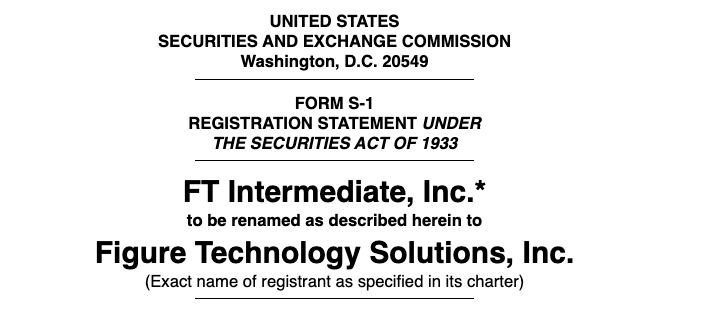

Blockchain-based lending firm Determine Know-how Options has filed publicly for an preliminary public providing within the US, becoming a member of a slate of crypto corporations which have entered the market.

The New York-based agency plans to checklist on the Nasdaq underneath the image “FIGR” with Goldman Sachs, Financial institution of America and Jefferies Monetary Group main the IPO. A few of its current shareholders will promote shares within the providing, Determine mentioned in a submitting on Monday with the Securities and Trade Fee.

Determine mentioned earlier this month that it had confidentially filed to go public, becoming a member of a flurry of crypto corporations eyeing a public debut underneath the crypto-friendly Trump administration and a blockbuster IPO from stablecoin issuer Circle Web Group.

It comes amid sturdy earnings within the first half of 2025. The corporate’s income was almost $191 million in H1, up over 22% from final yr. It recorded a revenue of $29 million, up from a $13 million loss final yr.

Determine valued at $3.2 billion

Determine was co-founded in 2018 by Mike Cagney, who helped create the layer 1 asset tokenization-focused blockchain Provenance and the fintech agency SoFi, the nation’s largest on-line lender.

Determine presents a blockchain platform for lending, buying and selling and asset tokenization on Provenance. It was valued at $3.2 billion in a 2021 Collection D funding spherical that raised $200 million.

Determine mentioned in its submitting that it has originated over $16 billion in blockchain-based loans and accomplished over $50 billion value of onchain transactions.

“Blockchain can do greater than disrupt current markets. By taking traditionally illiquid property – comparable to loans – and placing these property and their efficiency historical past onchain, blockchain can deliver liquidity to markets which have by no means had such,” Cagney mentioned within the submitting.

Associated: The actual tokenization revolution is in non-public markets, not public shares

He added that monetary providers require important intermediation and “huge corporations with huge market capitalizations have been constructed round this rent-seeking.”

“Blockchain has the ability to distill these multiparty marketplaces down to simply two: purchaser and vendor. All of the rent-seeking goes away,” Cagney added.

US sees rush of crypto IPOs

A number of crypto corporations have debuted or filed to go public within the US in latest weeks, with crypto change and CoinDesk proprietor Bullish itemizing on the NYSE on Wednesday, Aug. 13, which noticed its inventory soar over 200%.

Crypto change Gemini has additionally just lately filed for an IPO, becoming a member of crypto custodian BitGo and crypto exchange-traded fund issuer Grayscale, whereas crypto change Kraken has lengthy been rumoured to be going public subsequent yr.

Journal: How Ethereum treasury corporations may spark ‘DeFi Summer time 2.0’