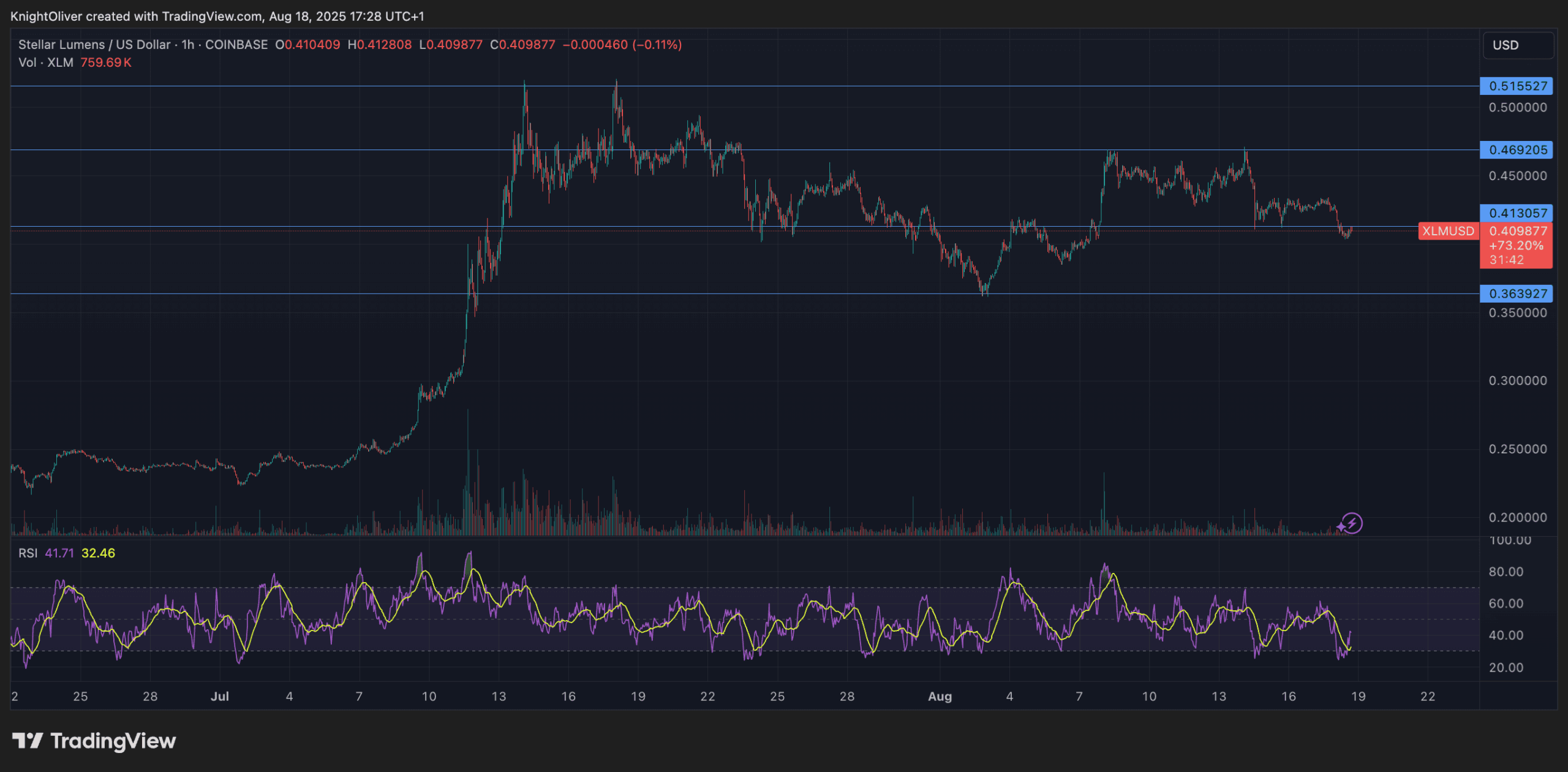

Stellar’s XLM token got here beneath heavy institutional promoting stress between August 17 at 3:00 PM and August 18 at 2:00 PM, sliding from $0.43 to $0.41 in a 6% decline.

Buying and selling volumes through the 24-hour interval topped $30 million, representing roughly 7% of every day turnover.

Probably the most notable liquidation occasion occurred between 1:00 AM and three:00 AM on August 18, when institutional sellers offloaded greater than 60 million tokens. This selloff compelled XLM down from $0.42 to $0.41, creating sturdy resistance on the $0.42 degree and defining new assist close to $0.41.

Regardless of makes an attempt at restoration, the asset persistently did not breach the resistance zone, signaling persistent institutional bearishness and leaving XLM susceptible to additional draw back.

The ultimate buying and selling hour on August 18 added recent stress, as XLM registered a 1% drop between 1:21 PM and a couple of:20 PM. Institutional promoting accelerated between 1:31 PM and 1:42 PM, with company liquidations pushing costs from $0.41 to $0.41 on volumes exceeding 2.7 million items.

This flurry of exercise confirmed resistance at $0.41 and set a short-term assist ground on the identical degree. A number of restoration makes an attempt all through the hour have been met with renewed promoting stress, culminating in a stagnant shut round $0.41 with minimal quantity within the final 20 minutes.

The dearth of shopping for curiosity highlights the potential for additional weak point ought to sellers regain momentum.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.