Key takeaways:

-

Web3 every day exercise held regular at 24 million in Q2 2025, however sector composition is shifting.

-

DeFi leads transaction counts with 240 million weekly, but Ethereum fuel utilization is now dominated by the RWA, DePIN and AI.

-

Sensible contract platforms’ cash and yield-generating DeFi and RWA tokens outperform the market, whereas AI and DePIN lag regardless of robust narratives.

Altcoins are greater than speculative bets on cash exterior Bitcoin. Normally, they symbolize — or purpose to symbolize — particular exercise sectors inside Web3, a decentralized various to the legacy web and its providers.

Assessing the state and potential of the altcoin market means trying past costs. Key indicators similar to fuel utilization, transaction counts, and distinctive lively wallets (UAW) assist gauge exercise and adoption, whereas coin value efficiency reveals whether or not markets observe onchain tendencies.

AI and social DApps acquire adoption

UAW counts distinct addresses interacting with DApps, providing a proxy for adoption breadth, although a number of wallets per consumer and automatic exercise can skew outcomes.

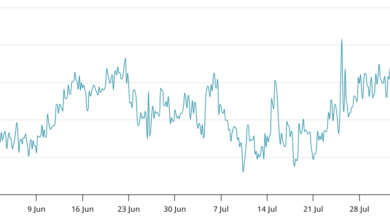

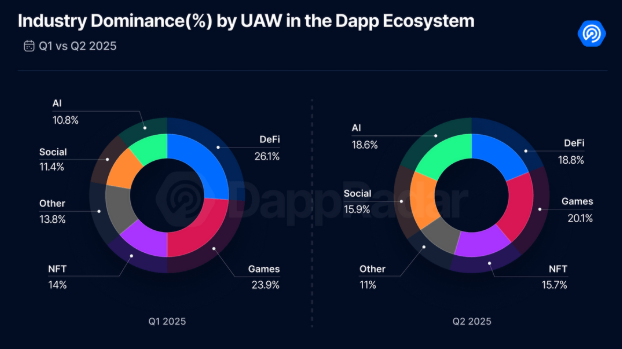

DappRadar’s Q2 2025 report reveals regular every day pockets exercise at round 24 million. But a shift in sector dominance is rising. Crypto gaming stays the biggest class, with over 20% market share, although down from Q1. DeFi has additionally slipped, falling from over 26% to under 19%. In distinction, Social and AI-related DApps are gaining traction. Farcaster leads Social with roughly 40,000 every day UAW, whereas in AI, agent-based protocols like Virtuals Protocol (VIRTUAL) are standing out, attracting 1,900 weekly UAW.

DeFi attracts large gamers

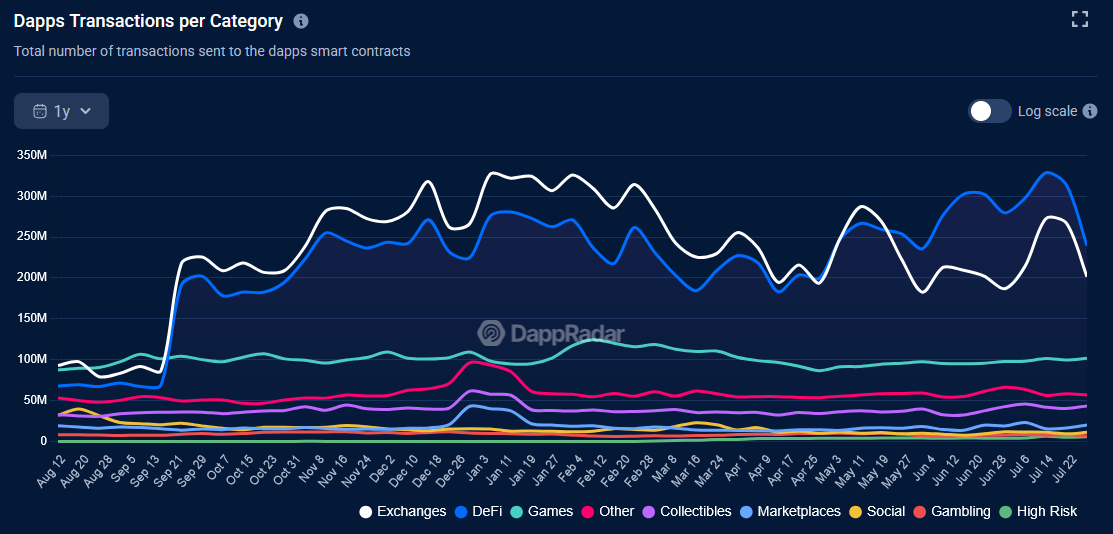

Transaction counts present how typically good contracts are triggered, however will be inflated by bots or automation.

DeFi’s transaction footprint is paradoxical. Its consumer base has declined, but it nonetheless generates over 240 million weekly transactions — greater than every other Web3 class. Trade-related exercise (can overlap with DeFi) provides to this dominance, with crypto gaming trailing at 100 million weekly transactions and the “Different” class (excluding Social however together with AI) at 57 million.

Whole worth locked (TVL) tells a good stronger story. In line with DefiLlama, DeFi TVL has reached $137 billion — up 150% since January 2024, although nonetheless under its $177 billion peak in late 2021. The divergence between rising TVL and falling UAW displays a key theme of this crypto cycle: institutionalization. Capital is concentrating in fewer, bigger wallets, which now additionally embody funds. This development remains to be younger, as DeFi faces regulatory uncertainty in lots of jurisdictions. Nonetheless, establishments are testing the waters by offering liquidity to permissioned swimming pools, lending in opposition to tokenized treasuries from platforms like Ondo Finance (ONDO) and Maple (SYROP), the latter additionally identified for its partnership with the funding financial institution Cantor Fitzgerald.

In the meantime, protocol-level automation provided by DeFi providers like Lido (LIDO) or EigenLayer (EIGEN) additional dampens pockets exercise, as DeFi evolves right into a capital-efficient layer geared towards large-scale yield technology relatively than retail participation.

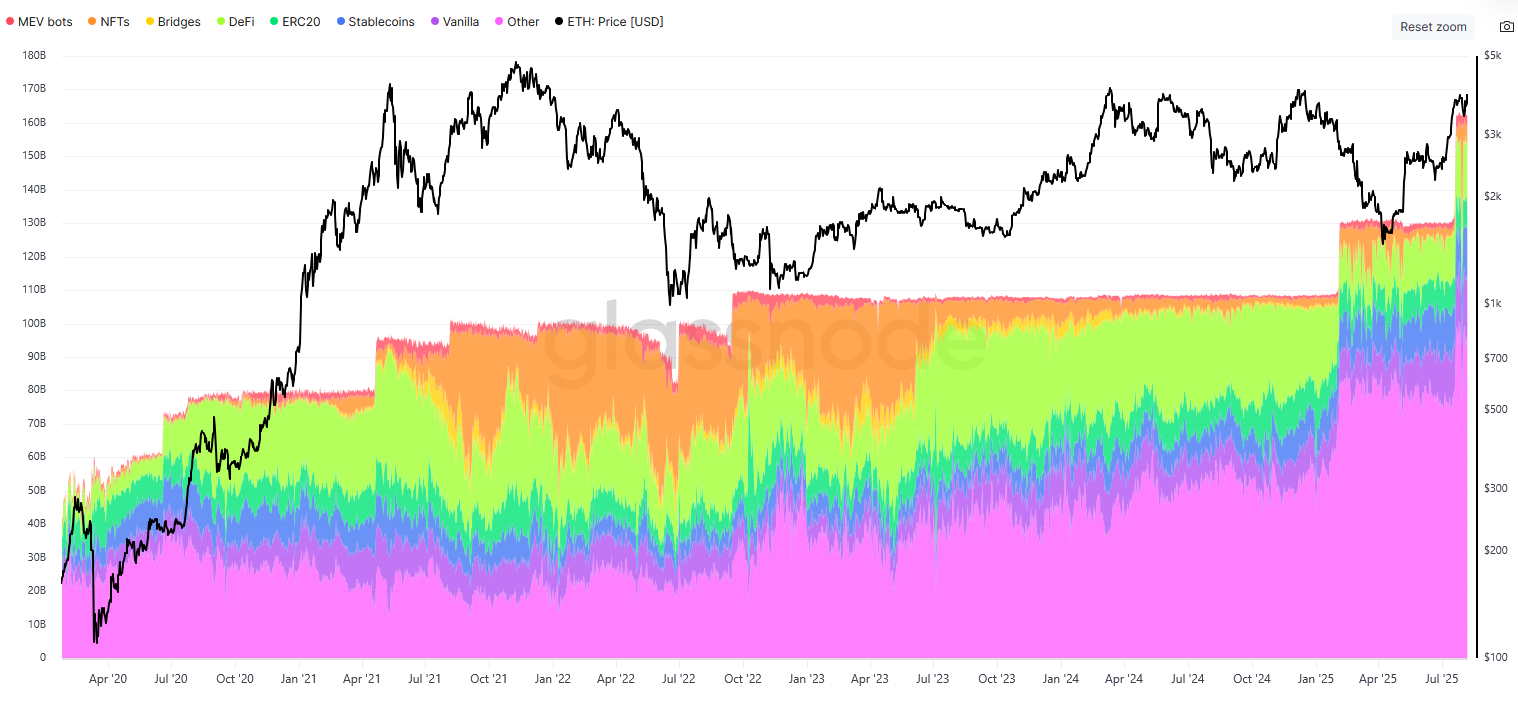

Different use circumstances dominate fuel

Transaction information alone doesn’t seize the entire Web3 image. Ethereum fuel utilization can present the place financial and computational weight really lies.

Glassnode information reveals that DeFi, regardless of being Ethereum’s key sector, now accounts for simply 11% of its fuel consumption. NFTs, which used a sizeable share of fuel again in 2022, have now fallen to 4%. The “Different” class, nonetheless, has surged from about 25% in 2022 to over 58% at present. This class covers rising areas similar to real-world asset tokenization (RWA), decentralized bodily infrastructure (DePIN), AI-based DApps, and different kind of novel providers which will outline Web3’s subsequent development section.

RWA, specifically, is also known as one of the promising crypto sectors. Excluding stablecoins, whole RWA worth has surged from $15.8 billion initially of 2024 to $25.4 billion at present, with an estimated 346,250 tokenholders.

Associated: How excessive will Ethereum value go after breaking $4K? ETH analysts weigh in

Do costs observe Web3 narratives?

Asset costs hardly ever transfer in lockstep with onchain exercise. Whereas hype can drive short-term spikes, sustained beneficial properties are inclined to align with sectors delivering tangible utility and adoption. Over the previous 12 months, this has meant infrastructure and yield-focused tasks outpacing narrative-driven performs.

Sensible contract platform cash posted the strongest beneficial properties, with the highest 10 up an unweighted 142% on common, led by HBAR (+360%) and XLM (+334%). Because the foundational layer of Web3, their value development alerts investor confidence within the sector’s long-term growth. DeFi tokens additionally fared effectively, averaging 77% YoY, with Curve DAO (CRV) up 308% and Pendle (PENDLE) up 110%.

The highest 10 RWA tokens gained 65% on common, pushed by XDC (+237%) and OUSG (+137%). DePIN’s high performers, JasmyCoin (JASMY) at +72% and Aethir (ATH) at +39%, couldn’t stop the sector’s common from hovering round +10%.

AI tokens have been the clear laggards: the highest 10 strictly AI-focused tasks are down 25% YoY, with Bittensor (TAO) the one standout at +34%. Gaming tokens principally posted losses, with solely SuperVerse (SUPER) gaining 750% prior to now 12 months. Social tokens stay largely absent within the crypto area, as main protocols nonetheless lack native property.

Total, Web3 funding stays concentrated in mature sectors, driving up the native currencies of main good contract platforms. Yield-focused DeFi and RWA tokens have additionally delivered strong returns. In distinction, the sectors behind probably the most hyped narratives — AI, DePIN, and Social — have but to translate consideration into significant token beneficial properties. As adoption deepens and extra sectors mature, the hole between narrative and efficiency could slim — however for now, investor confidence is clearly rooted within the constructing blocks of the decentralized financial system.

This text is for common info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don’t essentially replicate or symbolize the views and opinions of Cointelegraph.