The U.S. Treasury Division is in search of new concepts for detecting and slicing off illicit crypto exercise because it begins to place the brand new stablecoin regulation into impact.

The Guiding and Establishing Nationwide Innovation for U.S. Stablecoins (GENIUS) Act — the primary main U.S. regulation to erect a regulatory system within the crypto area — referred to as for presidency motion on limiting risks from dangerous actors in digital belongings, and the Treasury Division is asking for public feedback “to determine progressive or novel strategies, strategies, or methods that regulated monetary establishments use, or have the potential to make use of, to detect illicit exercise, resembling cash laundering, involving digital belongings.”

The crypto sector could have a 60-day remark window to share business views on clamping down on shady crypto use, in keeping with the division’s request on Monday.

The GENIUS Act is now coming into into what is usually a protracted interval of implementation when a brand new financial-regulation regulation enters the world of the federal businesses that must put it into impact. The U.S. banking laws, such because the Workplace of the Comptroller of the Foreign money and Federal Deposit Insurance coverage Corp. can even have insurance policies to work out sooner or later oversight of stablecoin issuers.

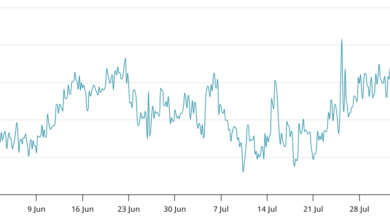

However GENIUS was solely the primary and fewer vital piece of the two-part legislative precedence for the crypto business. The sector nonetheless awaits additional motion from Congress on the invoice that might arrange guardrails for the broader digital belongings markets. The Home of Representatives was within the lead in just lately passing its Digital Asset Market Readability Act with a large bipartisan vote, however when the Senate returns from its summer season break, it’s going to take the reins in shaping that laws below a barely totally different method than the Home.

President Donald Trump has pushed his administration into quickly crafting crypto-friendly insurance policies, issuing a number of govt orders and statements driving federal regulators to set requirements after years of resistance and authorized challenges from the U.S. authorities. Company heads resembling Securities and Trade Fee Chairman Paul Atkins have prompt that they’ll get a number of the work completed even earlier than Congress finishes its crypto duties.

Learn Extra: Trump Indicators GENIUS Act Into Legislation, Elevating First Main Crypto Effort to Change into Coverage