Dutch cryptocurrency service supplier Amdax is making ready to launch a Bitcoin treasury agency on Amsterdam’s Euronext inventory alternate, as extra European firms observe US counterparts in adopting Bitcoin methods.

Amdax stated Monday it’s creating AMBTS B.V., a privately held firm with unbiased governance that can function as a stand-alone agency. AMBTS goals to turn out to be a “1% Bitcoin treasury firm,” with the objective of ultimately accumulating 1% of all Bitcoin (BTC) in circulation.

The corporate stated it plans to boost capital in phases via the markets to increase its Bitcoin holdings, develop fairness worth and improve Bitcoin-per-share metrics for traders. Accumulating 1% of Bitcoin’s whole provide would require greater than $24 billion at present costs, with Bitcoin buying and selling above $115,800 this week.

Amdax was the primary crypto service supplier to register with the Dutch Central Financial institution in 2020. The platform was among the many first Dutch crypto service suppliers to obtain a Markets in Crypto-Belongings Regulation (MiCA) license from the Dutch Authority for the Monetary Markets (AFM) on June 26.

Amdax and AMBTS plan to boost capital from non-public traders in an preliminary financing spherical, with the online proceeds anticipated for use to “make a head begin with the Bitcoin accumulation technique,” the announcement said.

Amdax stated its platform provides 33 cryptocurrencies for buying and selling, automated investing and expert-managed portfolio methods for customers.

Cointelegraph contacted Amdax for touch upon the timeline of the agency’s upcoming capital increase and future Bitcoin investments, however had not obtained a response by publication.

Associated: Spar rolls out nationwide stablecoin and crypto funds in Switzerland

Company Bitcoin adoption grows in Europe

Extra European firms are adopting Bitcoin as a major treasury reserve asset. Nonetheless, Bitcoin publicity continues to be “comparatively small in funding portfolios,” in response to Lucas Wensing, CEO of Amdax. He added:

“With now over 10% of bitcoin provide held by companies, governments and establishments, we expect the time is true to determine a Bitcoin treasury firm with the purpose to acquire a list on Euronext Amsterdam, as one of many main exchanges in Europe.”

Not less than 15 European firms have publicly introduced adopting Bitcoin as a part of their company steadiness sheet. These embrace Germany-based Bitcoin Group with 3,605 BTC, the United Kingdom-based Smarter Internet Firm with 2,395 BTC, France-based The Blockchain Group with 1,653 BTC and the UK’s Satsuma Know-how with 1,126 BTC.

The opposite European corporations with lower than 1,000 BTC embrace Sweden’s H100 Group, Samara Asset Group, CoinShares Worldwide Restricted, 3U Holding, Superior Bitcoin Applied sciences, Phoenix Digital Belongings, Baultz Capital, Vanadi Espresso, Aker ASA, K33 and Refined Group.

Bitcoin continues to outperform

Associated: Bitcoin’s company increase raises ‘Fort Knox’ nationalization issues

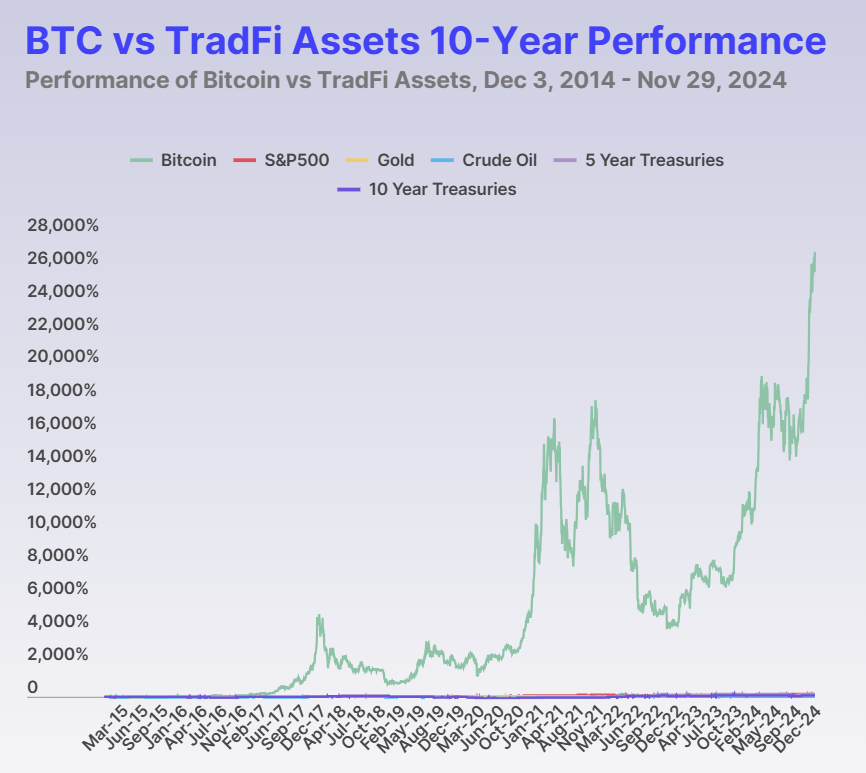

Bitcoin has outpaced all main asset courses over the previous decade, rising greater than 26,900%, in contrast with positive aspects of 193% for the S&P 500, 125% for gold and 4.3% for crude oil, in response to CoinGecko.

Past Europe and the US, company Bitcoin adoption can also be steadily rising in Asia, spearheaded by Japanese funding agency Metaplanet.

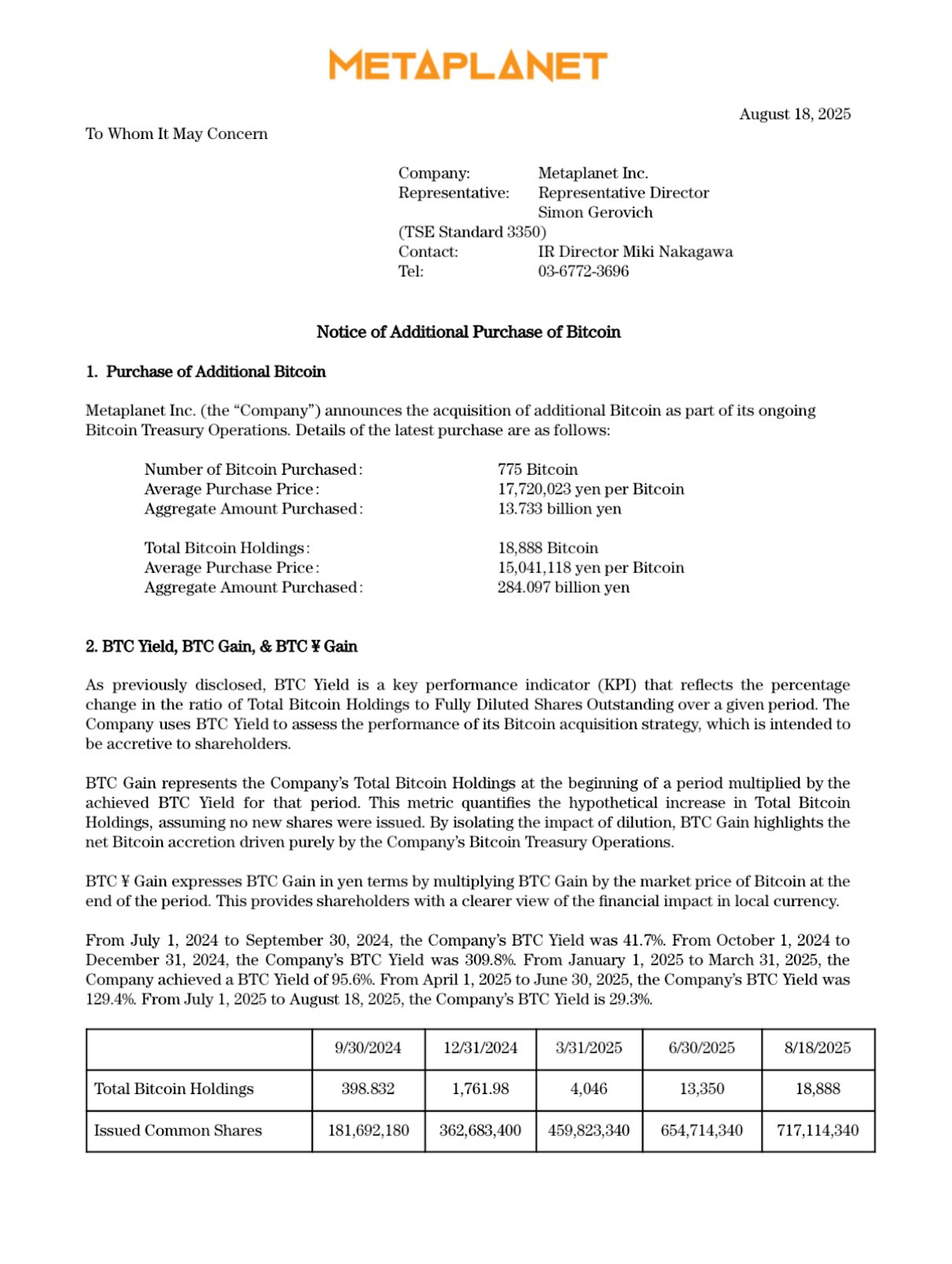

Metaplanet acquired an extra 775 BTC value over $89 million, to surpass 18,888 BTC or $2.1 billion in whole holdings, the corporate stated on Monday.

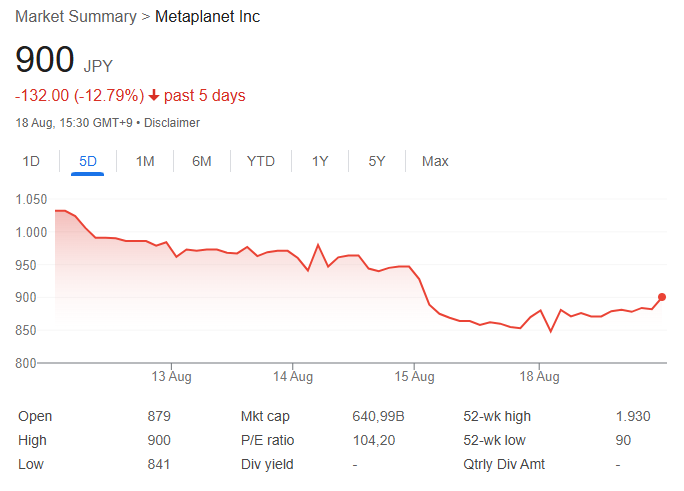

Metaplanet inventory surged almost 190% year-to-date, outperforming the 7.2% rise of Japan’s main and most liquid blue-chip firms tracked by the Tokyo Inventory Value Index (TOPIX) Core 30, Cointelegraph reported final Wednesday.

Regardless of an optimistic earnings report launched final week, Google Finance knowledge exhibits that Metaplanet’s inventory worth fell by over 12.7% in the course of the previous 5 buying and selling days, to commerce at 900 Japanese yen, or $6.11 per share.

Journal: Scottie Pippen says Michael Saylor warned him about Satoshi chatter