Dutch cryptocurrency service supplier Amdax is making ready to launch a Bitcoin treasury firm on Amsterdam’s Euronext inventory alternate, as extra European corporations observe US counterparts in adopting Bitcoin methods.

Amdax mentioned Monday it’s creating AMBTS B.V., a privately held firm with unbiased governance that can function as a stand-alone agency. AMBTS goals to change into a “1% Bitcoin treasury firm,” with the objective of ultimately accumulating 1% of all Bitcoin (BTC) in circulation.

The corporate mentioned it plans to boost capital in levels by the markets to increase its Bitcoin holdings, develop fairness worth and enhance Bitcoin-per-share metrics for buyers. Accumulating 1% of Bitcoin’s whole provide would require greater than $24 billion at present costs, with Bitcoin buying and selling above $115,800 this week.

Amdax was the primary crypto service supplier to register with the Dutch Central Financial institution in 2020. The platform was among the many first Dutch crypto service suppliers to obtain a Markets in Crypto-Property Regulation (MiCA) license from the Dutch Authority for the Monetary Markets (AFM) on June 26.

Amdax and AMBTS plan to boost capital from non-public buyers in an preliminary financing spherical, with the online proceeds anticipated for use to “make a head begin with the Bitcoin accumulation technique,” the announcement mentioned.

Amdax mentioned its platform gives 33 cryptocurrencies for buying and selling, automated investing and expert-managed portfolio methods for customers.

Cointelegraph contacted Amdax for touch upon the timeline of the agency’s upcoming capital increase and future Bitcoin investments, however had not obtained a response by publication.

Associated: Spar rolls out nationwide stablecoin and crypto funds in Switzerland

Company Bitcoin adoption grows in Europe

Extra European corporations are adopting Bitcoin as a main treasury reserve asset. Nevertheless, Bitcoin publicity continues to be “comparatively small in funding portfolios,” based on Lucas Wensing, CEO of Amdax. He added:

“With now over 10% of bitcoin provide held by firms, governments and establishments, we predict the time is correct to ascertain a Bitcoin treasury firm with the purpose to acquire a list on Euronext Amsterdam, as one of many main exchanges in Europe.”

Not less than 15 European corporations have publicly introduced adopting Bitcoin as a part of their company steadiness sheet. These embody Germany-based Bitcoin Group with 3,605 BTC, the United Kingdom-based Smarter Internet Firm with 2,395 BTC, France-based The Blockchain Group with 1,653 BTC and the UK’s Satsuma Know-how with 1,126 BTC.

Different European corporations with lower than 1,000 BTC embody Sweden’s H100 Group, Samara Asset Group, CoinShares Worldwide Restricted, 3U Holding, Superior Bitcoin Applied sciences, Phoenix Digital Property, Baultz Capital, Vanadi Espresso, Aker ASA, K33 and Refined Group.

Bitcoin continues to outperform

Associated: Bitcoin’s company increase raises ‘Fort Knox’ nationalization considerations

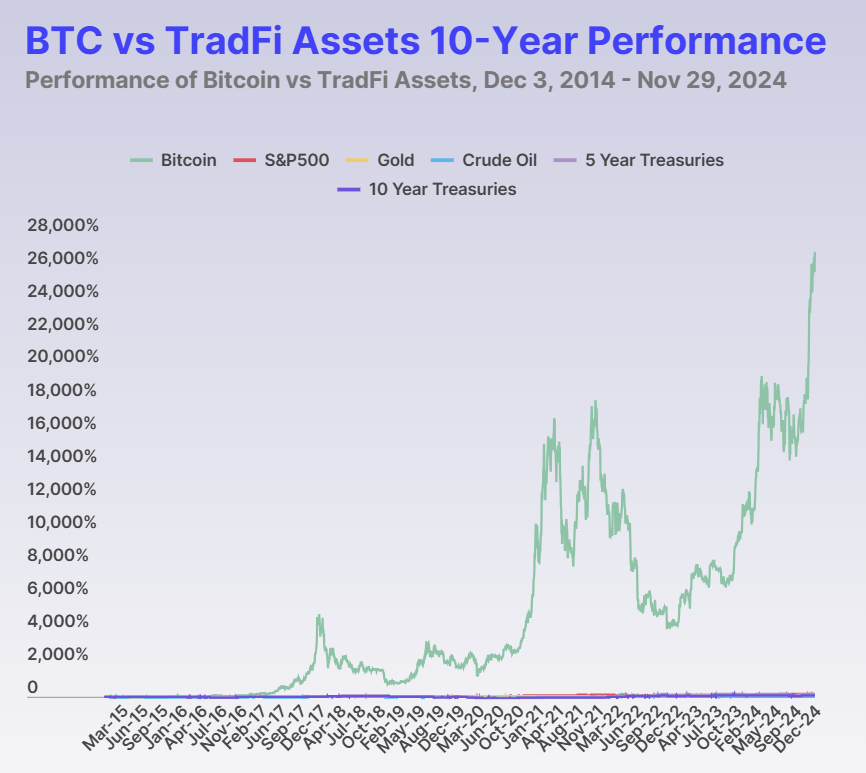

Bitcoin has outpaced all main asset courses over the previous decade, rising greater than 26,900%, in contrast with positive factors of 193% for the S&P 500, 125% for gold and 4.3% for crude oil, based on CoinGecko.

Past Europe and the US, company Bitcoin adoption can also be steadily rising in Asia, spearheaded by Japanese funding agency Metaplanet.

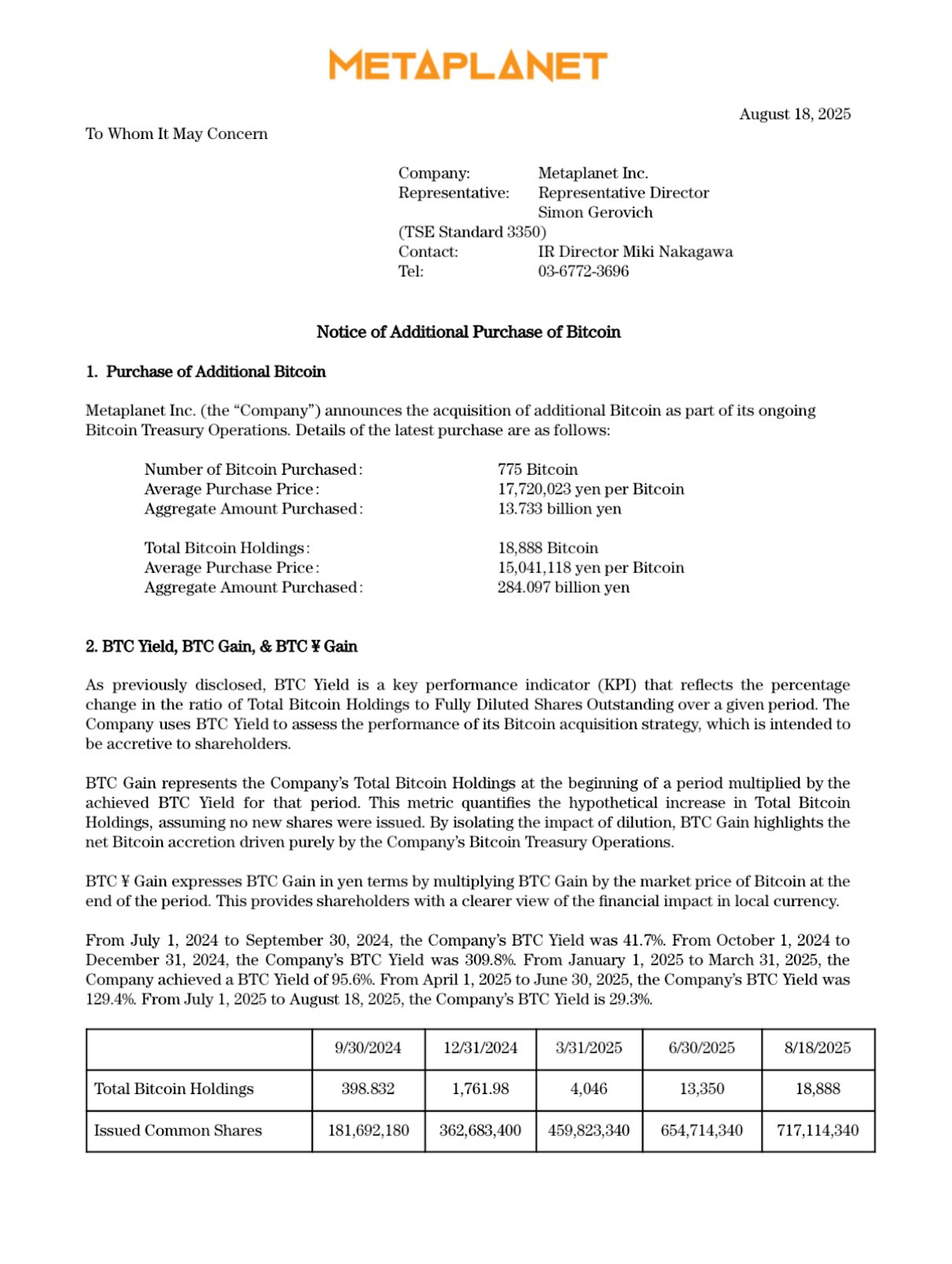

Metaplanet acquired an extra 775 BTC price over $89 million, to surpass 18,888 BTC or $2.1 billion in whole holdings, the corporate mentioned on Monday.

Metaplanet inventory has surged virtually 190% year-to-date, outperforming the 7.2% rise of Japan’s main and most liquid blue-chip corporations tracked by the Tokyo Inventory Worth Index (TOPIX) Core 30, Cointelegraph reported on Wednesday.

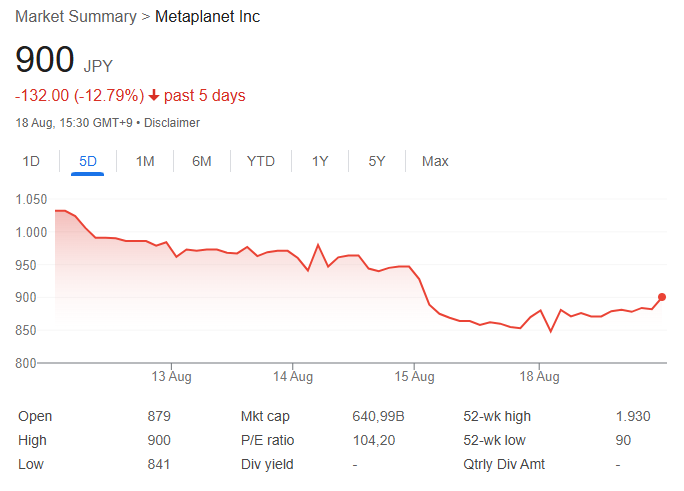

Regardless of an optimistic earnings report launched final week, Google Finance knowledge reveals that Metaplanet’s inventory value fell by over 12.7% through the previous 5 buying and selling days, to commerce at 900 Japanese yen, or $6.11 per share.

Journal: Scottie Pippen says Michael Saylor warned him about Satoshi chatter