US funding adviser Two Prime has partnered with staking infrastructure supplier Figment to supply institutional purchasers entry to cryptocurrency yield alternatives — highlighting the rising institutional shift towards blockchain-based yield methods.

By way of the partnership, Two Prime’s institutional purchasers will achieve entry to yield methods for Bitcoin (BTC) and greater than 40 different digital asset protocols, together with Ethereum, Solana, Avalanche and Hyperliquid, the businesses introduced Tuesday.

Two Prime, a crypto-native funding adviser registered with the US Securities and Trade Fee, manages roughly $1.75 billion in belongings and operates one of many trade’s bigger Bitcoin lending companies.

In July, Bitcoin miner MARA Holdings acquired a minority stake in Two Prime, considerably rising the quantity of BTC the agency manages on its behalf.

A number of blockchain corporations are turning to Bitcoin yield, in search of to faucet the underutilized potential of the $2.3 trillion asset. Solv Protocol has launched a structured vault system designed to generate BTC yield via a mixture of decentralized and conventional finance methods.

Bitcoin-focused DeFi startup BOB has raised $21 million to additional broaden Bitcoin yield alternatives utilizing hybrid fashions.

Coinbase has additionally entered the house with its new Bitcoin Yield Fund, concentrating on non-US traders with returns of as much as 8%. The trade mentioned the fund was launched “to handle the rising institutional demand for bitcoin yield.”

Associated: Bitcoin yield demand booming as establishments search liquidity — Solv CEO

Institutional adoption fuels rising demand for Bitcoin yield

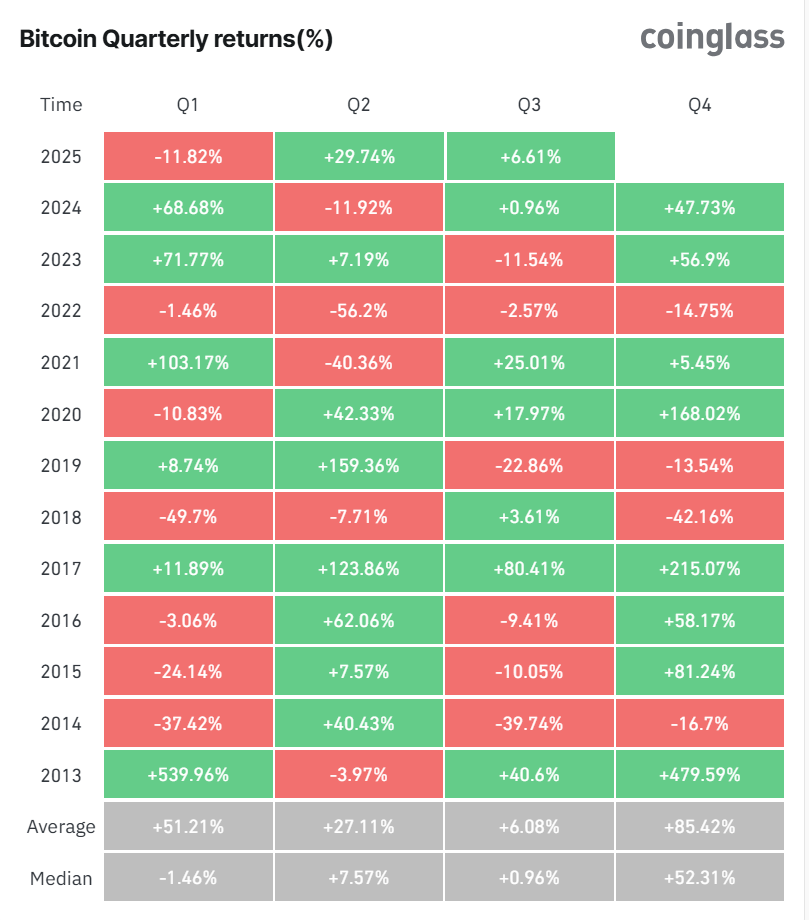

Bitcoin’s outsized historic returns are pushing extra traders towards yield methods that generate revenue on in any other case idle holdings.

As hedge funds, household workplaces and asset managers transfer into BTC, they more and more search publicity that additionally delivers predictable returns. In contrast to crypto-native “diamond arms,” establishments view Bitcoin as a part of a diversified portfolio — the place yield is a desired or anticipated element.

Javier Rodríguez-Alarcon, chief funding officer of digital asset supervisor XBTO, mentioned in June that Bitcoin’s maturation as an asset class “requires refined options that transcend easy publicity.”

Rodriguez-Alarcon’s agency partnered with Arab Financial institution Switzerland to supply wealth administration purchasers a Bitcoin yield product that generates returns by promoting BTC choices and accumulating further holdings throughout market dips.

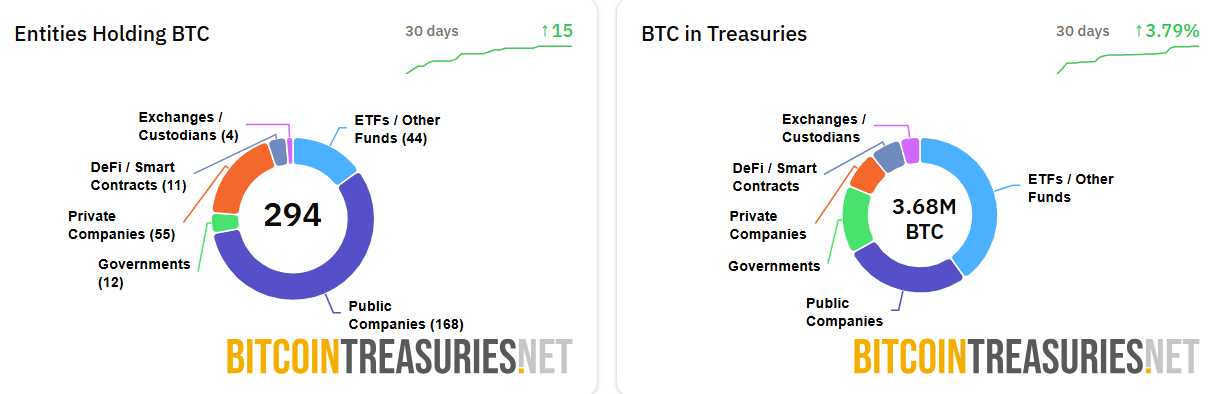

Bitcoin yield methods may achieve additional traction as extra firms add the asset to their steadiness sheets. Private and non-private firms collectively maintain about 1.509 million BTC, in accordance with trade trackers.

Associated: VC Roundup: Bitcoin DeFi surges, however tokenization and stablecoins achieve steam