The US Securities and Alternate Fee (SEC) has delayed rulings on three high-profile crypto exchange-traded funds (ETFs), extending assessment deadlines into October.

In notices filed Aug. 18, the company set new determination dates of Oct. 8 for NYSE Arca’s Reality Social Bitcoin and Ethereum ETF, Oct. 16 for 21Shares’ and Bitwise’s Solana ETFs, and Oct. 19 for the 21Shares Core XRP Belief.

The Reality Social Bitcoin and Ethereum ETF, submitted on June 24, is structured as a commodity-based belief holding Bitcoin (BTC) and Ether (ETH) straight and issuing shares backed by these property. Whereas branded below US President Donald Trump’s Reality Social platform, it features like different spot Bitcoin and Ether ETFs already in the marketplace.

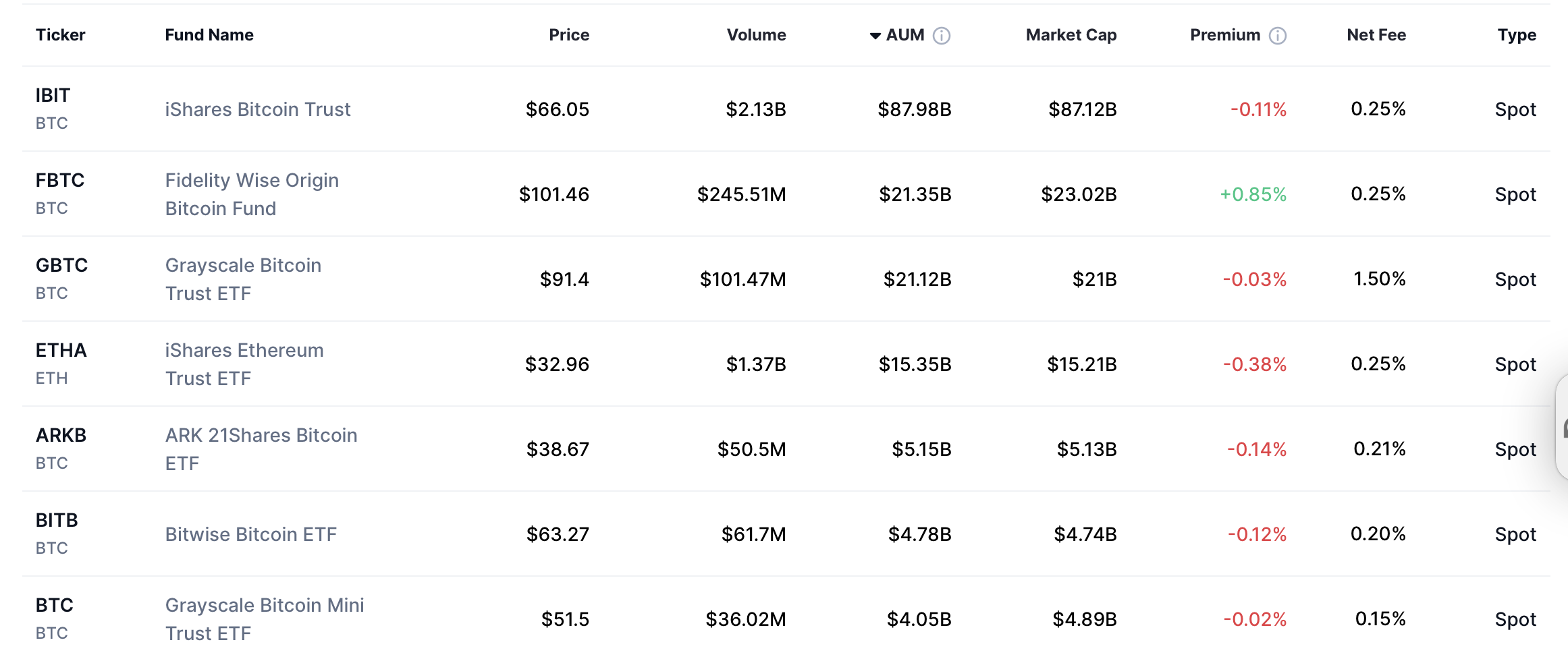

Cboe BZX additionally seeks approval for the primary US spot Solana ETFs by way of filings from 21Shares and Bitwise. These merchandise would maintain Solana (SOL) tokens and provides buyers a safe solution to achieve publicity to Solana’s value efficiency.

A separate utility from 21Shares goals to launch the Core XRP Belief, designed to carry XRP and monitor its market worth. First filed in February and later amended, the belief was approaching its 180-day deadline on Wednesday earlier than the SEC granted itself a further 60 days to assessment.

Associated: US regulator considers simplified path to marketplace for crypto ETFs

October shaping up as a giant month for ETF rulings

The latest ETF extensions should not out of the strange. The SEC has been submitting ETF extensions all summer time, and lots of of them are shaping as much as be selected this fall.

In March, Cointelegraph reported that the SEC had delayed selections on a number of altcoin ETF proposals, together with merchandise tied to XRP, Litecoin and Dogecoin.

Amongst them was CoinShares’ utility for a spot Litecoin ETF, which might maintain (LTC) straight and subject shares backed by the token. Cointelegraph famous that the SEC’s extension positioned its deadline in the identical cluster of fall opinions as different altcoin filings.

Individually, the SEC prolonged its assessment of Bitwise’s request to permit in-kind creations and redemptions for its spot Bitcoin and Ethereum ETFs. Now slated for September, that call would decide whether or not buyers can alternate ETF shares straight for the underlying crypto quite than money.

The SEC typically makes use of its full extension intervals to judge new merchandise and acquire public suggestions. Bloomberg ETF analyst James Seyffart wrote in a publish on X on Might 20 that the SEC “sometimes takes the total time to reply to a 19b‑4 submitting.” He added that “nearly all of those filings have ultimate due dates in October,” and an early determination can be “out of the norm.”

Ether ETFs smash information as crypto merchandise see $3.75B inflows

BlackRock dominates as ETF funds develop in recognition

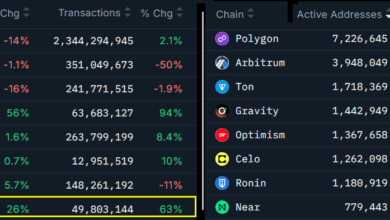

The US market now counts a dozen spot Bitcoin ETFs, a number of Ether merchandise, and a rising roster of purposes for Solana, XRP and different tokens. Globally, over 100 crypto-related ETFs are listed.

BlackRock’s iShares Bitcoin Belief dominates the sector, with greater than $87 billion in property below administration (AUM). Its scale, liquidity and model power have set it aside, drawing the majority of flows whereas rivals stay far smaller.

Journal: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments: Trezor CEO