Key factors:

-

Bitcoin promoting stress will increase as US shares dip on the Wall Avenue open.

-

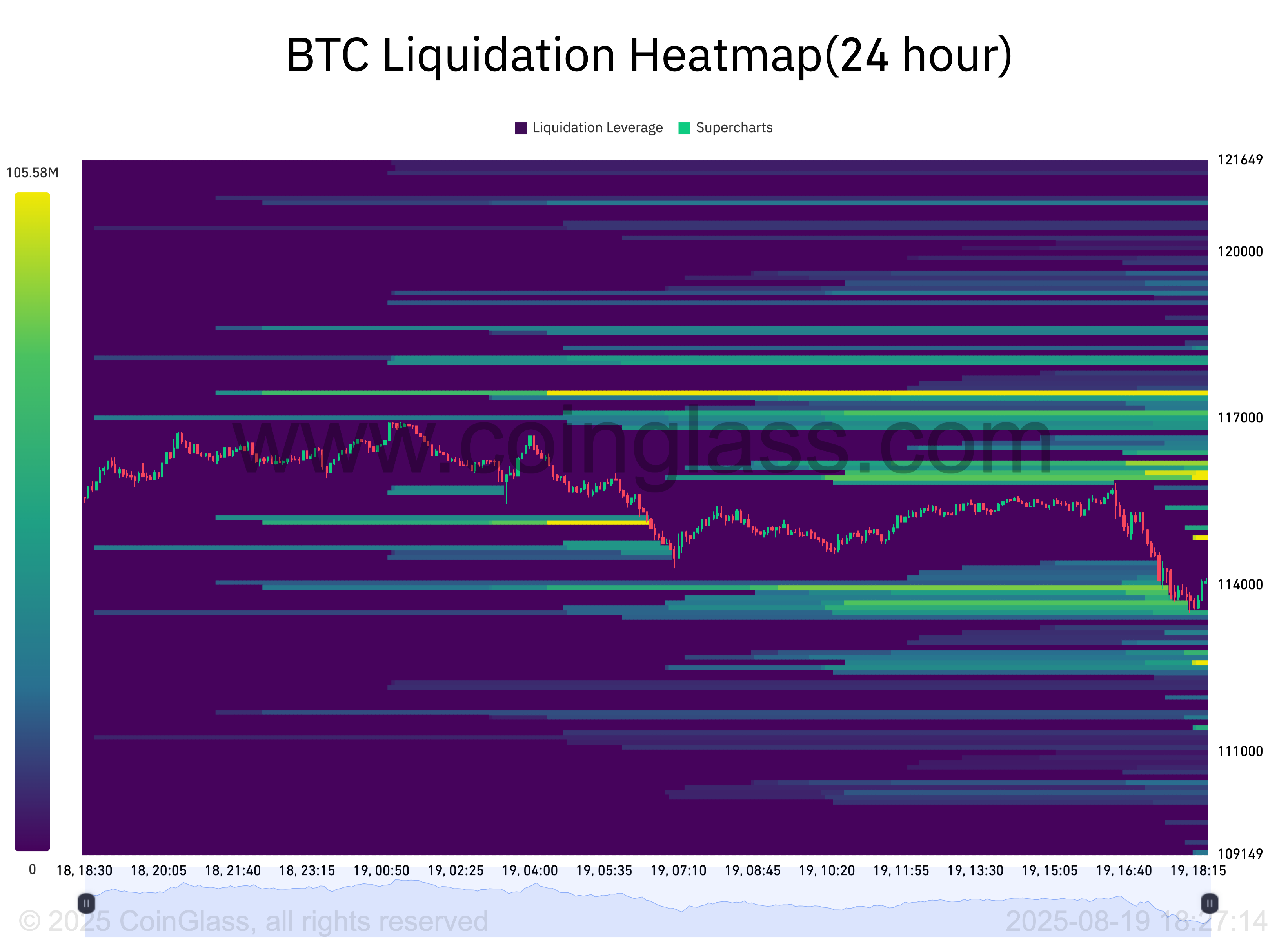

BTC worth nearly hits $113,500 as over $100 million in longs will get liquidated in an hour.

-

ETF flows at the moment are key as onchain fundamentals begin “weakening.”

Bitcoin (BTC) fell to close two-week lows at Tuesday’s Wall Avenue open as US promoting stress surged.

BTC worth motion “not an indication of energy”

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD dropping beneath $114,000.

Bitcoin and altcoins fell with US shares, with the Nasdaq Composite Index down 1.2% on the time of writing.

Lengthy BTC positions, topic to an ongoing squeeze, added one other $116 million to their liquidation tally in an hour.

Information from CoinGlass additionally confirmed bids lining up across the $112,000 mark — already a focal point for market members.

“TLDR: The $107k – $110k vary is coming into focus,” Keith Alan, cofounder of buying and selling useful resource Materials Indicators, summarized in a part of his newest publish on X.

“This isn’t an indication of energy for $BTC. The downward stress is palpable, however bulls are looking for their footing.”

Alan flagged the 100-day easy transferring common (SMA) at $110,950 as a possible assist barrier, with the 50-day counterpart at $115,875 now essential to reclaim.

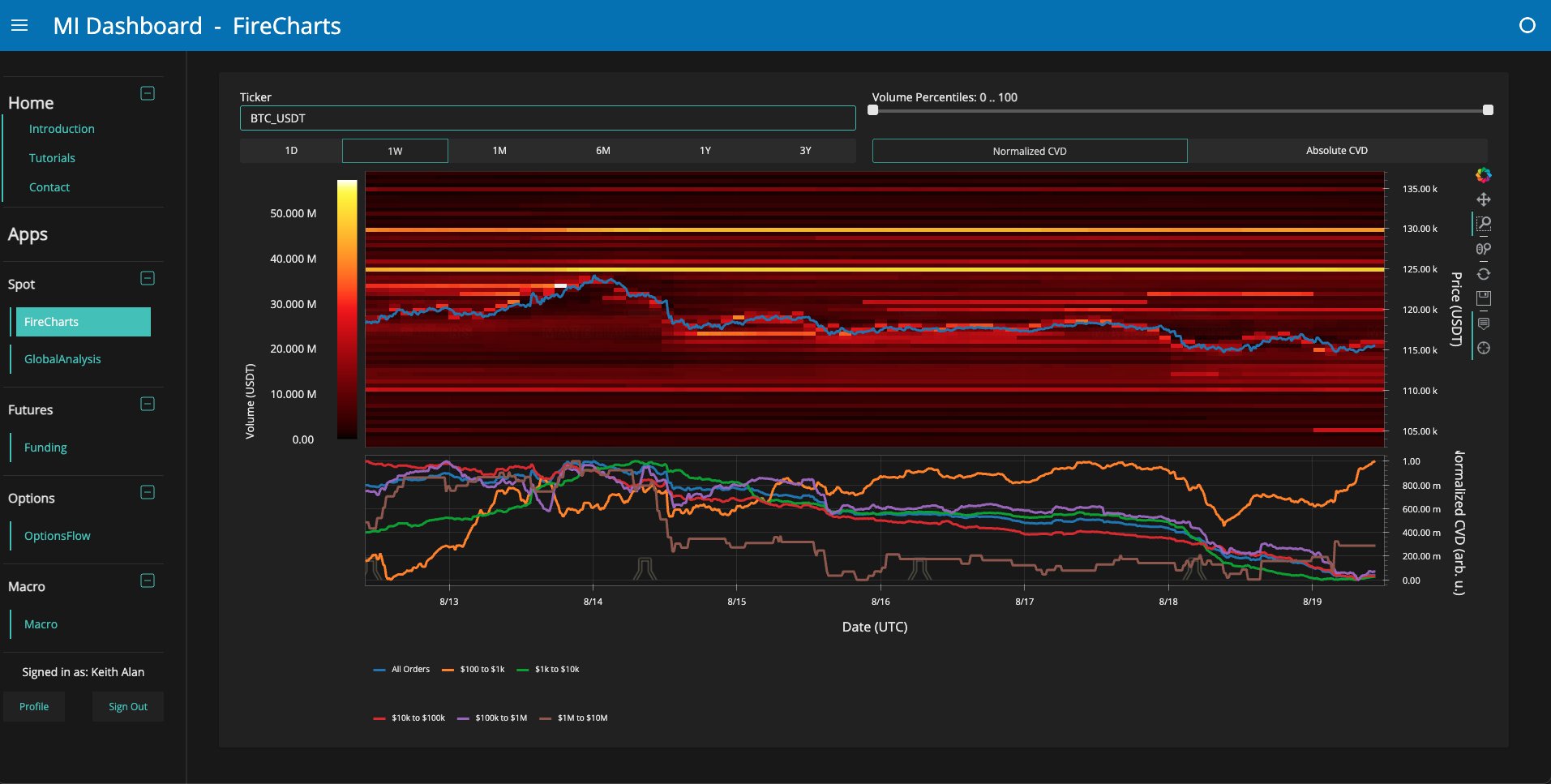

On alternate order books, Materials Indicators recognized a $25 million band of liquidity at $105,000 — “plunge safety” towards a deeper market rout.

“This bid liquidity doesn’t appear like it goals to get stuffed. It was positioned to heard liquidity upward. If it fails to perform that and worth reverts, I count on it to get rugged or moved earlier than it will get stuffed,” it commented alongside a chart of liquidity and whale order quantity.

Bitcoin ETF demand within the highlight

Within the newest version of its Market Pulse updates, onchain analytics agency Glassnode in the meantime highlighted a rising divergence between institutional demand and worth motion.

Associated: Bitcoin received’t go under $100K ‘this cycle’ as $145K goal stays: Analyst

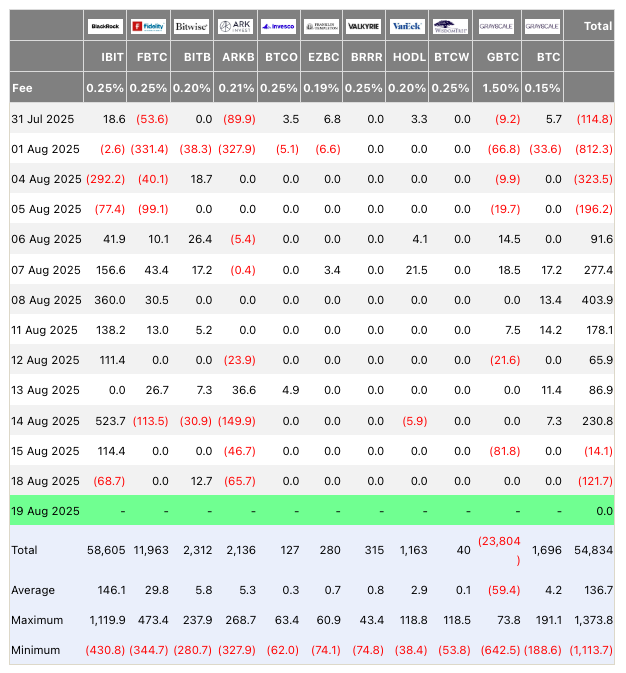

Funding automobiles, notably the US spot Bitcoin exchange-traded funds (ETFs), had been seeing inflows regardless of “weakening” onchain alerts resembling quantity.

“With profit-taking on the rise, the sustainability of institutional flows and renewed purchaser conviction in each spot and futures will decide whether or not this contraction stabilizes into contemporary upward momentum or extends into deeper consolidation,” it reported.

The ETFs recorded a internet outflow of $121 million on Monday, per knowledge from UK funding agency Farside Buyers. The most important ETF providing, BlackRock’s iShares Bitcoin Belief (IBIT), noticed its first outflows since Aug. 5.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.