Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a day by day abstract of prime tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

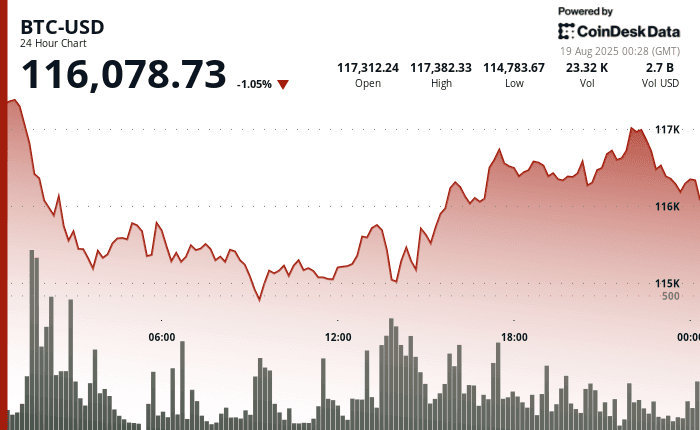

As East Asia begins its buying and selling day, BTC is buying and selling at $116,263, down 1.1% on the day and a pair of% decrease on the week, based on CoinDesk market knowledge, whereas ETH sits at $4,322, off 3.8% within the final 24 hours however nonetheless up 2.6% weekly.

The CoinDesk 20 (CD20), an index monitoring the biggest crypto property, is down 2.4%.

Polymarket odds counsel merchants are bracing for weak spot by way of the top of August. The most probably consequence for BTC is now a detailed under $111,000 with a 34% chance, whereas ETH’s highest-weighted situation is a end close to $4,800 at 43%.

Enflux, a Singapore-based market maker, mentioned the market is being pulled in two instructions.

“The market stays caught between sturdy underlying institutional conviction, highlighted by Technique Inc.’s extra 430 BTC buy and structural financing shift, and an absence of instant retail follow-through,” it wrote in a be aware to CoinDesk.

Enflux pointed to VanEck’s reiterated $180,000 year-end bitcoin goal as proof that establishments are positioning for continuation, whilst retail-favored narratives equivalent to XRP and DOGE have been capped by the SEC’s delays on ETF approvals.

Solana stays an exception, Enflux wrote, with “quiet energy” from its dominance in USDC transfers and PumpFun’s share of latest token issuance.

Nonetheless, derivatives positioning reveals warning.

QCP reported in a latest market replace that perpetual funding charges turned destructive over the weekend, a setup that preceded earlier pullbacks, and choices skews now favor places throughout maturities.

The result’s a market that appears structurally supported on the prime however tactically defensive into Thursday’s Jackson Gap symposium, the place Fed Chair Jerome Powell is predicted to deal with coverage underneath the burden of higher-than-expected inflation and a White Home that continues to problem the Fed’s neutrality.

With crypto search curiosity at a four-year excessive and the GENIUS Act crusing by way of Washington, and now within the palms of regulators, the muse for a broader rally continues to be being constructed.

However for now, prediction markets and value motion counsel conviction is concentrated on the prime, whereas flows stay selective.

Market Movers

BTC: Bitcoin swung between $114,993 and $117,620 on August 18, with volumes far above common as merchants digested Treasury Secretary Scott Bessent’s clarification that strategic reserves can be stuffed by way of budget-neutral acquisitions fairly than direct authorities purchases in addition to anticipated the upcoming Jackson Gap summit the place Jerome Powell is predicted to stipulate the case for protecting charges as is.

ETH: Ethereum fell 3% to $4,330.61 on Aug. 18 amid heavy volatility and repeated resistance close to file highs, whilst U.S. spot ETFs drew $3.71 billion of inflows in stark distinction to ongoing retail promoting.

Gold: Gold hovered close to $3,333–$3,394 an oz. Monday, rising in early U.S. buying and selling as position-squaring set in forward of the Fed’s Jackson Gap symposium, the place Chair Jerome Powell might trace at September fee cuts, whereas merchants additionally weighed U.S.-Ukraine diplomacy and broader geopolitical uncertainties shaping haven demand.

Nikkei 225: Asia-Pacific shares principally slipped Tuesday forward of White Home talks between Trump, Zelenskyy and European leaders, although Japan’s Nikkei 225 edged up 0.1% and the Topix was flat.

S&P 500: U.S. shares had been little modified Monday because the summer season rally confirmed indicators of fatigue forward of Fed minutes, main retail earnings, and Jerome Powell’s Jackson Gap speech later this week.

Elsewhere in Crypto

- U.S. Treasury Division Begins Work on GENIUS, Gathering Views on Illicit Exercise (CoinDesk)

- After Attacking Monero, Qubic Units Its Sights on Dogecoin—This is Why (Decrypt)

- Michael Saylor Eases Inventory-Sale Limits as Bitcoin Premium Falls (Bloomberg)