Michael Saylor revealed on Aug. 18 that Technique (previously MicroStrategy) has revised its inventory issuance coverage amid the monetary instrument’s present downward development.

The corporate had beforehand restricted inventory gross sales beneath 2.5x market-to-net asset worth (mNAV) strictly to cowl debt curiosity or most well-liked share dividends. Beneath the brand new guidelines, the agency can now challenge inventory beneath this threshold every time it deems it strategically helpful.

mNAV measures how the market values the corporate relative to its property, together with Bitcoin holdings and operational sources. The prior restrict was meant to guard shareholders from dilution.

Nonetheless, by stress-free this restriction, Technique positive aspects extra flexibility to boost capital or speed up Bitcoin acquisitions, signaling a willingness to behave opportunistically in a unstable market.

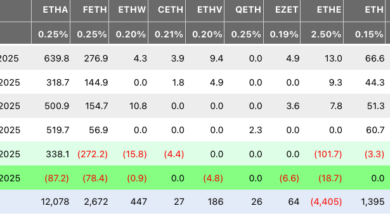

In the meantime, the replace comes as MSTR shares have declined roughly 15% over the previous month, closing at $363.6, their lowest stage since April, based on Yahoo Finance knowledge.

Consequently, Technique Tracker knowledge reveals the corporate’s NAV premium is now simply 1.59, the narrowest hole between market value and Bitcoin-equivalent web property this yr.

Nonetheless, Technique stays the world’s largest company Bitcoin holder, with 629,376 BTC price round $72 billion as of press time.

Buyers response fluctuate

Technique’s coverage shift has drawn combined reactions from traders within the agency.

James Chanos, a well-known brief vendor who has taken a place towards the Saylor-led agency, criticized the change, claiming it weakens protections towards shareholder dilution and indicators restricted demand for the corporate’s most well-liked shares.

In the meantime, different market consultants see the adjustment as a tactical transfer that may assist Technique purchase extra Bitcoin.

Cern Basher, chief funding officer at Sensible Recommendation, famous that so long as mNAV stays above 1.0, issuing new fairness can enhance Bitcoin per share, benefiting current shareholders.

In line with Basher:

“If Technique is now in a position to challenge new fairness at mNAVs all the way in which right down to 1.0, they successfully have two strategies (issuing most well-liked inventory & widespread inventory) to amass extra Bitcoin (each serving to the opposite). Consider it as having two separate taps to replenish a tub – permitting you to replenish the bathtub quicker.”

Nonetheless, he famous that whereas “Technique runs a threat of buying an excessive amount of Bitcoin too quick,” the corporate’s shareholders ought to need it to develop into the world’s monetary fortress rapidly as a result of this might open them as much as extra market alternatives.