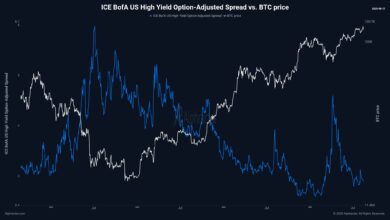

HBAR confronted robust downward stress within the final 24 hours, slipping 6.68% from $0.26 to $0.24, whereas buying and selling exercise surged previous 109 million tokens—almost double the each day common. The steepest drop occurred throughout in a single day periods, when sellers accelerated outflows and compelled costs down at a tempo far sharper than regular. Analysts attribute the volatility to broader market stress triggered by $460 million in liquidations, compounded by U.S. financial knowledge displaying the Producer Value Index rising to three.3%.

Regardless of near-term weak point, market strategists keep a bullish long-term outlook for Hedera’s native token. Targets stay set between $0.40 and $0.50, although merchants are being warned of potential turbulence within the interim. With sentiment gauges pointing to overheated situations, technical watchers warning that sharp swings stay possible because the market digests each macroeconomic headwinds and sudden liquidity shocks.

In the meantime, Binance has moved to combine HBAR inside its BNB Good Chain infrastructure, a step designed to enhance cross-chain interoperability. The event will allow smoother asset transfers and broaden entry to sensible contracts throughout blockchain ecosystems, bolstering Hedera’s utility. Nonetheless, the mixing arrives as HBAR consolidates beneath resistance, underscoring the problem of balancing long-term adoption narratives with short-term market pressures.

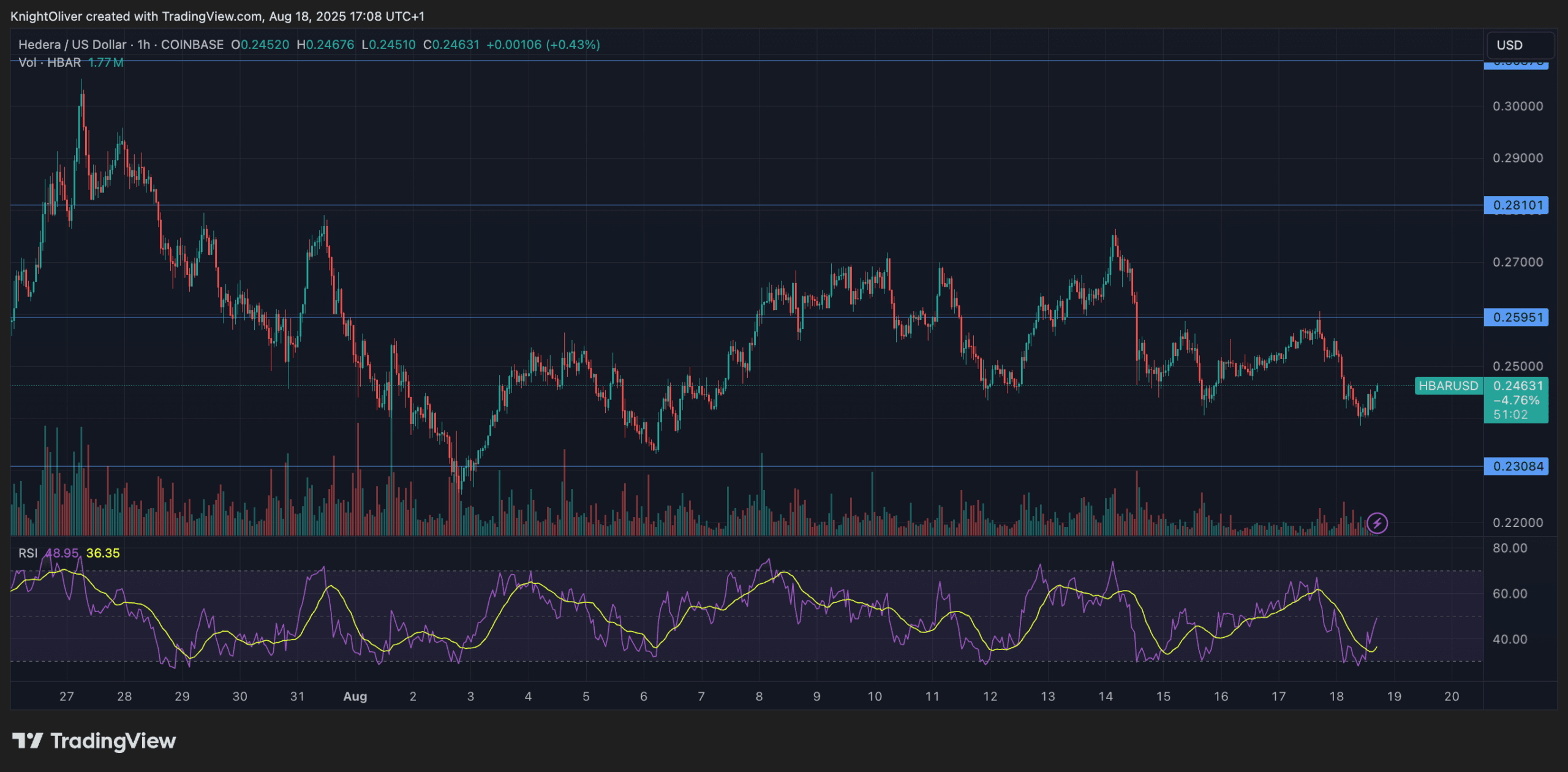

Technical Metrics

- HBAR registered an combination buying and selling vary of $0.018, constituting 6.93% of peak valuation through the session.

- Strong resistance consolidated proximate the $0.252 threshold with a number of rejection makes an attempt.

- Assist infrastructure recognized close to $0.240, furnishing non permanent value stabilisation.

- Buying and selling volumes exceeded 109 million tokens, markedly surpassing the 24-hour common of 58.5 million.

- The terminal 20-minute interval exhibited full market paralysis at $0.243 on negligible quantity, suggesting potential technical disruptions or acute illiquidity situations.

- Distinct resistance consolidation emerged round $0.245 through the last buying and selling hour.

- Provisional help materialised close to the $0.242 stage previous market stagnation.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.