Circle’s new layer-1 blockchain Arc will combine with Fireblocks, a New York–based mostly digital asset custody and tokenization platform serving greater than 2,400 banks, asset managers and fintechs. Arc isn’t but dwell, however Circle plans to roll out a public testnet this fall forward of a full launch by year-end.

Fireblocks stated it prepares custody and compliance help so purchasers can transact on Arc as soon as the community launches. Its platform helps over 120 blockchains and facilitates settlement for establishments throughout world markets.

The unusually early integration drew some criticism on X. Solana, for instance, launched in 2020, however wasn’t added to Fireblocks till late 2021, after its ecosystem reached crucial mass. Arc will as a substitute debut with Fireblocks integration, giving banks and asset managers “day one” entry.

Associated: Stablecoins will quickly have their ‘iPhone second,’ Circle CEO

Shifting together with US stablecoin laws

Whereas US regulators superior readability round stablecoins with the GENIUS Act signed on July 18, Circle has been increasing its footprint.

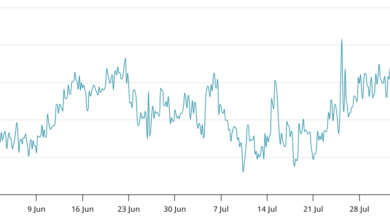

On June 5, Circle raised $1.05 billion within the first IPO by a stablecoin issuer. Shares opened at $69, climbed as excessive as $103.75, and closed at $83.23 — a acquire of 168% from the IPO worth. The inventory reached as excessive as $298.99 on July 23, and is presently buying and selling round $145.

The corporate’s first earnings report since going public was launched on Tuesday, reporting $658 million in Q2 income, a 53% enhance year-over-year. It stated circulation of USDC grew 90% over the identical interval, reaching $61.3 billion by June 30 and climbing above $65 billion in early August.

That very same day, Circle moved to develop its funds infrastructure with the launch of the Circle Funds Community, and introduced Arc — describing it as a layer 1 purpose-built chain for “stablecoin finance.”

Whereas Circle was forward of the curve with its IPO, the Arc announcement comes amid a broader wave of latest blockchain launches, together with Stripe growing Tempo with Paradigm and Robinhood rolling out a tokenization-focused L2 in June.

Associated: USDC stablecoin launches on XRP Ledger

Stablecoin rivals drive market development

The stablecoin market cap now stands at roughly $277.16 billion, up from $253.87 billion on July 1, in accordance with knowledge from DefiLlama. Whereas Circle’s USDC accounts for a few quarter of the fiat-backed stablecoin market, Tether continues to dominate globally with round 60% market share.

Tether reported $4.9 billion in revenue in Q2 2025, a 277% enhance in contrast with the identical interval a yr earlier. Most of that revenue got here from Treasury yields, with the corporate’s $127 billion short-term US debt producing regular earnings.

Tether has now turn out to be one of many largest non-sovereign holders of US Treasurys, surpassing international locations akin to South Korea and the UAE, an unprecedented place for a non-public firm.

Journal: Bitcoin vs stablecoins showdown looms as GENIUS Act nears