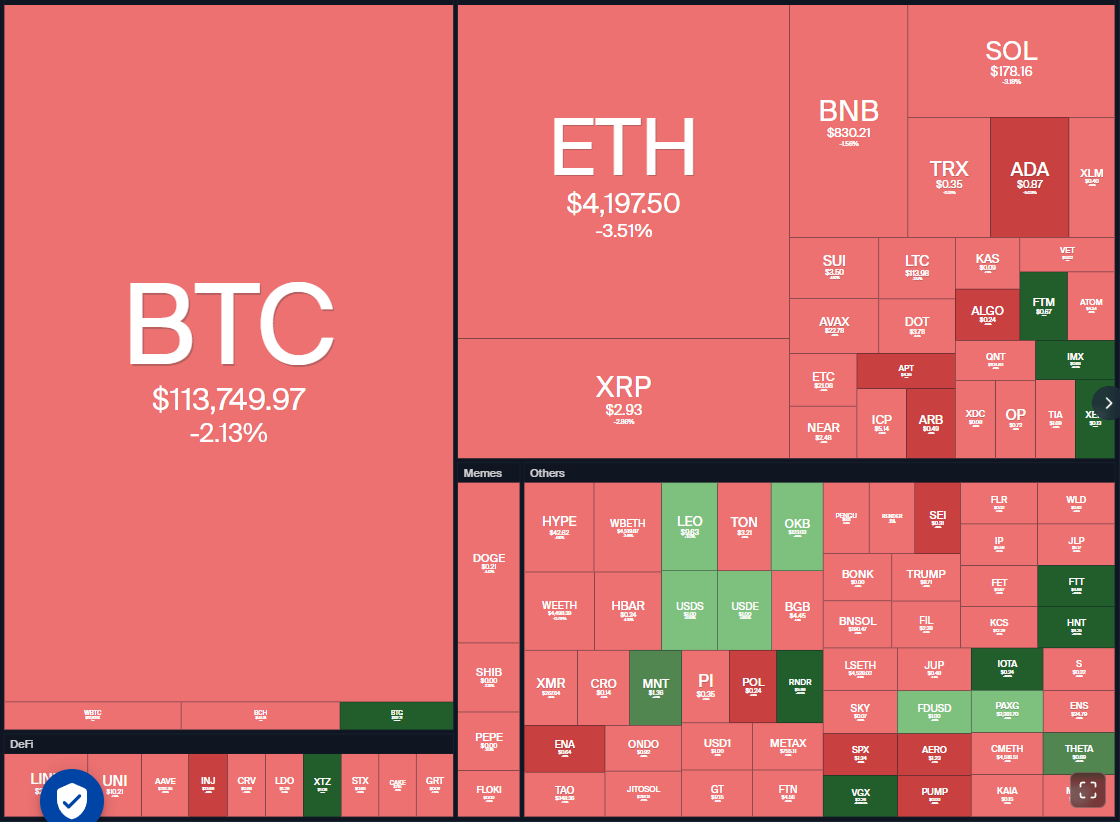

Key factors:

-

Bitcoin dangers falling to $110,530, the place the patrons are anticipated to step in.

-

Bitcoin is approaching a stable assist, and a powerful rebound off it might see patrons return to ETH, BNB, LINK, and MNT.

Bitcoin (BTC) is step by step pulling decrease, indicating revenue reserving by short-term merchants. Bitfinex analysts mentioned in a report on Monday that BTC might stay range-bound till stronger macro catalysts emerge as buyers stay in a wait-and-watch mode.

Whereas some analysts anticipate BTC to drop towards $100,000, X analyst BitQuant thinks in any other case. He mentioned BTC stays heading in the right direction to soar to $145,000 and wouldn’t even come near $100,000.

BTC’s near-term uncertainty has put the brakes on the rallies of a number of altcoins, together with Ether (ETH). Spot ETH exchange-traded funds recorded $196.7 million in outflows, the second-largest every day outflow since launch, in line with SoSoValue knowledge.

Unfazed by the dip, dealer Merlijn mentioned in a publish on X that ETH might surge above $8,000, terming it “a brand new chapter” in ETH’s historical past.

If BTC rebounds off the assist, choose altcoins might shock to the upside. Let’s analyze the charts of the highest 5 cryptocurrencies that look sturdy on the charts within the close to time period.

Bitcoin value prediction

BTC bounced off the neckline of the inverse head-and-shoulders sample on Monday, however the bulls couldn’t clear the overhead hurdle on the 20-day exponential shifting common ($117,032).

The bears resumed promoting on Tuesday and try to keep up the worth under the neckline. In the event that they handle to do this, the BTC/USDT pair might plummet to stable assist at $110,530. Patrons are anticipated to fiercely defend the $110,530 stage as a result of a break under it might speed up promoting. The Bitcoin value might then skid towards $100,000.

The primary signal of energy shall be a break and shut above the 20-day EMA. That implies the promoting stress is lowering. The pair might then climb to $120,000 and finally to the all-time excessive of $124,474.

The 20-EMA is sloping down, and the relative energy index (RSI) is within the damaging territory on the 4-hour chart. That implies the bears have the higher hand within the close to time period. The Bitcoin value might skid to $112,000, which is more likely to act as sturdy assist. If the worth rebounds off $112,000 and breaks above the shifting averages, the pair might type a variety within the brief time period.

Sellers must yank the worth under the $112,000 to $110,530 assist zone to deepen the correction. The pair might stoop to $107,000 after which to $105,000.

Ether value prediction

Ether has pulled again to the breakout stage of $4,094, which is a essential stage to be careful for within the close to time period.

The upsloping shifting averages point out benefit to patrons, however the damaging divergence on the RSI suggests the bullish momentum is weakening. If the worth rebounds off $4,094, the ETH/USDT pair might rise to $4,576 after which to $4,788.

As an alternative, if the worth continues decrease and breaks under $4,094, it indicators that bulls are speeding to the exit. That might sink the Ether value to $3,745 and subsequently to the 50-day easy shifting common ($3,557).

The shifting averages have accomplished a bearish crossover, and the RSI has dipped into the damaging territory on the 4-hour chart, signaling that the bears are trying a comeback. A break and shut under $4,094 might intensify promoting, pulling Ether’s value to $3,875 and, after that, to $3,550.

Quite the opposite, if the worth rebounds off $4,094 and breaks above the 50-SMA, it means that the correction could also be over. The pair might then rally to $4,576.

BNB value prediction

BNB (BNB) is going through resistance within the $861 to $869 zone, however a constructive signal is that the bulls haven’t ceded a lot floor to the bears.

A shallow pullback enhances the prospects of a break above the overhead zone. If that occurs, the BNB value might resume the uptrend to $900 and subsequently to the psychological stage of $1,000.

Sellers are more likely to produce other plans. They are going to attempt to tug the worth under the 20-day EMA ($811). In the event that they do this, the BNB/USDT pair might type a variety within the close to time period. The BNB value might swing between $732 and $869 for some time.

The BNB value has fashioned a symmetrical triangle sample on the 4-hour chart, indicating indecision between the bulls and the bears. A break and shut above the triangle reveals that the patrons have overpowered the sellers. That opens the doorways for a doable rally to the sample goal of $918.

Opposite to this assumption, a drop under the triangle might begin a deeper correction to $812 after which to $794.

Associated: Cardano set for ‘huge’ rally if $1 breaks: How excessive can ADA value go?

Chainlink value prediction

Chainlink (LINK) turned down from the $27 overhead resistance on Monday, indicating revenue reserving by short-term bulls.

The primary assist is at $24 after which on the 20-day EMA ($21.49). A stable rebound off the 20-day EMA indicators shopping for on dips. The bulls will then make yet one more try to beat the barrier at $27. In the event that they succeed, the LINK/USDT pair might surge to $31 and thereafter to $36.

Contrarily, if the worth turns down and breaks under the 20-day EMA, it means that the bulls are dropping their grip. The Chainlink value might tumble towards the 50-day SMA ($17.97), the place the bulls are anticipated to step in.

The bulls try to arrest the pullback on the shifting averages on the 4-hour chart. If the worth rebounds off the shifting averages with energy, the pair might retest the overhead resistance at $27. A break and shut above $27 indicators the resumption of the uptrend.

This constructive view shall be invalidated within the close to time period if the worth turns down and breaks under the 50-SMA. The Chainlink value might then descend to $21, which is a essential stage to be careful for.

Mantle value prediction

Mantle (MNT) has rallied sharply previously few days, indicating aggressive shopping for by the bulls.

The bears tried to halt the rally at $1.42, however they may not pull the worth under $1.20. That implies a constructive sentiment the place each dip is considered as a shopping for alternative. The bulls try to renew the uptrend by pushing the worth above $1.42. If they’ll pull it off, the MNT/USDT pair might soar to $1.67. There’s resistance at $1.51, however it’s more likely to be crossed.

Alternatively, if the worth turns down sharply from $1.42 and breaks under $1.20, it indicators that the bulls are closing their positions in a rush. The Mantle value might then plummet to the 20-day EMA ($1.07).

The pair turned up from the 20-EMA on the 4-hour chart, however the restoration is going through promoting on the overhead resistance of $1.42. If the worth continues decrease and breaks under the 20-EMA, the correction might stretch to the 50-SMA. A brief-term pattern change shall be signaled if the 50-SMA assist cracks. Mantle’s value might then slide to $1.06 and subsequently to $0.93.

Quite the opposite, if the worth turns up and breaks above $1.42, the pair might begin the subsequent leg of the rally to $1.50.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.