Gemini has filed for a Nasdaq IPO below the ticker GEMI, revealing a $282.5 million internet loss for the primary half of 2025.

The trade additionally disclosed a $75 million credit score settlement with Ripple within the Aug. 15 submitting submitted to the US Securities and Alternate Fee (SEC),

The trade, based by Cameron and Tyler Winklevoss, joins a wave of crypto firms searching for public market entry following President Donald Trump’s return to the White Home.

The submitting disclosed monetary particulars that place Gemini because the third potential US crypto trade to commerce publicly after Coinbase and Bullish.

Bitwise chief funding officer Matthew Hougan had predicted this motion in December 2024, naming 2025 the “Yr of the Crypto IPO” with no less than 5 crypto unicorns anticipated to go public within the US.

Hougan and the agency’s head of analysis, Ryan Rasmussen, recognized “rising investor demand, institutional adoption, a good macro setting, and a hotter political setting” as the principle catalysts driving crypto firms to pursue public listings following Trump’s election victory.

Monetary efficiency and Ripple partnership

Gemini’s losses widened significantly from $41.4 million within the first half of 2024 to $282.5 million throughout the identical interval in 2025.

The trade posted whole income of $67.9 million for the six months, down from $74.3 million year-over-year. For the total 12 months 2024, Gemini recorded a internet lack of $158.5 million on income of $142.2 million.

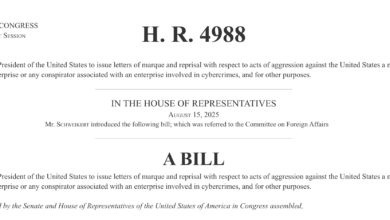

The submitting revealed the trade entered a credit score settlement with Ripple Labs in July. The deal permits lending requests of no less than $5 million every as much as an mixture dedication of $75 million.

The settlement permits will increase as much as $150 million based mostly on particular metrics.

As soon as the preliminary dedication exceeds $75 million, lending requests might make the most of USD-denominated Ripple’s RLUSD stablecoin upon mutual consent.

All lending bears rates of interest of 6.5% or 8.5% yearly and requires collateral safety with compensation in US {dollars}.

Trade momentum below

The crypto IPO pattern gained momentum after Trump’s Jan. 20 inauguration, with a number of exchanges and crypto-native firms pursuing public listings.

Circle accomplished its NYSE debut in June, elevating over $1.2 billion and seeing shares surge 472% relative to Bitcoin since launch.

The stablecoin issuer’s market capitalization reached $66.9 billion, exceeding its USDC circulating provide of $61.27 billion.

Hougan and Rasmussen particularly recognized Circle, Kraken, Anchorage Digital, Chainalysis, and Determine because the 5 strongest candidates for IPO listings in 2025.

Their prediction proved prescient as Circle accomplished its blockbuster NYSE debut in June, Bullish adopted in August, and now Gemini is pursuing its public providing.

Galaxy Digital had already transferred its itemizing from Toronto to Nasdaq in Could, whereas crypto buying and selling platform eToro debuted with providers together with crypto investments.

The momentum displays broader institutional confidence in crypto’s regulatory outlook below Trump.

Hougan emphasised that the Trump administration’s pro-crypto stance creates unprecedented alternatives for digital asset firms to entry conventional capital markets. Moreover, he acknowledged that 2025 represents a “hotter political setting” for crypto IPOs in comparison with earlier years.

Regulatory technique and construction

Gemini plans to function by way of a dual-entity construction, separating operations between New York-based Gemini Belief and Florida-based Moonbase.

The Moonbase entity will function the first platform for many customers, permitting the trade to navigate New York’s restrictive BitLicense laws that restrict staking providers.

This construction displays the corporate’s strategy to sustaining operational flexibility whereas addressing complicated state-level regulatory necessities.

Goldman Sachs, Citigroup, Morgan Stanley, and Cantor function lead bookrunners for the providing. The IPO phrases stay undisclosed, with completion topic to SEC assessment and market situations.