Bitcoin’s (BTC) stalling between its latest all-time excessive and vary lows is an indication of traders digesting the motion fairly than market weak spot.

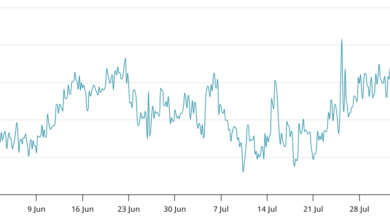

In line with the August 18 Bitfinex Alpha report, BTC surged to a document $123,640 earlier than retreating 5.44% from peak to trough, returning to the decrease finish of its established buying and selling vary.

The pullback adopted higher-than-expected US shopper and producer value inflation readings, which tempered threat urge for food throughout asset lessons.

Bitcoin has since entered a consolidation part, with traders adopting a wait-and-watch strategy forward of potential coverage alerts. For now, BTC continues to oscillate between its all-time excessive and native vary lows, reflecting a digestion interval fairly than structural weak spot.

The report famous that the probability of a Federal Reserve rate-cutting cycle later this 12 months might present a supportive backdrop for each Bitcoin and Ethereum (ETH).

Till then, merchants ought to count on range-bound circumstances to dominate, with volatility formed by incoming macroeconomic information.

Altcoins underneath stress

Within the present atmosphere, altcoins stay extra susceptible than majors. Liquidity is concentrating in Bitcoin and Ethereum, whereas capital rotation away from higher-beta belongings leaves smaller tokens uncovered to sharper retracements.

This sample is typical within the early phases of bull markets, the place institutional inflows first consolidate in BTC and ETH earlier than increasing into the broader market.

A decisive break above all-time highs in these majors could be the important thing catalyst for renewed inflows and broader power.

Ethereum has performed a vital function in setting the tone for digital belongings. From April lows of $1,386.80, ETH climbed to $4,783.90 on August 14, lower than 2% under its all-time excessive of $4,864.90. The advance bolstered Ethereum’s standing as the first liquidity driver outdoors Bitcoin, with its efficiency fuelling renewed hypothesis in altcoins.

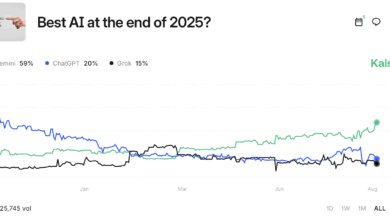

The rotation is seen in Bitcoin Dominance, which has declined from 65% to 59% over the previous two months. Traditionally, such declines in dominance have typically coincided with durations of accelerating hypothesis throughout various belongings.

Whereas majors consolidate, capital continues shifting down the danger curve, a dynamic that will persist till a transparent macroeconomic catalyst emerges.

Bitcoin Market Knowledge

On the time of press 8:34 pm UTC on Aug. 18, 2025, Bitcoin is ranked #1 by market cap and the worth is down 1.23% over the previous 24 hours. Bitcoin has a market capitalization of $2.32 trillion with a 24-hour buying and selling quantity of $70.41 billion. Study extra about Bitcoin ›

Crypto Market Abstract

On the time of press 8:34 pm UTC on Aug. 18, 2025, the entire crypto market is valued at at $3.94 trillion with a 24-hour quantity of $189.38 billion. Bitcoin dominance is at present at 58.89%. Study extra concerning the crypto market ›