By Omkar Godbole (All instances ET except indicated in any other case)

There is a word of warning seeping into crypto markets, with bitcoin

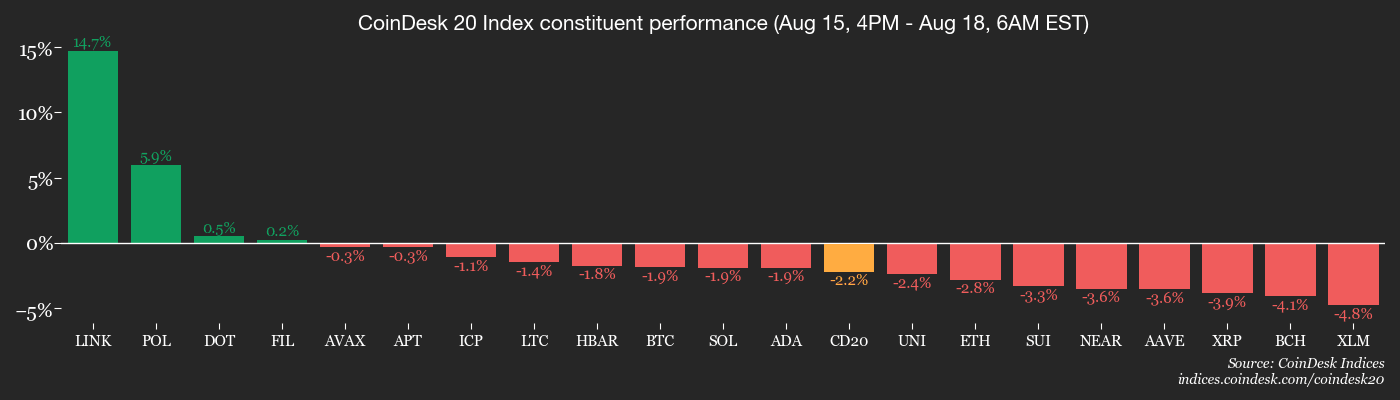

sliding below $115,000 and ether (ETH) falling to $4,220 forward of Fed Chairman Jerome Powell’s speech on the Jackson Gap Symposium later this week. The CoinDesk 20 Index, a measure of the most important tokens, has dropped greater than 4.5% prior to now 24 hours.

Bitcoin’s drop took the most important cryptocurrency to under it is 50-day easy shifting common (SMA) and marks fairly a retrenchment from the file excessive of $124,000 it registered final week. In ether’s case, on-chain information signifies a threat of large liquidations at $4,170.

“Greater than $400m in lengthy positions had been liquidated in a single day as BTC slid from 118k to 115k and ETH from 4,500 to 4,300,” QCP Capital mentioned in a market replace. “This extends final week’s 5 % pullback amid over $1bn of DeFi liquidations and revenue‑taking. Funding charges have turned detrimental and threat reversals favor places, suggesting cautious positioning forward of Jackson Gap.”

Notably, ether losses come after the second-largest cryptocurrency confronted a file validator exit queue, with 855,158 tokens price over $3.5 billion seeking to go away. Moreover, final week, BlackRock’s ether ETF (ETHA) registered a file buying and selling quantity of 364.25 million shares, in line with information supply TradingView. The fund additionally registered file inflows of $2.32 billion.

“Spot Bitcoin and Ethereum ETFs clocked a record-breaking US$40 billion in weekly buying and selling quantity, with Ethereum contributing US$17 billion, and US$2.85 billion of that in internet inflows. This isn’t simply short-term momentum; we’re seeing the infrastructure solidify round crypto in actual time,” Mena Theodorou, a co-founder of crypto trade Coinstash, mentioned.

Talking of the broader market, the bitcoin-to-altcoin liquidations ratio continued to slip, reaching its lowest level since early 2024, in line with information supply CryptoQuant. (See Chart of the Day.) The drop reveals altcoins have been experiencing extra speculative exercise relative to bitcoin, a dynamic typically noticed at market tops.

Monero attacker Qubic’s group overwhelmingly voted in favor of focusing on the Dogecoin community over ZCash. DOGE dropped over 4%, disappointing bulls positioned for a rally following final week’s golden crossover.

In conventional markets, gold rose, European shares dropped and U.S. inventory index futures had been muted as merchants awaited a key assembly between European leaders and President Donald Trump over Ukraine’s future. Keep alert!

What to Watch

- Crypto

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the quickest blockchain ever recorded, will endure its first yearly halving occasion as a part of a managed emission mannequin. Though gross emissions stay fastened at one trillion QUBIC tokens per week, the adaptive burn fee will improve considerably — burning some 28.75 trillion tokens and lowering internet efficient emissions to about 21.25 trillion tokens.

- Macro

- Aug. 18, 1 p.m. ET: President Donald Trump will greet Ukrainian President Volodymyr Zelensky on the White Home, adopted by a bilateral assembly. European leaders will be part of for a multilateral assembly together with Zelensky beginning at 3 p.m.

- Aug. 18, 6 p.m.: The Central Reserve Financial institution of El Salvador releases July producer value inflation information.

- Aug. 19, 8:30 a.m.: Statistics Canada releases July client value inflation information.

- Core Inflation Charge MoM Est. 0.4% vs. Prev. 0.1%

- Core Inflation Charge YoY Prev. 2.7%

- Inflation Charge MoM Est. 0.4% vs. Prev. 0.1%

- Inflation Charge YoY Prev. 1.9%

- Aug. 19, 2:10 p.m.: Fed Vice Chair for Supervision Michelle W. Bowman will converse on “Fostering New Expertise within the Banking System” on the Wyoming Blockchain Symposium 2025. Watch stay.

- Aug. 19, 4 p.m.: The Central Financial institution of Uruguay pronounces its financial coverage resolution.

- Financial Coverage Charge Prev. 9%

- Aug. 20, 11 a.m.: Fed Governor Christopher J. Waller will converse on “Funds” on the Wyoming Blockchain Symposium 2025. Watch stay.

- Aug. 20, 2 p.m.: The Fed will launch the FOMC minutes from the July 29-30 assembly.

- Earnings (Estimates primarily based on FactSet information)

- Aug. 18: Bitdeer Applied sciences Group (BTDR), pre-market, -$0.12

Token Occasions

- Governance votes & calls

- SoSoValue DAO is voting to allocate 5 million SOSO tokens for a Researcher Ecosystem Fund geared toward boosting top-tier crypto analysis by means of competitions and incentives, enhancing content material high quality, transparency and SOSO’s utility. Voting ends Aug. 18.

- Uniswap DAO is voting to allocate $540,000 in UNI over six months to as many as 15 high delegates, with as much as $6,000 a month primarily based on voting exercise, group engagement, proposal authorship and holding 1,000+ UNI. Voting ends Aug. 18

- Aavegotchi DAO is voting on a Bitcoin Ben’s Crypto Membership Las Vegas sponsorship: a $1,000/month company membership (brand on sponsor wall, crew entry, publication characteristic, one branded meetup/month) or a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Unlocks

- Aug. 18: Fasttoken to unlock 4.64% of its circulating provide price $91.6 million.

- Aug. 20: LayerZero to unlock 8.53% of its circulating provide price $57.59 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating provide price $27.55 million.

- Token Launches

- OPENPAD TOKEN (OPAD) lists on KuCoin

- Backroom (ROOM) lists on LBank

Conferences

The CoinDesk Coverage & Regulation convention (previously generally known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that enables basic counsels, compliance officers and regulatory executives to fulfill with public officers chargeable for crypto laws and regulatory oversight. House is proscribed. Use code CDB10 for 10% off your registration by means of Aug. 31.

Token Speak

By Shaurya Malwa

- Solana’s on-chain liquidations exceeded wipeouts at centralized exchanges throughout the weekend stoop, with $37.4 million of SOL flushed on the blockchain versus $20.9 million on CEXs. Drift and Hyperliquid carried many of the circulation, displaying how a lot perp exercise has migrated on-chain.

- Hyperliquid OI in SOL hit a file $1.2 billion whilst Binance volumes slipped. Whole OI is again close to $5 billion, with whales cut up: 59 wallets lengthy, 70 quick. One standout, “White Whale,” holds a $79 million 20x leveraged lengthy now sitting $1.22 million within the crimson.

- Ecosystem charges are again above $1 million a day as Jupiter, Jito and Kamino see recent inflows. Stablecoins on Solana have crossed $12 billion, with almost half of latest capital migrating in from Ethereum.

- A Shiba inu whale shifted 3 trillion SHIB (~$38 million) off Coinbase Institutional into chilly storage on Aug. 15, signaling conviction over buying and selling. The pockets had no prior historical past.

- The transfer coincided with SHIB’s burn fee leaping almost 2,000% in 24 hours, with 4.7 million tokens destroyed. Provide compression stays a key narrative for the group.

- Builders are prepping cross-chain enlargement to Base and Solana utilizing Chainlink CCIP alongside a brand new dev hub and DEX to deepen liquidity. Worth motion is regular close to $0.000013, with technicals pointing to a gradual grind greater.

Derivatives Positioning

- Bitcoin’s value decline since Friday is marked by a gentle improve in futures open curiosity (OI), which has surged to 720,000 BTC, probably the most since Aug. 2.

- On the similar time, optimistic funding charges are fading, indicating that bearish quick positions are gaining momentum available in the market.

- The identical will be mentioned for the ether market, the place open curiosity has elevated to 14.34 million ETH, additionally the very best since Aug. 2.

- OI in LINK, which has bucked the broader market weak point, reached a file excessive 68.13 million LINK, alongside annualized funding charges of round 10%. The mix factors to investor curiosity in chasing value beneficial properties.

- On the CME, open curiosity in Solana futures hovers at a file excessive of over 4.6 million SOL. Nonetheless, the annualized three-month premium has declined sharply to fifteen% from 35% final week. The premium for BTC and ETH stays locked close to 10%.

- Open curiosity in CME bitcoin futures stays effectively under July highs, pointing to low participation from institutional merchants. The OI right here has continued to print decrease highs since December, diverging bearishly from the brand new highs within the spot value.

- On Deribit, threat reversals out to November expiry confirmed a bias for put choices because the spot value drop spurred demand for draw back safety. In ETH’s case, bearishness was pronounced on the short-end.

- Block flows featured an enormous quick strangle, involving writing of $4.4K places and $4.7K calls. The dealer collected a premium of $680,000, betting on a rangeplay between $4,040 and $5,020.

- In BTC’s case, a dealer picked up the Sept. 25 expiry put choice at $110,000, anticipating a value sell-off.

Market Actions

- BTC is down 1.84% from 4 p.m. ET Friday at $115,205.89 (24hrs: -2.73%)

- ETH is down 2.75% at $4,305.90 (24hrs: -5.77%)

- CoinDesk 20 is down 1.93% at 4,057.54 (24hrs: -4.56%)

- Ether CESR Composite Staking Charge is down 8 bps at 2.85%

- BTC funding fee is at 0.0018% (1.9392% annualized) on Binance

- DXY is up 0.14% at 97.99

- Gold futures are up 0.43% at $3,397.00

- Silver futures are up 0.65% at $38.22

- Nikkei 225 closed up 0.77% at 43,714.31

- Grasp Seng closed down 0.37% at 25,176.85

- FTSE is unchanged at 9,132.66

- Euro Stoxx 50 is down 0.46% at 5,423.34

- DJIA closed on Friday unchanged at 44,946.12

- S&P 500 closed down 0.29% at 6,449.80

- Nasdaq Composite closed down 0.4% at 21,622.98

- S&P/TSX Composite closed unchanged at 27,905.49

- S&P 40 Latin America closed up 1.23% at 2,686.10

- U.S. 10-12 months Treasury fee is down 3.3 bps at 4.295%

- E-mini S&P 500 futures are down 0.19% at 6,459.50

- E-mini Nasdaq-100 futures are down 0.2% at 23,756.25

- E-mini Dow Jones Industrial Common Index are down 0.11% at 44,992.00

Bitcoin Stats

- BTC Dominance: 59.7% (+0.48%)

- Ether-bitcoin ratio: 0.03698 (-2.92%)

- Hashrate (seven-day shifting common): 957 EH/s

- Hashprice (spot): $56.04

- Whole charges: 2.54 BTC / $299,765

- CME Futures Open Curiosity: 141,755 BTC

- BTC priced in gold: 34.3 oz.

- BTC vs gold market cap: 9.74%

Technical Evaluation

- The chart reveals greenback index’s (DXY) weekly value motion within the candlesticks format.

- The DXY has didn’t penetrate the previous support-turned-resistance at 99.58.

- The repeated bull failure means that promoting stress is kind of robust and the index may undergo a deeper decline.

Crypto Equities

- Technique (MSTR): closed on Friday at $366.32 (-1.78%), -2.03% at $358.90 in pre-market

- Coinbase International (COIN): closed at $317.55 (-2.26%), -1.78% at $311.90

- Circle (CRCL): closed at $149.26 (+7.2%), -1.03% at $147.72

- Galaxy Digital (GLXY): closed at $26.09 (-8.68%), -2.26% at $25.50

- Bullish (BLSH): closed at $69.54 (-6.82%), -4.23% at $66.60

- MARA Holdings (MARA): closed at $15.67 (-0.51%), -2.11% at $15.34

- Riot Platforms (RIOT): closed at $11.33 (-7.51%), -1.68% at $11.14

- Core Scientific (CORZ): closed at $14.13 (+2.13%), +0.28% at $14.17

- CleanSpark (CLSK): closed at $9.75 (-2.01%), -2.05% at $9.55

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $26.70 (-1%), -4.08% at $25.61

- Semler Scientific (SMLR): closed at $33.84 (-3.67%)

- Exodus Motion (EXOD): closed at $28.82 (+7.34%), unchanged in pre-market

- SharpLink Gaming (SBET): closed at $19.85 (-15.5%), -4.23% at $19.01

ETF Flows

Spot BTC ETFs

- Day by day internet flows: -$14.13 million

- Cumulative internet flows: $54.97 billion

- Whole BTC holdings ~1.29 million

Spot ETH ETFs

- Day by day internet flows: -$59.34 million

- Cumulative internet flows: $12.67 billion

- Whole ETH holdings ~6.49 million

Supply: Farside Buyers

Chart of the Day

- The bitcoin-to-altcoin liquidations ratio peaked in November and has declined sharply since July.

- It reveals that an growing variety of merchants have been speculating within the altcoin market, resulting in the pressured closure of positions on antagonistic value swings.

Whereas You Had been Sleeping

- Zelensky Brings Backup to the White Home as Trump Aligns Extra Carefully With Putin (The New York Occasions): European leaders’ Washington go to goals to safeguard NATO cohesion and Ukraine’s sovereignty after Trump dropped a ceasefire-first stance, fueling fears he may stress Zelensky into concessions favoring Putin.

- Ether Market Could Turn into Extra Thrilling Under $4.2K. Right here is Why. (CoinDesk): Massive clusters of ETH longs at $4,170 and under put $236 million in danger, with analysts warning cascading liquidations may snowball into as a lot as $5 billion in pressured promoting.

- Metaplanet Expands Bitcoin Treasury by 775 BTC, Belongings Outweigh Debt 18-Fold (CoinDesk): The acquisition, made at a mean value of 17.72 million yen ($120,500) per bitcoin, lifts the corporate’s whole holdings to 18,888 BTC, price roughly 284.1 billion yen ($1.95 billion).

- Japan’s First Yen-Denominated Stablecoin to Be Accredited by the Monetary Providers Company, JPC To Be Issued as Early as Autumn (Nikkei): JPYC, a Tokyo-based agency, will register as a cash switch operator this month to concern a stablecoin pegged 1:1 to the yen and backed by financial institution deposits and Japanese authorities bonds.

- Bolivia’s Left in Historic Defeat as Presidential Vote Set for October Runoff (Reuters): Centrist Rodrigo Paz, conservative Jorge “Tuto” Quiroga and leftist Eduardo del Castillo secured 32.18%, 26.94% and three.16% of the vote, respectively. No candidate cleared 40%, forcing an Oct. 19 runoff election.

- Trump Stress Lights Hearth Beneath Mexico’s ‘Powder Keg’ Ruling Celebration (Monetary Occasions): Trump’s tariffs, financial institution sanctions and cartel allegations towards senior officers are pressuring President Claudia Sheinbaum as she navigates U.S. calls for and protectionist insurance policies inherited from former president López Obrador.

Within the Ether