Key factors:

-

Bitcoin promoting stress will increase as US shares dip on the Wall Road open.

-

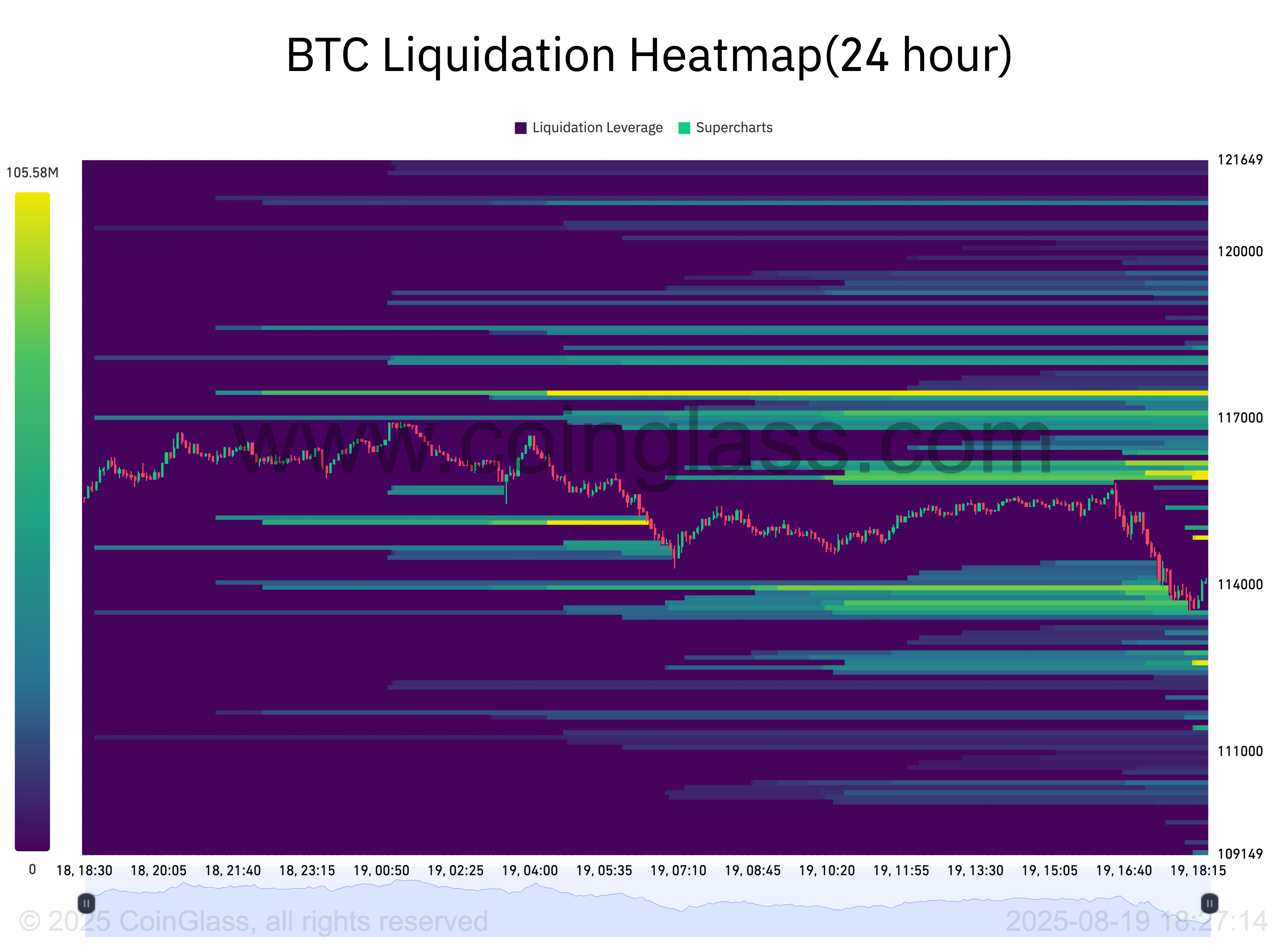

BTC value virtually hits $113,500 as over $100 million in longs will get liquidated in an hour.

-

ETF flows are actually key as onchain fundamentals begin “weakening.”

Bitcoin (BTC) fell to close two-week lows at Tuesday’s Wall Road open as US promoting stress surged.

BTC value motion “not an indication of power”

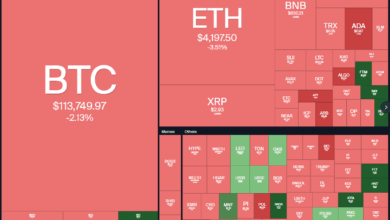

Information from Cointelegraph Markets Professional and TradingView confirmed BTC/USD dropping beneath $114,000.

Bitcoin and altcoins fell with US shares, with the Nasdaq Composite Index down 1.2% on the time of writing.

Lengthy BTC positions, topic to an ongoing squeeze, added one other $116 million to their liquidation tally in an hour.

Information from CoinGlass additionally confirmed bids lining up across the $112,000 mark — already a focal point for market individuals.

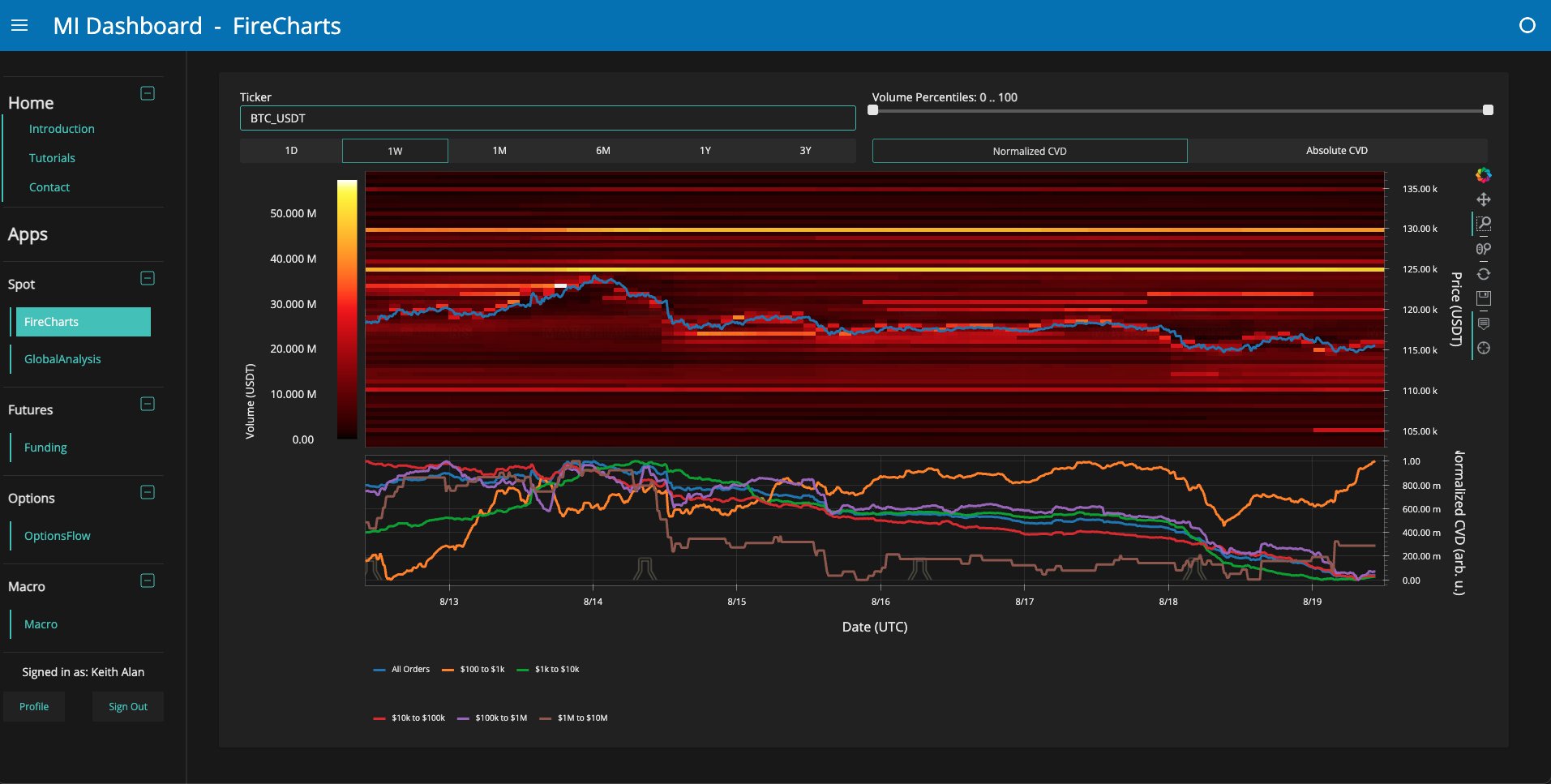

“TLDR: The $107k – $110k vary is coming into focus,” Keith Alan, cofounder of buying and selling useful resource Materials Indicators, summarized in a part of his newest put up on X.

“This isn’t an indication of power for $BTC. The downward stress is palpable, however bulls are looking for their footing.”

Alan flagged the 100-day easy shifting common (SMA) at $110,950 as a possible help barrier, with the 50-day counterpart at $115,875 now essential to reclaim.

On change order books, Materials Indicators recognized a $25 million band of liquidity at $105,000 — “plunge safety” towards a deeper market rout.

“This bid liquidity doesn’t seem like it goals to get stuffed. It was positioned to heard liquidity upward. If it fails to perform that and value reverts, I count on it to get rugged or moved earlier than it will get stuffed,” it commented alongside a chart of liquidity and whale order quantity.

Bitcoin ETF demand within the highlight

Within the newest version of its Market Pulse updates, onchain analytics agency Glassnode in the meantime highlighted a rising divergence between institutional demand and value motion.

Associated: Bitcoin received’t go under $100K ‘this cycle’ as $145K goal stays: Analyst

Funding automobiles, notably the US spot Bitcoin exchange-traded funds (ETFs), have been seeing inflows regardless of “weakening” onchain indicators comparable to quantity.

“With profit-taking on the rise, the sustainability of institutional flows and renewed purchaser conviction in each spot and futures will decide whether or not this contraction stabilizes into recent upward momentum or extends into deeper consolidation,” it reported.

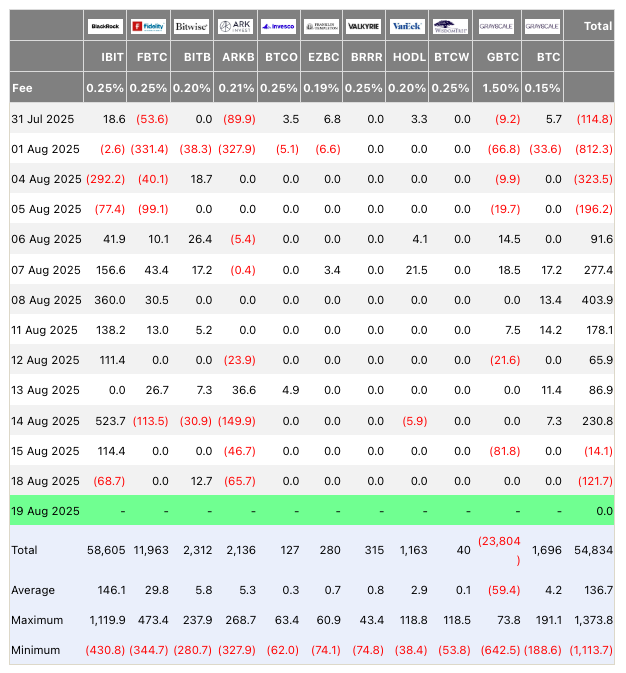

The ETFs recorded a web outflow of $121 million on Monday, per knowledge from UK funding agency Farside Buyers. The most important ETF providing, BlackRock’s iShares Bitcoin Belief (IBIT), noticed its first outflows since Aug. 5.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.