Key takeaways:

-

Ether faces a liquidity battle between the $3,900 help and $4,400 resistance.

-

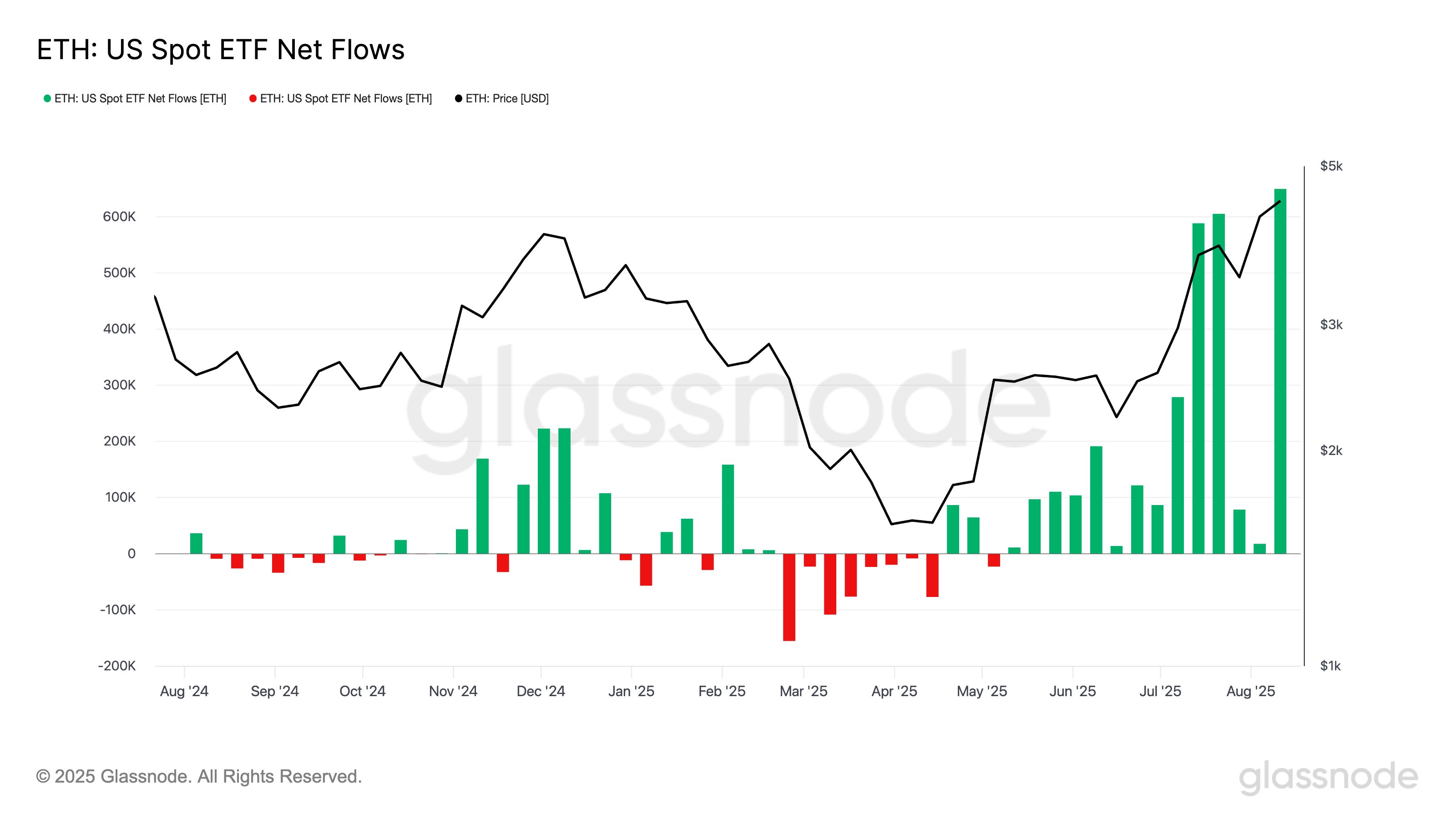

Report ETF inflows of 649,000 ETH spotlight sustained institutional demand.

-

Lengthy-term projections stay bullish, with dips towards $3,000 to $3,500 seen as setups for a rally towards $8,000.

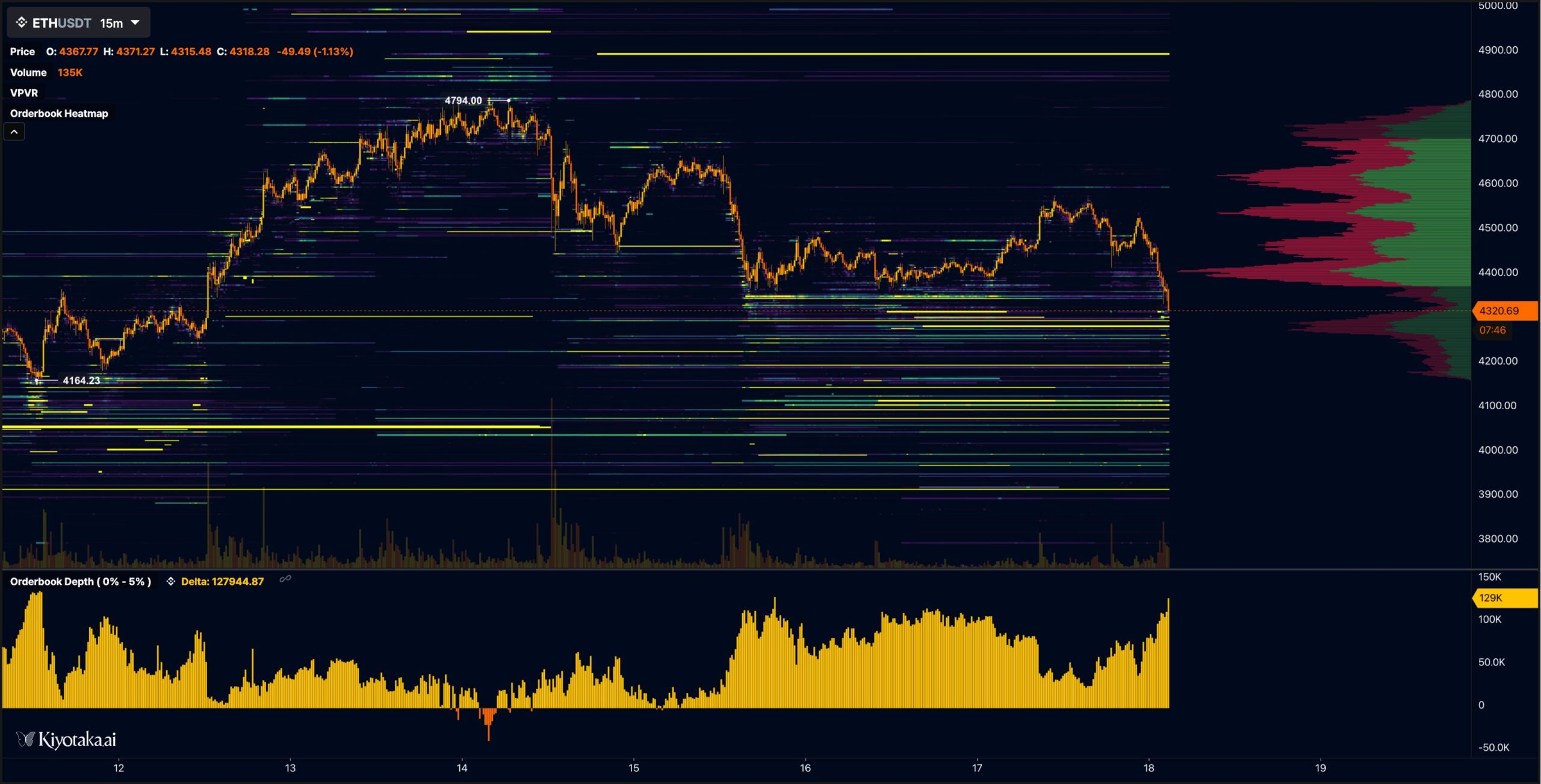

Ether (ETH) is getting into a decisive buying and selling week after recording its highest weekly candle shut in over 4 years, with the worth motion at present caught between two vital liquidity zones, driving value fluctuations of greater than 11%.

On the draw back, ETH established a Monday low at $4,224, putting instant concentrate on the $4,150 stage, a help zone bolstered by a number of liquidity lows. Simply beneath lies a good worth hole round $4,000, aligning with the 0.50–0.618 Fibonacci retracement vary between $4,100 and $3,900. This confluence suggests a lovely space for swing merchants to ascertain bids.

Buying and selling platform Kiyotaka highlights this zone as a “big cluster of resting bids stacked all the way in which right down to $3.9K,” making it a vital vary to look at for liquidity-driven cease hunts and potential reversals.

To the upside, Ether faces a direct liquidity cluster close to $4,400, the imbalance shaped through the Monday lows, which can act as a near-term magnet earlier than a possible retracement. A sustained bullish response at this stage might propel ETH towards $4,583, a better timeframe resistance.

A confirmed break and stabilization above this stage would strengthen the case for a brand new all-time excessive within the days forward, extending the coin’s multi-week bullish momentum.

From a structural standpoint, a deeper retest close to $3,900 often is the extra constructive state of affairs for bulls, as it could flush out early lengthy positions and gasoline liquidity for a stronger restoration towards $4,500 and new highs in This fall.

In the meantime, the four-hour relative power index (RSI) stays under 50, suggesting room for additional draw back earlier than ETH enters oversold territory and units up for a possible bullish breakout.

Associated: Bitcoin, Ether set for squeeze as merchants go report quick ETH at $4.3K

Institutional flows and long-term setup preserve Ether outlook bullish

Regardless of short-term liquidity battles, the broader outlook for Ether stays firmly bullish, supported by report institutional inflows and a positive technical backdrop.

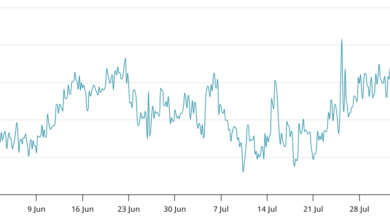

Final week, US-listed spot Ether ETFs recorded practically 649,000 ETH in web inflows, the biggest weekly haul on report. Whereas ETH briefly touched $4,740 earlier than a weekend pullback, the influx momentum highlights deep institutional demand.

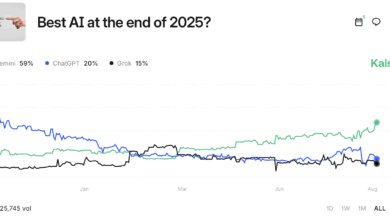

Market analysts have additionally turned more and more optimistic on Ether’s positioning relative to Bitcoin. Senior ETF analyst at Bloomberg, Eric Balchunas, describes Ether ETFs as turning Bitcoin into the “second finest” crypto asset in July, awarding the class ETF of the Month after unprecedented investor curiosity.

On the technical entrance, merchants level to Ether’s multi-year bullish pennant, a “sleeper setup” now nearing breakout territory.

In line with outstanding dealer Merlijn, each dip has been met with sensible cash accumulation, with weak fingers flushed out throughout prior consolidations.

ETH’s long-term projection envisions a pullback towards the $3,000–$3,500 vary earlier than ETH embarks on a rally previous $8,000, marking what could possibly be the start of a brand new chapter in Ether’s value historical past.

Associated: Ethereum units highest weekly shut in 4 years: Watch these ETH value ranges

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.