Key factors:

-

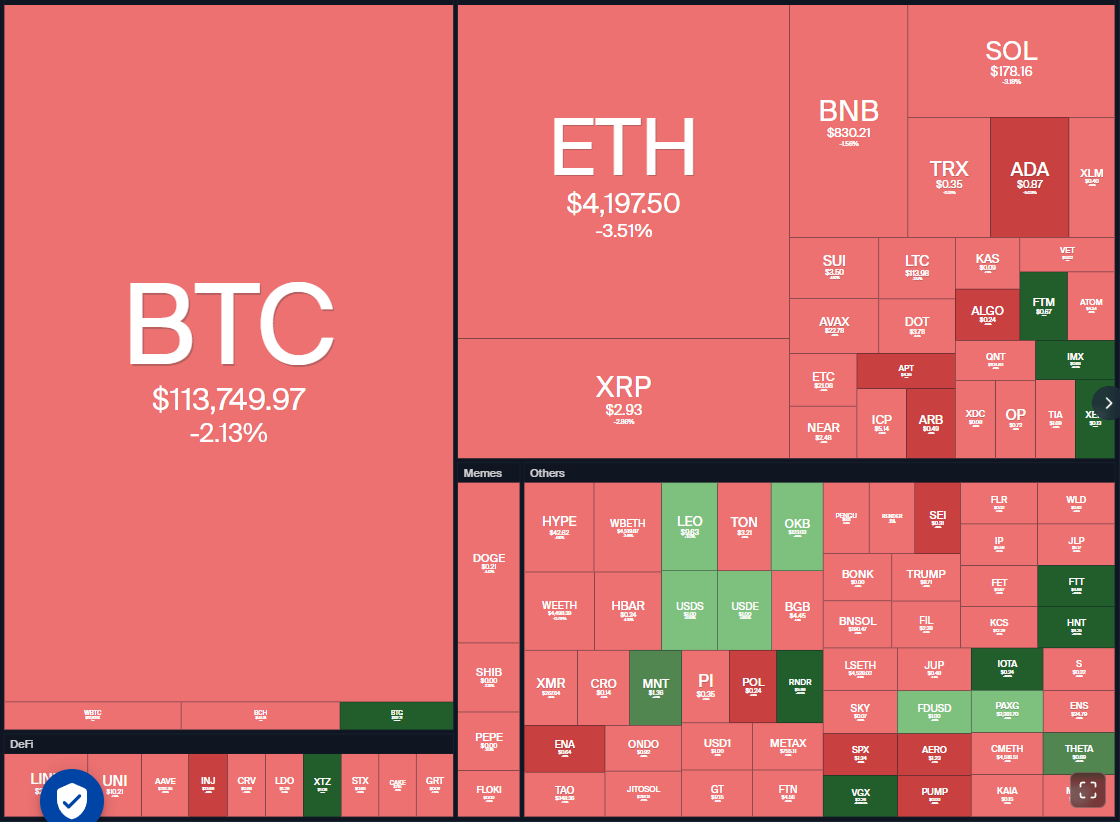

Bitcoin dangers falling to $110,530, the place the consumers are anticipated to step in.

-

Bitcoin is approaching a strong help, and a robust rebound off it may see consumers return to ETH, BNB, LINK, and MNT.

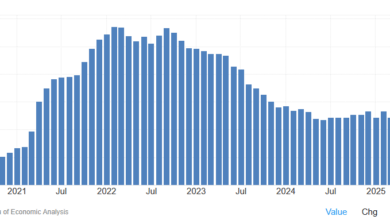

Bitcoin (BTC) is step by step pulling decrease, indicating revenue reserving by short-term merchants. Bitfinex analysts stated in a report on Monday that BTC may stay range-bound till stronger macro catalysts emerge as traders stay in a wait-and-watch mode.

Whereas some analysts count on BTC to drop towards $100,000, X analyst BitQuant thinks in any other case. He stated BTC stays on course to soar to $145,000 and wouldn’t even come near $100,000.

BTC’s near-term uncertainty has put the brakes on the rallies of a number of altcoins, together with Ether (ETH). Spot ETH exchange-traded funds recorded $196.7 million in outflows, the second-largest each day outflow since launch, in keeping with SoSoValue knowledge.

Unfazed by the dip, dealer Merlijn stated in a publish on X that ETH may surge above $8,000, terming it “a brand new chapter” in ETH’s historical past.

If BTC rebounds off the help, choose altcoins may shock to the upside. Let’s analyze the charts of the highest 5 cryptocurrencies that look sturdy on the charts within the close to time period.

Bitcoin worth prediction

BTC bounced off the neckline of the inverse head-and-shoulders sample on Monday, however the bulls couldn’t clear the overhead hurdle on the 20-day exponential shifting common ($117,032).

The bears resumed promoting on Tuesday and are attempting to keep up the value beneath the neckline. In the event that they handle to do this, the BTC/USDT pair may plummet to strong help at $110,530. Consumers are anticipated to fiercely defend the $110,530 stage as a result of a break beneath it may speed up promoting. The Bitcoin worth could then skid towards $100,000.

The primary signal of energy shall be a break and shut above the 20-day EMA. That implies the promoting stress is decreasing. The pair could then climb to $120,000 and finally to the all-time excessive of $124,474.

The 20-EMA is sloping down, and the relative energy index (RSI) is within the damaging territory on the 4-hour chart. That implies the bears have the higher hand within the close to time period. The Bitcoin worth may skid to $112,000, which is more likely to act as sturdy help. If the value rebounds off $112,000 and breaks above the shifting averages, the pair may kind a spread within the quick time period.

Sellers should yank the value beneath the $112,000 to $110,530 help zone to deepen the correction. The pair could stoop to $107,000 after which to $105,000.

Ether worth prediction

Ether has pulled again to the breakout stage of $4,094, which is a vital stage to be careful for within the close to time period.

The upsloping shifting averages point out benefit to consumers, however the damaging divergence on the RSI suggests the bullish momentum is weakening. If the value rebounds off $4,094, the ETH/USDT pair may rise to $4,576 after which to $4,788.

As a substitute, if the value continues decrease and breaks beneath $4,094, it alerts that bulls are speeding to the exit. That might sink the Ether worth to $3,745 and subsequently to the 50-day easy shifting common ($3,557).

The shifting averages have accomplished a bearish crossover, and the RSI has dipped into the damaging territory on the 4-hour chart, signaling that the bears try a comeback. A break and shut beneath $4,094 may intensify promoting, pulling Ether’s worth to $3,875 and, after that, to $3,550.

Quite the opposite, if the value rebounds off $4,094 and breaks above the 50-SMA, it means that the correction could also be over. The pair could then rally to $4,576.

BNB worth prediction

BNB (BNB) is dealing with resistance within the $861 to $869 zone, however a constructive signal is that the bulls haven’t ceded a lot floor to the bears.

A shallow pullback enhances the prospects of a break above the overhead zone. If that occurs, the BNB worth may resume the uptrend to $900 and subsequently to the psychological stage of $1,000.

Sellers are more likely to produce other plans. They’ll attempt to drag the value beneath the 20-day EMA ($811). In the event that they do this, the BNB/USDT pair may kind a spread within the close to time period. The BNB worth may swing between $732 and $869 for some time.

The BNB worth has shaped a symmetrical triangle sample on the 4-hour chart, indicating indecision between the bulls and the bears. A break and shut above the triangle reveals that the consumers have overpowered the sellers. That opens the doorways for a attainable rally to the sample goal of $918.

Opposite to this assumption, a drop beneath the triangle may begin a deeper correction to $812 after which to $794.

Associated: Cardano set for ‘huge’ rally if $1 breaks: How excessive can ADA worth go?

Chainlink worth prediction

Chainlink (LINK) turned down from the $27 overhead resistance on Monday, indicating revenue reserving by short-term bulls.

The primary help is at $24 after which on the 20-day EMA ($21.49). A strong rebound off the 20-day EMA alerts shopping for on dips. The bulls will then make another try to beat the barrier at $27. In the event that they succeed, the LINK/USDT pair may surge to $31 and thereafter to $36.

Contrarily, if the value turns down and breaks beneath the 20-day EMA, it means that the bulls are shedding their grip. The Chainlink worth may tumble towards the 50-day SMA ($17.97), the place the bulls are anticipated to step in.

The bulls are attempting to arrest the pullback on the shifting averages on the 4-hour chart. If the value rebounds off the shifting averages with energy, the pair may retest the overhead resistance at $27. A break and shut above $27 alerts the resumption of the uptrend.

This constructive view shall be invalidated within the close to time period if the value turns down and breaks beneath the 50-SMA. The Chainlink worth may then descend to $21, which is a vital stage to be careful for.

Mantle worth prediction

Mantle (MNT) has rallied sharply previously few days, indicating aggressive shopping for by the bulls.

The bears tried to halt the rally at $1.42, however they may not pull the value beneath $1.20. That implies a constructive sentiment the place each dip is seen as a shopping for alternative. The bulls are attempting to renew the uptrend by pushing the value above $1.42. If they’ll pull it off, the MNT/USDT pair may soar to $1.67. There’s resistance at $1.51, however it’s more likely to be crossed.

Alternatively, if the value turns down sharply from $1.42 and breaks beneath $1.20, it alerts that the bulls are closing their positions in a rush. The Mantle worth may then plummet to the 20-day EMA ($1.07).

The pair turned up from the 20-EMA on the 4-hour chart, however the restoration is dealing with promoting on the overhead resistance of $1.42. If the value continues decrease and breaks beneath the 20-EMA, the correction may stretch to the 50-SMA. A brief-term development change shall be signaled if the 50-SMA help cracks. Mantle’s worth may then slide to $1.06 and subsequently to $0.93.

Quite the opposite, if the value turns up and breaks above $1.42, the pair may begin the subsequent leg of the rally to $1.50.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.