The inclusion of cryptocurrency in US retirement plans might mark a milestone for Bitcoin adoption and unlock billions of {dollars} in new capital, doubtlessly pushing the asset above $200,000 by the tip of 2025, in keeping with André Dragosch, the pinnacle of European analysis at crypto asset supervisor Bitwise.

President Donald Trump paved the best way for cryptocurrency inclusion in US 401(okay) retirement plans after signing an government order on Aug. 7, granting People entry to digital property by way of their retirement plans.

The inclusion of crypto in 401(okay) plans could also be much more vital for the Bitcoin (BTC) value than the approval of the US spot Bitcoin exchange-traded funds (ETFs) in January 2024, Dragosch stated.

This “bullish” growth could also be even “larger than the US Bitcoin ETF approval itself,” signaling one other $122 billion value of latest capital, assuming a modest 1% portfolio allocation, Dragosch informed Cointelegraph throughout the Chain Response every day X areas present on Monday, throwing in a value prediction for good measure:

“The official prediction stays $200,000 by the tip of the yr.”

“Should you have a look at 401(Okay) and defined-contribution retirement plans within the US, they’re enormous,” stated Dragosch, including that 1% is a “comparatively conservative” allocation estimate for the $12.2 trillion business.

Is Bitcoin Headed for a 2025 Peak? Or is the 4-12 months Cycle Useless? https://t.co/DckFjvkJIx

— Cointelegraph (@Cointelegraph) August 18, 2025

Together with digital property in retirement plans will allow 401(okay) portfolio managers to spend money on Bitcoin ETFs, which can push Bitcoin’s value to new all-time highs, flashing one other optimistic sign for Bitwise’s $200,000 Bitcoin value goal for the tip of 2025.

Associated: Bitcoin’s company growth raises ‘Fort Knox’ nationalization issues

Fed coverage, retirement plans seen as twin drivers

Based mostly on Bitwise’s survey for monetary advisers, most portfolio managers usually tend to advocate a 2.5% or 3% Bitcoin allocation for retirement plans, suggesting extra vital inflows than the preliminary 1% allocation.

The primary Bitcoin inflows from retirement plan managers might come as quickly as this fall, coinciding with the primary anticipated rate of interest reduce by the US Federal Reserve, which can drive Bitcoin to new highs, stated Dragosch, including:

“Should you see additional Fed price cuts, there’s positively a case for $200,000 by the tip of the yr.”

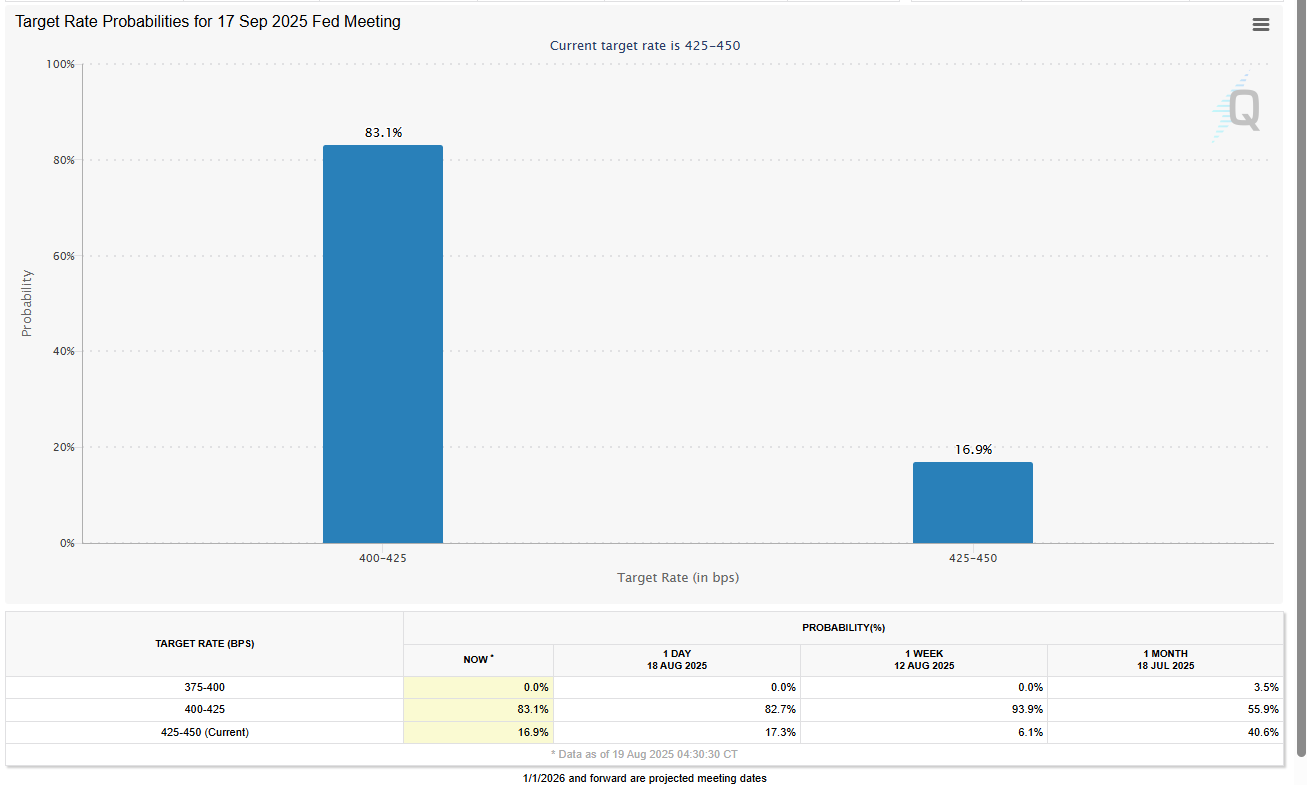

Markets are pricing in an 83% probability that the Fed will hold rates of interest regular throughout the subsequent Federal Open Market Committee assembly on Sept. 17, in keeping with the most recent estimates of the CME Group’s FedWatch software.

Associated: Analysts see Bitcoin purchaser exhaustion as retail shifts to altcoins

Past bettering financial coverage expectations, Bitcoin adoption may be accelerated by the monetary incentive of 401(okay) plan suppliers to supply Bitcoin ETF publicity.

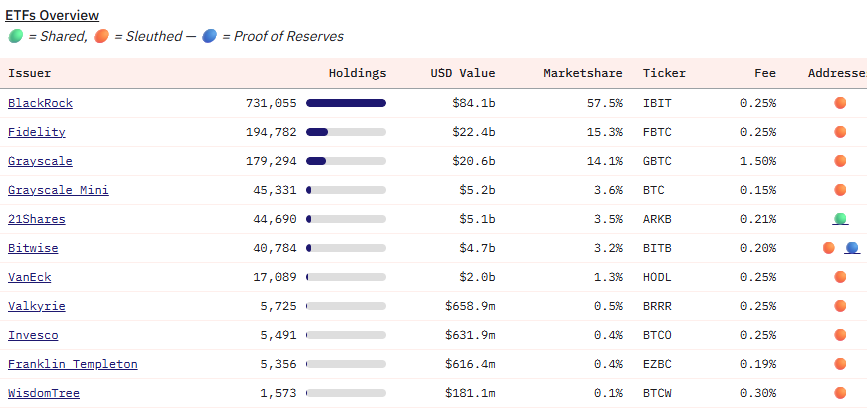

BlackRock, Constancy and Vanguard are among the many largest retirement plan suppliers within the US. Whereas Vanguard has but to “greenlight” crypto ETFs, “BlackRock and Constancy have an enormous financial incentive to incorporate these Bitcoin ETFs of their normal plans,” stated Dragosch.

BlackRock is the issuer of the biggest Bitcoin ETF, the iShares Bitcoin Belief, with over $84 billion in property below administration, accounting for 57.5% of the full market share, whereas Constancy’s ETF is the second-largest, holding $22.4 billion, accounting for 15.3% of the full market share, Dune knowledge exhibits.

Final Friday, US Securities and Alternate Fee Chair Paul Atkins confirmed that the regulatory company is working with the Trump administration to allow retail traders’ retirement plan entry to non-public fairness, together with crypto property, however urged the need of “correct guardrails” round various investments.

Journal: Crypto merchants ‘idiot themselves’ with value predictions — Peter Brandt