Key takeaways:

-

The Bitcoin choices skew and stablecoin exercise present worry stays contained, pointing to restricted draw back stress.

-

Spot BTC ETF flows and prime dealer positioning verify liquidity and resilience, signaling restoration potential above $120K.

Bitcoin (BTC) fell to an 11-day low of $114,755 on Monday, igniting debate over whether or not Thursday’s report excessive signaled the tip of the present bull run. But 4 distinct indicators counsel the correction is barely non permanent and that Bitcoin might quickly reclaim the $120,000 mark.

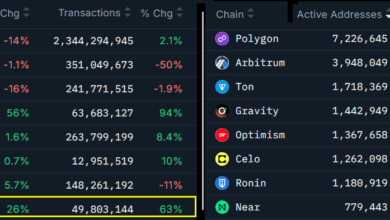

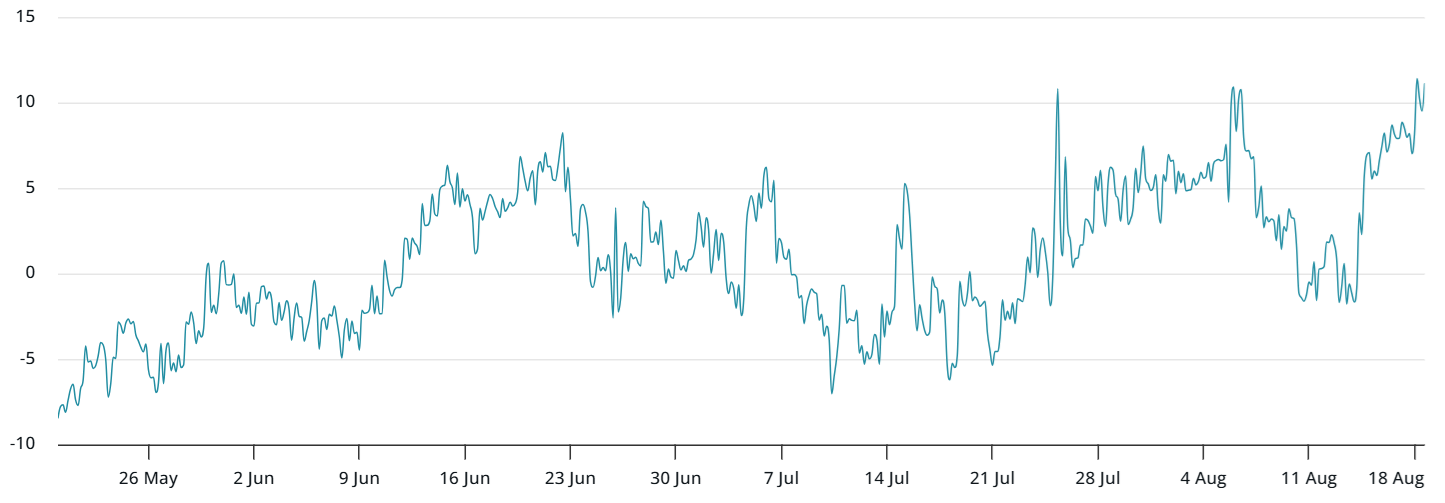

The Bitcoin choices skew metric climbed to its highest level in 4 months, highlighting sudden and extreme worry. In balanced circumstances, the skew ought to transfer between -6% and +6%. When demand for protecting put choices will increase, the indicator jumps above the impartial band, whereas durations of FOMO push it beneath.

Historical past reveals such occasions typically create sturdy shopping for alternatives. On Aug. 5, an analogous skew bounce was adopted by a $9,657 rally inside six days. Likewise, when Bitcoin plunged to $74,587 on April 9, the skew touched 13%, setting the stage for a double backside and an $11,474 restoration in simply 4 days.

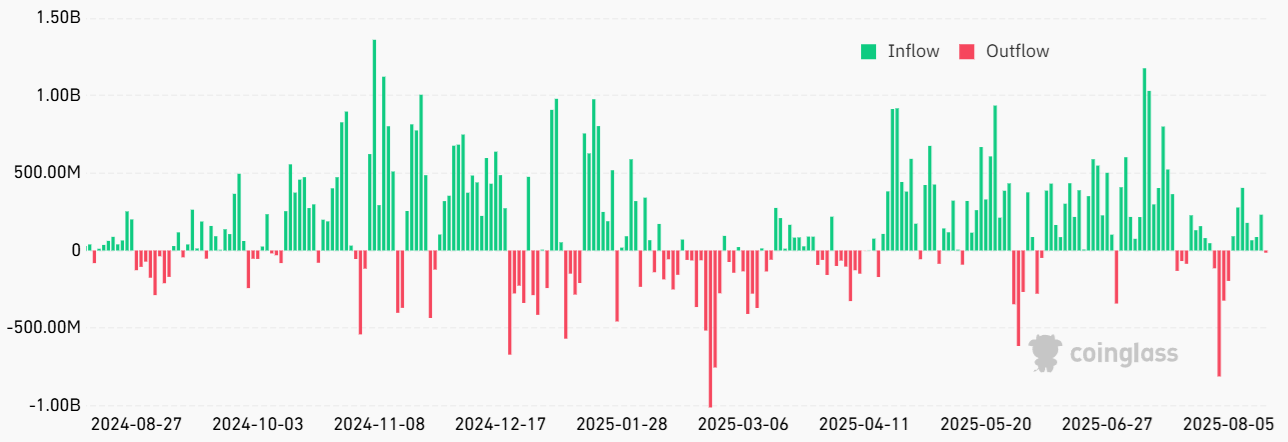

Some traders at the moment are afraid that outflows from spot Bitcoin exchange-traded funds (ETFs) may start, particularly after a seven-day influx streak ended on Friday. But the panic appears misplaced. Between July 31 and Aug. 5, the ETFs registered $1.45 billion in web outflows, which translated into solely a modest 6% correction to $112,000.

Spot Bitcoin ETFs signify a $152 billion market, which means 1% inflows or outflows over a brief span must be thought-about regular. Given the decrease volatility in current months, liquidity stays sturdy sufficient to soak up massive ETF redemptions. Notably, the final time Bitcoin moved greater than 12% inside 72 hours was April 7.

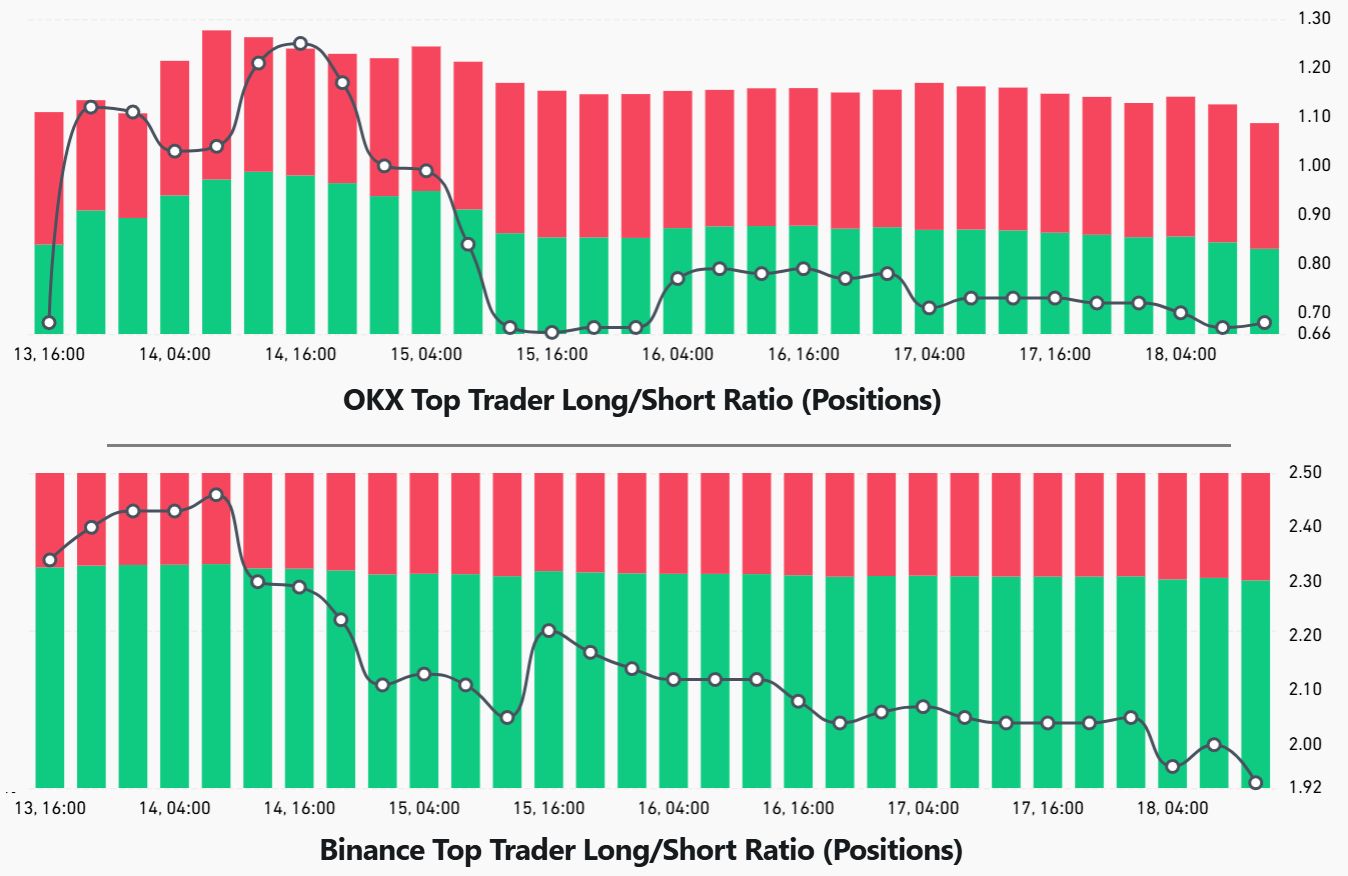

Bitcoin prime merchants didn’t cut back their longs, reinforcing the bullish thesis

Positions from prime merchants at OKX and Binance present little response to the newest value drop. These information cowl spot, margin and futures markets, providing a broader view of how skilled gamers are positioned.

Though prime merchants decreased longs between Thursday and Friday, the long-to-short ratio has since stabilized. Whereas some might argue these merchants hesitate to purchase the dip at $115,000, it’s equally potential they’re ready for a possible retest of $112,000 earlier than deploying further capital.

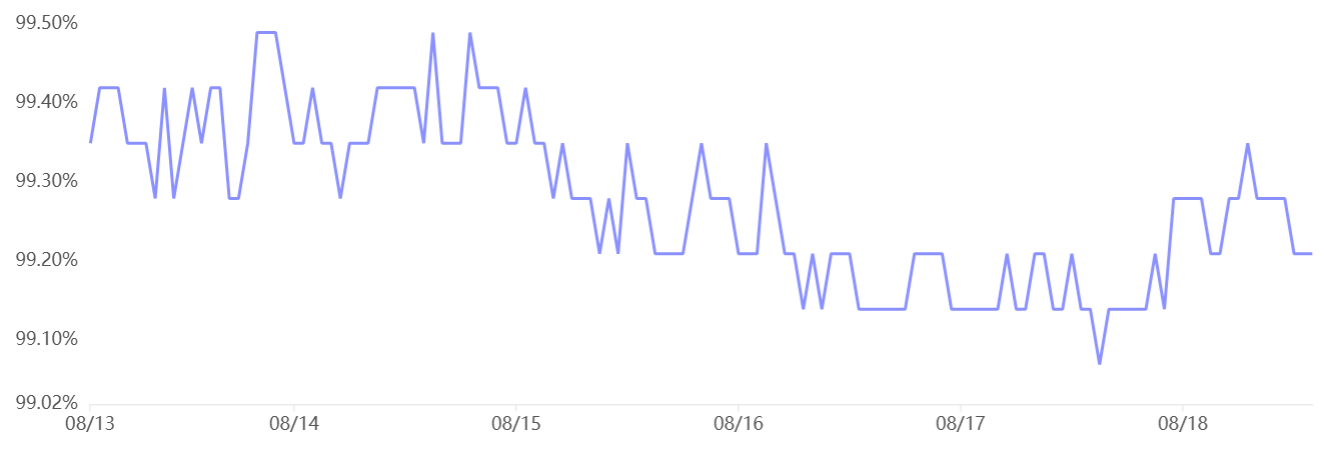

Stablecoin demand in China affords additional perspective. Sturdy retail-driven exercise often pushes stablecoins to commerce at a 2% premium in opposition to the official US greenback fee. Against this, a reduction above 0.5% typically displays worry, as merchants exit crypto holdings.

Associated: Technique provides $51M in Bitcoin as value hit $124K forward of sharp dip

At current, Tether (USDT) trades at a 0.8% low cost in China, indicating delicate stress to depart crypto markets. Nonetheless, the determine has remained regular since Friday night, suggesting no worsening sentiment.

Taken collectively, these 4 metrics — choices skew, ETF flows, prime dealer positioning, and stablecoin demand — counsel Bitcoin’s pullback was a short lived setback and level to $114,755 being the probably backside of this correction.

This text is for normal info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially replicate or signify the views and opinions of Cointelegraph.