Key factors:

-

Bitcoin is secure from breaking beneath $100,000 for the remainder of the present bull market, analyst BitQuant believes.

-

The most recent predictions trace that $145,000 remains to be in play for BTC value.

-

A brand new dip beneath $114,500 closes a CME futures hole in place since July.

Bitcoin (BTC) is not going to “come shut” to $100,000 through the present correction with new all-time highs nonetheless to come back.

The most recent predictions from common X analyst BitQuant give hope to nervous merchants, and embrace a $145,000 BTC value goal.

BitQuant hints street to $145,000 BTC nonetheless open

Bitcoin could have sagged beneath $114,500 to seal an 8.8% drawdown towards its newest report excessive, however not everyone seems to be nervous concerning the close to future.

BitQuant, well-known on social media for his bullish tackle Bitcoin market construction throughout each shorter and longer timeframes, nonetheless believes that BTC/USD will protect the six-figure mark.

“Bitcoin isn’t going beneath $100K — not on this cycle. Doesn’t matter the information, the Fed, or inflation…,” he summarized Monday.

Requested whether or not value may “contact” that psychological barrier, he added that BTC/USD wouldn’t “even come shut” to such ranges.

That perspective adopted BitQuant reiterating his subsequent native high goal of $145,000, in play all through 2025.

The pseudonymous analyst has made the headlines earlier than, efficiently predicting Bitcoin’s outdated all-time excessive from 2024, which unusually hit earlier than its block subsidy halving.

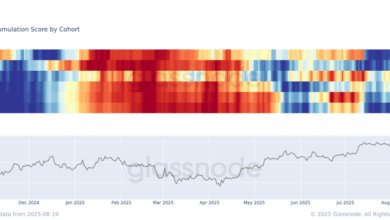

Present indications counsel {that a} cycle high may come at round $250,000.

One other Bitcoin dip, one other CME hole crammed

Different market individuals proceed to concern the worst.

Associated: Bitcoin gained’t be ‘priced in’ till Trump pronounces new Fed chair

For common dealer Roman, equally conspicuous for his conservative views on value on the present stage within the bull market, $100,000 is something however secure.

“My wager is that this dump doesn’t discover a first rate space to bounce till 112k,” he advised X followers Tuesday.

“Relying on IF we will discover a reversal, an in depth beneath could be ugly and take us straight to 97k. Presently not seeing any indicators of reversal up to now.”

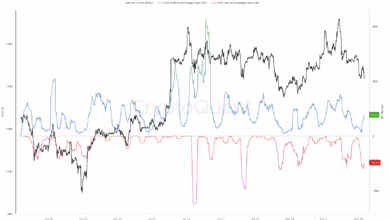

Roman beforehand referenced weak quantity accompanying the most recent all-time excessive as proof of the transfer’s unsustainable nature. Bitcoin, he argued, was wanting more and more prefer it did through the peak of its earlier bull run in late 2021.

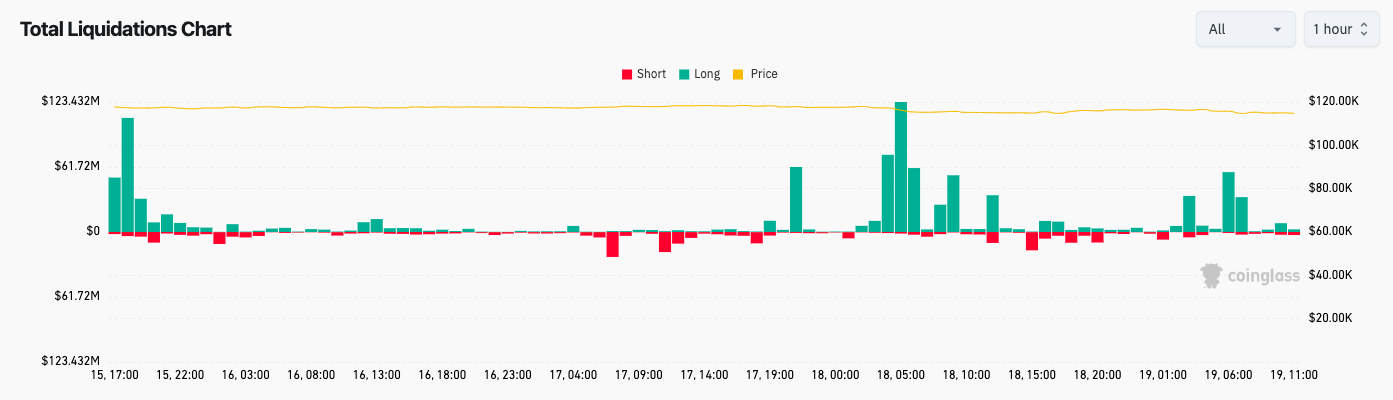

🚨 $BTC Examine this out.

This liquidation map exhibits an enormous cluster of quick liquidations build up simply above 117k. It is a enormous magnet for value. Most merchants are targeted on the present chop, however institutional gamers are watching these strain factors.

The… pic.twitter.com/piDcohuAeO

— TheKingfisher (@kingfisher_btc) August 19, 2025

Dealer consideration continues to deal with trade order-book liquidity, with expectations of a contemporary retaliatory quick squeeze to observe the journey beneath $114,500.

Information from monitoring useful resource CoinGlass places 24-hour crypto liquidations at $333 million on the time of writing.

Dealer and analyst Rekt Capital in the meantime notes that BTCprice has totally crammed a “hole” left in CME Group’s Bitcoin futures market from July.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.