Key takeaways

-

Distant employees and digital nomads can now pay hire in Bitcoin throughout main cities and coastal hubs.

-

Blockchain-powered rental platforms and sensible contracts simplify lease administration, cut back disputes, and allow safe, near-instant settlements.

-

Tenants and landlords can select direct or oblique Bitcoin funds, with stablecoins, intermediaries or escrow providers serving to mitigate volatility and compliance dangers.

-

Cities like Miami, Lisbon, Berlin, Toronto and Paris lead the development, whereas hotspots like El Zonte and Rosario showcase how Bitcoin leases are increasing worldwide.

Paying hire with Bitcoin (BTC) is not only a idea, due to technological developments and adoption. For distant employees and nomads, it has change into a sensible choice to pay for rental property in cities around the globe. From main monetary facilities to crypto-friendly coastal cities, extra landlords and property managers settle for digital currencies as a handy cost methodology.

Whether or not you’re a digital nomad or distant employee, or somebody avoiding conventional banking challenges, these cities make renting with Bitcoin simple. Due to blockchain-based clear rental platforms and automatic sensible contracts, paying hire in Bitcoin supplies velocity, flexibility and world accessibility.

This text explains the explanation why paying hire in Bitcoin has change into standard. It discusses the highest 5 cities the place Bitcoin leases have change into socially acceptable. It additionally talks in regards to the locations which were within the information concerning crypto-backed leases and tells easy methods to discover and safe them.

Why paying hire in Bitcoin is gaining reputation

As cryptocurrencies acquire mainstream acceptance, Bitcoin is rising instead cost possibility past simply buying and selling and investing. Renting property with Bitcoin is changing into engaging to each tenants and landlords, due to its benefits:

-

Rise of blockchain-powered property administration: Rental platforms built-in with blockchain-based sensible contracts automate lease agreements, streamline funds and cut back disputes, making transactions clear and safe.

-

Close to-instant settlements: Bitcoin allows near-instant settlements with out delays or banking charges (although customers pay a fuel charge for Bitcoin transactions). It’s invaluable for worldwide tenants and property house owners managing cross-border properties.

-

Keep away from expensive forex conversions: Paying hire in Bitcoin helps you put aside costly conversions in fiat currencies. In keeping with YCharts, the common value of a Bitcoin transaction was $1.064 on July 27, 2025.

However the advantages, bearing in mind Bitcoin’s fluctuating worth and jurisdictional legal guidelines is necessary for tenants and landlords.

Do you know? Blockchain-based leases cut back disputes by timestamping funds and automating phrases, constructing belief between landlords and tenants globally.

Direct and oblique Bitcoin cost for leases

Relying on the area, hire might be paid instantly or not directly in Bitcoin.

-

In direct crypto funds, the tenant sends Bitcoin (or one other cryptocurrency) on to the owner’s digital pockets. The cost stays in cryptocurrency until the owner later converts it to fiat forex. This methodology is quick, has low charges and is totally decentralized, however each events face dangers from value fluctuations and potential tax problems.

-

In oblique crypto funds, a third-party service like BitPay, Coinbase Commerce or a rental platform handles the transaction. The tenant pays in cryptocurrency, however the landlord receives fiat forex (reminiscent of USD or EUR). This protects landlords from value volatility and simplifies monetary record-keeping whereas permitting tenants to make use of digital currencies.

Direct funds provide higher independence and go well with conditions the place each events are snug with cryptocurrency and the native legal guidelines totally help such transactions. Oblique funds, nonetheless, cut back regulatory challenges and are extra handy for landlords unfamiliar with digital belongings.

Do you know? World co-living networks focusing on crypto professionals now settle for Bitcoin, offering versatile housing for folks avoiding conventional financial institution setups.

High 5 cities for paying leases in Bitcoin

The prospect of paying hire with Bitcoin is changing into a actuality in an growing variety of cities worldwide. Listed here are the highest 5 city facilities which are main the cost in Bitcoin rental adoption:

1. Miami, Florida, United States

Taking part in host to the Bitcoin Convention every year, Miami is a metropolis the place crypto has the help of native management. Former mayor Francis Suarez even opted to obtain his municipal wage in Bitcoin. A number of luxurious apartment builders and condo tasks, reminiscent of The Rider Residences in Wynwood, settle for cryptocurrency funds for purchases. In April 2025, a crypto transaction occurred for a unit there instantly between digital wallets.

Though devoted rental platforms aren’t widespread, tenants can nonetheless negotiate with landlords if month-to-month hire funds in Bitcoin are acceptable. In Downtown, Brickell, or Wynwood, choose properties could also be accessible for Bitcoin-based leases.

2. Lisbon, Portugal

Since new guidelines concerning crypto-backed buy and sale of property have been launched in April 2022, there was a transparent set of procedures. There’s a rising digital‑nomad community centered in Lisbon, and crypto providers designed to help them are growing.

As reported on July 12, 2025, RentRemote partnered with BitPay to simply accept cryptocurrency as hire cost. Whereas most transactions nonetheless convert Bitcoin to euros for authorized settlement, many property sellers, builders and businesses are open to accepting crypto.

Property leases in Bitcoin could also be accessible in Lisbon’s prime neighborhoods like Chiado, Alfama and the startup districts. Tenants paying in Bitcoin often work through notaries or brokers that deal with conversion and compliance, making hire in Bitcoin possible the place each events agree.

3. Berlin, Germany

Berlin has a progressive actual property sector that facilitates oblique Bitcoin rental adoption in a number of circumstances. Flatio, a European brief‑time period rental service, accepts Bitcoin funds in Berlin for stays lasting one to 6 months, although modest service charges could apply.

Since April 1, 2023, Germany’s Cash Laundering Act has prohibited direct crypto-based property purchases. Nonetheless, renting stays attainable when events agree to make use of middleman providers that convert Bitcoin to euros earlier than cost clears. Berlin continues to draw tenants preferring flexibility concerning funds.

4. Toronto, Ontario, Canada

Canada’s property panorama is step by step embracing Bitcoin. Some rental platforms in Toronto have enabled Bitcoin hire funds, letting tenants pay in Bitcoin whereas landlords obtain fiat through trade providers.

Residents can ebook providers, dinners, and hire utilizing crypto all through town. Whereas instantly accepting Bitcoin as hire should still be a distinct segment, the infrastructure exists to help crypto-savvy tenants. Some providers deal with conversion, invoices, and clear transaction flows.

5. Paris, France

Paris is quick catching up with crypto hotspots to facilitate crypto-based leases. Businesses like Lodgis, which specialise in furnished and short-term leases, have provided purchasers the choice to pay company charges in Bitcoin since 2014.

There are actual property platforms that allow lease agreements or property gross sales in France utilizing Bitcoin, making certain compliance by means of PSAN‑licensed companions and notaries. Whereas full hire‑in‑Bitcoin leases are uncommon, tenants and landlords can typically discover workable choices.

Do you know? For expats and nomads, Bitcoin leases simplify transferring throughout borders by eliminating the necessity for native financial institution accounts or forex conversions.

Paying hire in Bitcoin? Actual property adopts crypto from El Zonte to Rosario

Individuals are more and more getting open to utilizing digital belongings like Bitcoin and Ether (ETH) for hire and deposits, signaling a big shift in how actual property transactions are performed.

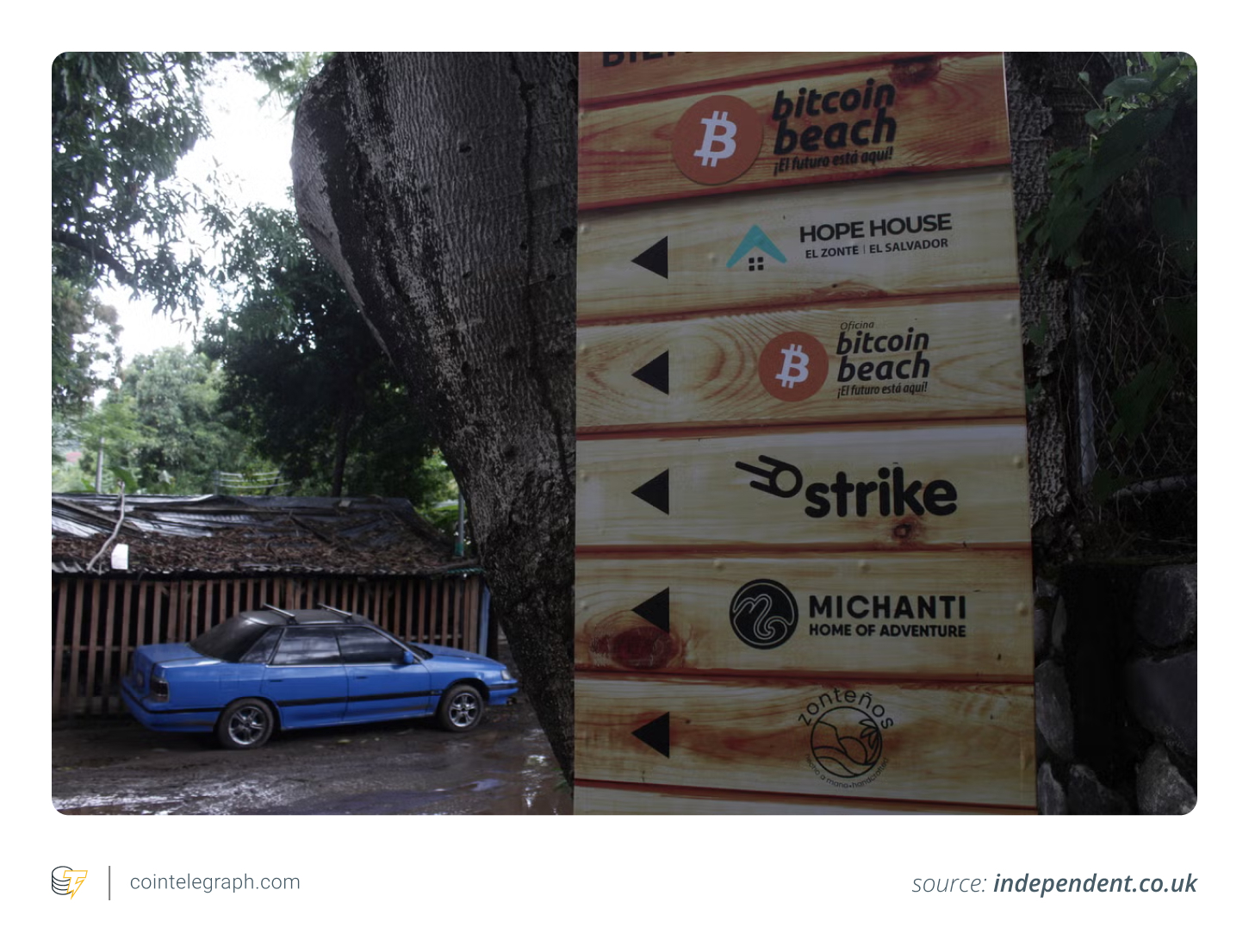

El Zonte, El Salvador

El Zonte, referred to as “Bitcoin Seashore” in El Salvador, pioneered community-wide Bitcoin adoption, influencing the nation’s 2021 resolution to make Bitcoin authorized tender. At the moment, studios or boutique flats close to the seashore might be rented with cost in Bitcoin or some other acceptable cryptocurrency.

Ocean-view properties with Bitcoin cost choices can be found. Regardless of its modest infrastructure, this energetic surf city continues to attract crypto-savvy digital nomads in search of a Bitcoin-integrated life-style.

Rosario, Santa Fe, Argentina

In early 2024, Rosario, Argentina’s third-largest metropolis, hosted the nation’s first rental settlement denominated in Bitcoin. Beneath this groundbreaking lease, the tenant agreed to pay the equal of $100 monthly in Bitcoin, facilitated by the native crypto platform Fiwind, which transformed USDT (USDT) to Bitcoin and transferred it to the owner’s pockets.

This milestone adopted pro-crypto reforms by President Javier Milei’s administration, which, by means of a December 2023 deregulation decree, allowed contracts in Bitcoin and different cryptocurrencies. Nonetheless, the Argentine Congress didn’t approve the president’s crypto reforms, which have been dropped. Argentina continues to deal with crypto beneath its normal tax laws, with out the deregulated regime Milei initially envisioned.

Easy methods to discover and safe Bitcoin-friendly leases

You should utilize crypto actual property platforms and native blockchain-based rental apps for locating leases that settle for Bitcoin and different cryptocurrencies.

Some businesses or landlords could provide reductions to long-term tenants who pay with Bitcoin or stablecoins. Throughout negotiations, verify conversion charges, cost schedules and whether or not hire is tied to a selected cryptocurrency.

For safety, chances are you’ll use escrow providers, which maintain funds till each events meet the agreed phrases, decreasing the danger of fraud. At all times confirm the owner’s credibility by means of references or property paperwork, as cryptocurrency transactions can’t be reversed. The place possible, use sensible contracts to automate funds and defend each events.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.