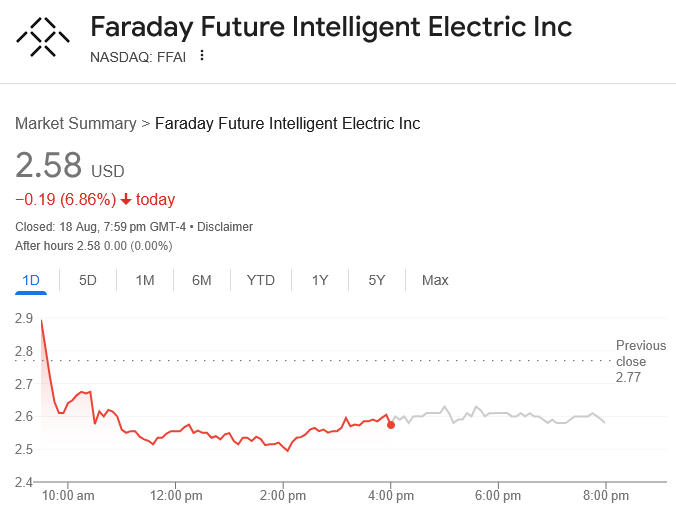

Shares in electrical car maker Faraday Future Clever Electrical fell almost 7% on Monday after the corporate filed its second-quarter earnings, which additionally got here only a day after saying a multibillion-dollar crypto reserve plan.

Faraday Future Clever Electrical (FFAI) noticed a short spike because the markets opened on Monday, however finally closed the buying and selling session at $2.58, shedding per week of good points, in accordance with Google Finance.

It comes the day after the corporate revealed its intention to finally purchase “tens of billions” value of crypto after shopping for $30 million value of crypto for its strategic reserve.

The EV maker launched its C10 Treasury, a basket of the highest 10 crypto belongings weighed by market capitalization, excluding stablecoins. Bitcoin constitutes 50% of the fund, whereas Ethereum is second with 23.7%. The corporate additionally mentioned it intends to launch an ETF for the product.

The crypto technique additionally consists of shopping for $500 million to $1 billion value of crypto from the highest 10 cryptocurrencies for its strategic reserve.

Second quarter earnings

The slide got here as Faraday Future reported a muted set of earnings for the June quarter; nonetheless, the corporate’s commentary for the second half of the 12 months remained optimistic.

The corporate witnessed a internet lack of $48.1 million from operations, barely higher than the $50.6 million loss it posted throughout the identical quarter final 12 months.

In the meantime, the corporate’s complete working bills stood at $21.3 million, a lower of 29% from the identical interval final 12 months.

The corporate’s administration mentioned that they may proceed to keep up monetary self-discipline and roll out their EVs as per schedule.

“Within the second quarter, we achieved a number of notable capital markets milestones and likewise continued to strengthen our working efficiencies and value management measures,” Matthias Aydt, International Co-CEO of Faraday Future, mentioned.

The corporate additionally introduced that the inventory has been added to the Russell 3000 Index, which represents the three,000 largest publicly traded corporations within the US.

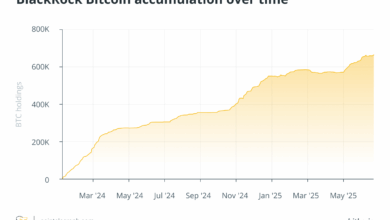

Institutional demand stays sturdy

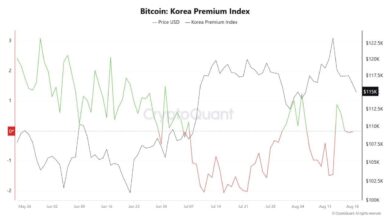

Regardless of the temporary downtick in Bitcoin and the broader market, publicly-traded crypto treasury companies have continued to increase their strategic crypto reserves.

Associated: Bitcoin bull and billionaire recordsdata for $250M SPAC concentrating on DeFi, AI

Technique, the biggest company holder of Bitcoin, purchased 430 BTC value $51.4 million final week.

In the meantime, the Ether holdings of BitMine Immersion Applied sciences, the biggest company holder of Ether, exceeded $6.6 billion, with the corporate buying greater than 370,000 ETH prior to now week.

Journal: Animoca’s Tower crypto surges 214%, gaming exercise up in July: Web3 Gamer