What proportion of Bitcoin is owned by BlackRock?

BlackRock’s entry into the Bitcoin market by means of the iShares Bitcoin Belief (IBIT) has marked a brand new period in institutional Bitcoin accumulation.

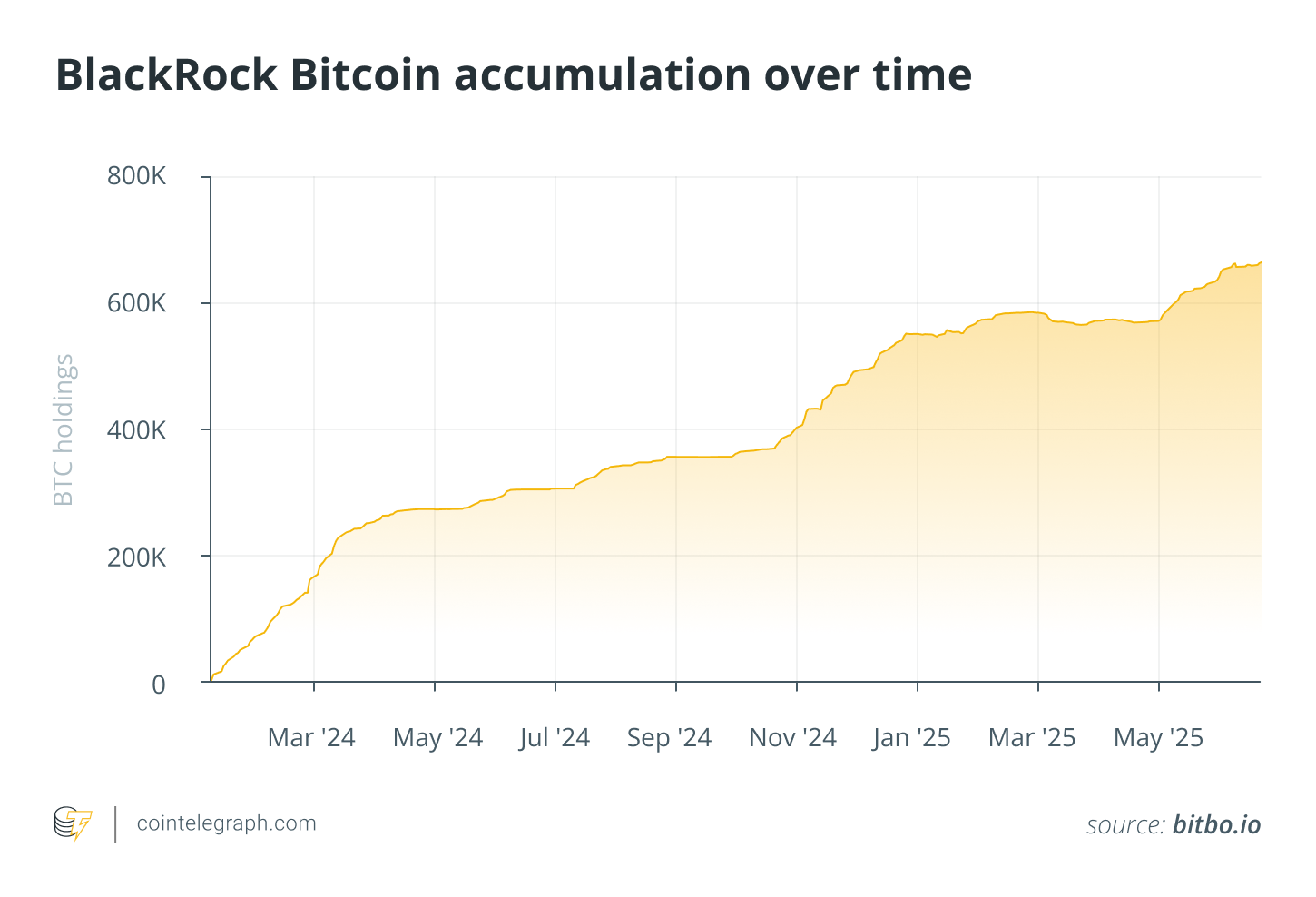

Since its launch on Jan. 11, 2024, IBIT has grown at a tempo that few anticipated, and no different ETF has matched. As of June 10, 2025, BlackRock holds over 662,500 BTC, accounting for greater than 3% of Bitcoin’s complete provide. At at the moment’s costs, that’s $72.4 billion in Bitcoin publicity, a staggering determine by any measure.

For comparability, it took SPDR Gold Shares (GLD) over 1,600 buying and selling days to achieve $70 billion in property below administration. IBIT did it in simply 341 days, making it the fastest-growing ETF in historical past. Along with being a milestone for BlackRock itself, this truth additionally exhibits us how deeply institutional curiosity in Bitcoin has matured.

BlackRock’s Bitcoin holdings now eclipse these of many centralized exchanges and even main company holders like Technique. By way of uncooked Bitcoin possession, solely Satoshi Nakamoto’s estimated 1.1 million BTC outnumbers IBIT, and that lead is narrowing.

If inflows proceed on the present tempo, IBIT could finally grow to be the only largest holder of Bitcoin, a serious change for Bitcoin provide distribution and possession focus.

BlackRock Bitcoin accumulation over time

Do you know? Coinbase Custody, not BlackRock, holds the personal keys for the BTC in IBIT, safely storing consumer property offline and backed by industrial insurance coverage.

Why is BlackRock betting massive on Bitcoin in 2025?

Behind BlackRock’s huge allocation is a strategic shift in the way it views Bitcoin: as a professional part of long-term, diversified portfolios.

The BlackRock Bitcoin technique

BlackRock’s inside thesis embraces Bitcoin’s volatility as a tradeoff for its potential upside. With IBIT, they’re betting that broader adoption will stabilize the asset over time, bettering value discovery, rising liquidity and narrowing spreads.

On this view, Bitcoin is a long-term play on financial evolution and digital asset infrastructure.

This philosophy (coming from the world’s largest asset supervisor) sends a powerful sign to friends. It reframes the dialog round institutional adoption of Bitcoin, shifting it from “whether or not” to “how a lot” publicity is acceptable.

The funding case for institutional Bitcoin accumulation

BlackRock highlights a number of components that make Bitcoin interesting in 2025:

- Scarce by design: With a tough cap of 21 million cash and a halving-based issuance mannequin, Bitcoin shortage mirrors gold, however with a digital spine. Some estimates counsel a significant share of present cash are misplaced or inaccessible, making the efficient provide even tighter.

- Different to dollar-dominance: With rising sovereign debt and geopolitical fragmentation in thoughts, Bitcoin’s decentralized nature provides a hedge towards fiat danger. It’s positioned as a impartial reserve asset, immune to authorities overreach and financial manipulation.

- A part of the broader digital transformation: BlackRock views Bitcoin as a macro proxy for the shift from “offline” to “on-line” worth programs, from finance to commerce to generational wealth switch. Of their phrases, this development is “supercharged” by demographic tailwinds, particularly as youthful traders acquire affect.

Put collectively, these components present distinct risk-return traits that conventional asset courses can’t replicate. BlackRock’s framing (that Bitcoin provides “additive sources of diversification”) makes a compelling case for its integration into mainstream portfolios.

BlackRock crypto portfolio integration

BlackRock advocates a measured method, 1% to 2% publicity inside a conventional 60/40 stock-bond combine. This will likely sound small, however in a portfolio of institutional scale, it’s sufficient to generate affect and normalize Bitcoin publicity for conservative allocators.

Additionally they benchmark Bitcoin’s danger profile towards high-volatility equities, just like the “Magnificent Seven” tech shares, to show the way it can match inside customary portfolio fashions.

Do you know? Surprising by-products (“mud”) from Bitcoin transactions inside IBIT have included tiny quantities of different tokens. BlackRock retains these in a separate pockets or donates them to charity, avoiding tax problems.

BlackRock Bitcoin ETF affect

BlackRock’s resolution to build up over 3% of Bitcoin’s complete provide by means of its iShares Bitcoin Belief (IBIT) is a turning level for the way Bitcoin is perceived, traded and controlled.

Bitcoin has at all times been recognized for its volatility, pushed by mounted provide, shifting sentiment and regulatory uncertainty. Traditionally, the comparatively skinny liquidity of crypto markets made massive trades extremely impactful. Now, with IBIT absorbing a whole lot of 1000’s of BTC, the query is whether or not institutional capital will stabilize or additional complicate the market.

Supporters of the ETF mannequin argue that institutional Bitcoin funding helps cut back volatility. With regulated gamers like BlackRock concerned, the considering goes, Bitcoin turns into extra liquid, extra clear and extra immune to erratic strikes.

BlackRock itself has said that broader participation improves Bitcoin value discovery, deepens market liquidity and may result in a extra steady buying and selling surroundings over time.

Alternatively, critics (together with sure teachers) warn that large-scale institutional involvement introduces conventional market dangers into Bitcoin. These embrace leveraged buying and selling, flash crashes triggered by algorithms and value manipulation by way of ETF flows.

On this view, Bitcoin’s financialization could commerce one form of volatility (retail-driven FOMO) for one more (systemic, leverage-based danger). Additionally, as ETFs develop in affect, Bitcoin could grow to be extra correlated with different monetary property, undermining its worth as an uncorrelated hedge.

Institutional Bitcoin accumulation lends mainstream legitimacy

Undoubtedly, BlackRock’s crypto technique has turned Bitcoin from a fringe asset right into a mainstream funding device.

For years, Bitcoin was dismissed by main monetary establishments. BlackRock’s deep publicity to BTC indicators that the tide has turned. The launch of IBIT (and its speedy ascent to grow to be one of many largest Bitcoin holders globally) has legitimized Bitcoin in a means no white paper or convention ever might.

ETFs like IBIT provide a well-known, regulated construction for publicity, particularly for establishments cautious of the technical complexity or custodial dangers of direct crypto possession. BlackRock’s involvement reduces reputational danger for others on the fence. In impact, this has normalized Bitcoin possession by establishments, accelerating its inclusion in conventional portfolios.

Retail traders profit too. As a substitute of navigating wallets, seed phrases and gasoline charges, they will acquire publicity to Bitcoin with a click on by means of conventional brokerages.

Do you know? Abu Dhabi’s Mubadala sovereign wealth fund owns a big stake in IBIT, with filings displaying round $409 million invested.

BlackRock owns 3% of Bitcoin: A rising paradox

Bitcoin was constructed as a decentralized different to centralized finance. Nevertheless, when the world’s largest asset supervisor buys up over 600,000 BTC by way of a centralized automobile, it creates a paradox: The decentralized asset is more and more managed by centralized establishments.

Most customers at the moment depend on centralized exchanges (CEXs), custodians or ETFs. These platforms are simpler to make use of, provide safety features like insurance coverage and chilly storage and supply regulatory compliance (KYC, AML), which many see as important. In distinction, decentralized instruments like DEXs and self-custody wallets have greater friction, decrease liquidity and fewer person safety.

So at the same time as Bitcoin stays technically decentralized, most individuals work together with it by means of centralized layers. Right here, BlackRock’s Bitcoin accumulation is emblematic. Whereas some argue this undermines Satoshi’s unique imaginative and prescient, others view it as a obligatory trade-off, a “centralization of entry” that permits Bitcoin to scale to international relevance.

That is the guts of the Bitcoin centralization debate: balancing ideological purity with sensible adoption.

For now, the market appears to be accepting a hybrid mannequin, with decentralized base layers and centralized entry factors.

The regulatory catch-up sport

BlackRock’s potential to launch IBIT was made attainable by a landmark resolution: the US Securities and Alternate Fee’s approval of spot Bitcoin ETFs in early 2024. That ruling broke a years-long impasse and opened the floodgates for institutional capital. Nonetheless, the broader regulatory surroundings stays inconsistent and infrequently contradictory.

One of many greatest challenges with regards to crypto? Asset classification. The SEC continues to ship blended indicators on whether or not varied tokens, like Ether (ETH) or Solana (SOL), are securities. This regulatory grey zone has delayed the event of merchandise like staking ETFs or altcoin ETPs, and created confusion for traders, builders and issuers alike.

As Commissioner Caroline Crenshaw has identified, the SEC’s present stance creates “muddy waters” and reactive enforcement that stifles innovation. This immediately impacts whether or not establishments really feel assured investing past Bitcoin.

For now, Bitcoin enjoys a extra easy regulatory path. For the broader crypto market to mature, together with Ether ETFs or DeFi-linked merchandise, a extra constant and globally aligned regulatory framework will probably be important.

Establishments are prepared – however they want guidelines they will belief.