Bitcoin (BTC) begins a brand new week with a recent sell-off, and merchants are break up over the place BTC will head subsequent.

-

BTC value motion has dipped $10,000 since its newest all-time excessive simply days in the past, resulting in comparisons with the 2021 high.

-

Order-book manipulation could also be guilty, evaluation argues — a big entity could also be “shopping for the dip.”

-

The US Federal Reserve’s Jackson Gap symposium is due, with the US inflation battle contrasting with hopes of a Russia-Ukraine peace settlement.

-

Bitcoin hodlers might have much less time to take pleasure in positive aspects as the most recent uptrend enters its seventh week.

-

In a “unusual” improvement, BTC value weak spot is diverging from a constructive Coinbase premium.

Bitcoin value has “lowered” breakout odds this week

A swift sell-off disturbed a relaxed weekly shut for BTC/USD on Monday, knowledge from Cointelegraph Markets Professional and TradingView exhibits.

Simply days after its newest all-time excessive above $124,500, the pair shed 2% in hours, bringing its whole drawdown because the peak to over $10,000.

Commenting on the present market construction, merchants have been fast to name new native lows within the coming days.

Rising wedge taking part in out as anticipated. I’ve shared this state of affairs for just a few days now. pic.twitter.com/cWbO7UNweq

— Crypto Tony (@CryptoTony__) August 18, 2025

Buying and selling platform Materials Indicators even dismissed Bitcoin presumably holding its 21-day easy shifting common (SMA), flagging a “fairly strong” down sign on one among its proprietary buying and selling instruments.

“That does not assure a nuke, however it drastically reduces the chance of a $BTC breakout this week,” it wrote in a part of its newest submit on X.

Fashionable dealer Daan Crypto Trades gave $112,000 because the BTC value stage to observe to the draw back, in addition to a break of $120,000 within the occasion of a reversal.

“These early week strikes do have the tendency to retrace however let’s see how the US Market does immediately,” he advised X followers.

Some have been extra involved in regards to the long-term affect of current value habits. Fellow dealer Roman, lengthy cautious of market weak spot, pressured that low quantity had didn’t cement the most recent highs.

“Now $BTC is down $10,000 from prior highs. The dearth of quantity has been extraordinarily regarding for the previous few months,” he concluded.

“To me it’s distribution. Every little thing nonetheless lining up like 2021.”

Roman referred to Bitcoin’s final bull market, which led to late 2021 after a blow-off high at $69,000 — a stage that remained as resistance for a number of years and which triggered the beginning of a 77% bear market drawdown.

Evaluation sees manipulation and “shopping for the dip”

Whereas crypto market manipulation is never thought of constructive, Bitcoin could also be experiencing undue sell-side strain, which isn’t reflective of true demand.

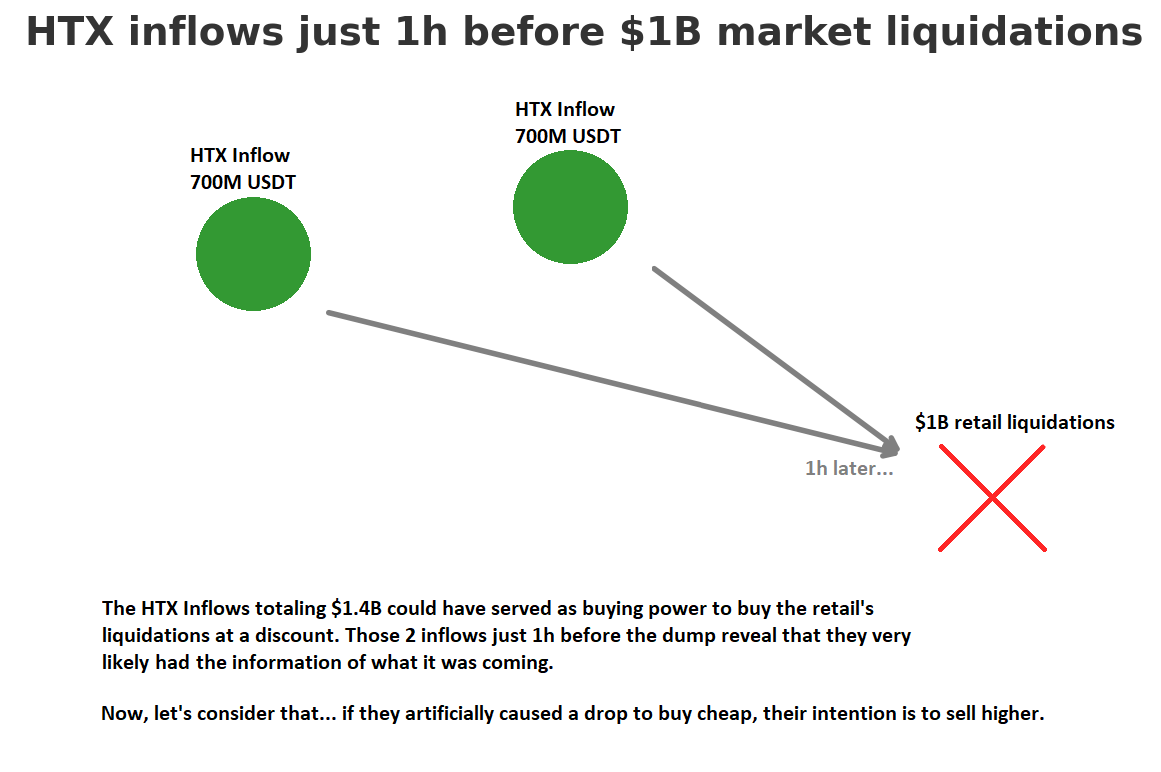

That is the conclusion from well-liked dealer CrypNuevo, who in his newest X thread argued that the snap BTC value dip was something however natural.

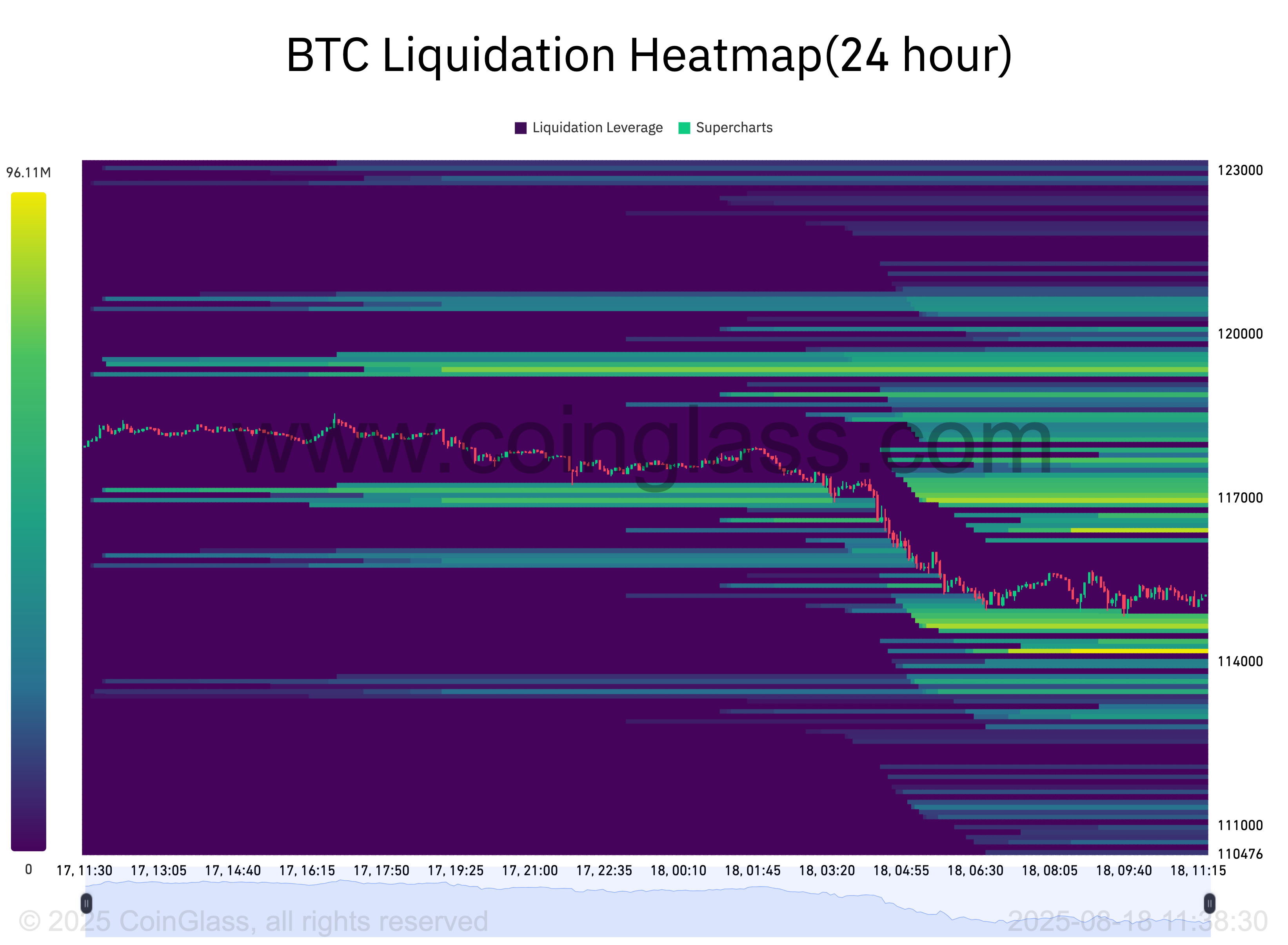

“Bitcoin made a brand new ATH, however then a manipulated organized transfer dumped value inflicting $1B in liquidations in 24h. On the identical time that retail was getting stopped out & liquidated… a hand purchased all these liquidations,” he summarized.

A big-volume purchaser on crypto alternate HTX, CrypNuevo argues, is just trying to purchase in at decrease ranges earlier than the uptrend continues.

“It is possible that they ‘stopped the practice’ to get just a few extra buys earlier than it goes once more. So it is doable that we see some consolidation, perhaps uneven PA, for some days earlier than reclaiming once more that $120k stage,” he continued.

“As soon as value can maintain above $120k, we should always see a very good transfer up.”

Trade order-book knowledge from CoinGlass exhibits how value sliced by means of bid liquidity, with $114,000 the realm of curiosity on the time of writing.

Jackson Gap meets Ukraine peace hopes

This week, the Federal Reserve’s annual coverage symposium in Jackson Gap, Wyoming, is the occasion on each dealer’s calendar.

Chair Jerome Powell will communicate on Friday in what guarantees to be a dangerous climax for market uncertainty over future coverage — particularly, rates of interest.

“Investor consideration can be fixated on Federal Reserve Chair Jerome Powell’s Jackson Gap speech, and the way the Fed is viewing the steadiness of dangers between current weak labor market knowledge and rising inflation,” buying and selling agency Mosaic Asset confirmed within the newest version of its common publication, “The Market Mosaic.”

“Previous speeches by Powell have delivered insights on the metrics that central financial institution officers are monitoring to make coverage selections.”

🇺🇸 UPDATE: Fed Chair Powell is about to talk on Friday, Aug. 22 at 10:00 A.M. ET on financial outlook and framework evaluate. pic.twitter.com/CU7BRxC7D8

— Cointelegraph (@Cointelegraph) August 18, 2025

The Fed is caught between rising inflation and weakening labor-market knowledge, making neither elevating nor reducing charges a gorgeous possibility.

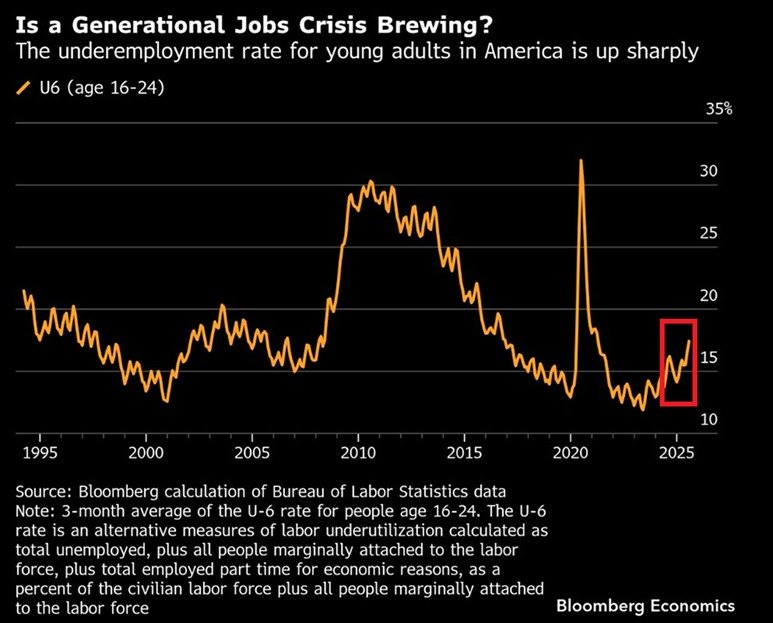

Analyzing present employment developments, buying and selling useful resource The Kobeissi Letter warned {that a} “generational jobs disaster” might start.

“Now, the youth underemployment fee has climbed by ~5 proportion factors during the last 2 years. That is practically according to the height in the course of the 2001 recession and the early phases of the 2008 Monetary Disaster,” it noticed in a part of an X submit on the weekend.

“This additionally indicators the US labor market may weaken additional, with younger employees sometimes the primary to really feel the affect when the economic system turns. The job market is quickly deteriorating.”

On the identical time, Powell is underneath intense strain from Washington, significantly President Donald Trump, to chop charges considerably. Trump has repeatedly known as Powell “too late” in doing so, and the latter’s successor is because of be unveiled shortly.

Danger-asset volatility, in the meantime, might find yourself heightened amid ongoing negotiations to finish the Russia-Ukraine battle.

Kobeissi described Monday’s upcoming assembly between Trump and Ukrainian President Volodymyr Zelenskyy as “essential.” Markets are already “pricing in” a peace settlement.

Finish of “value discovery uptrend”?

Whereas seeing a number of short-term corrections, Bitcoin has loved six weeks of strong uptrend to date.

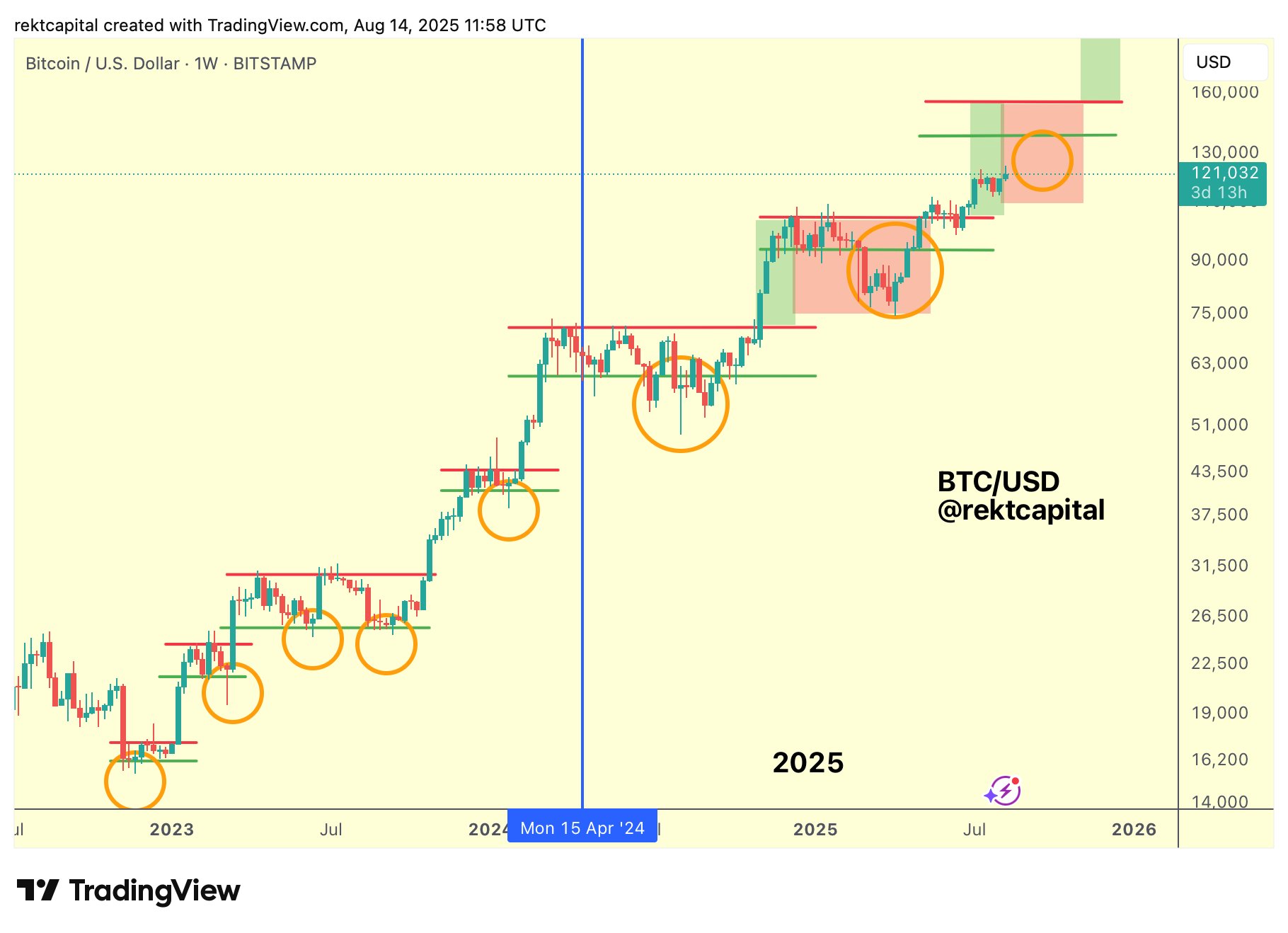

As week seven begins, nevertheless, well-liked dealer Rekt Capital has a phrase of warning for bulls. Bitcoin bull market uptrend phases, he famous Sunday, have a behavior of reversing after between 5 and 7 weeks.

“Traditionally, Bitcoin Value Discovery Uptrend 1 tends to finish between Week 6 & 8 of its uptrend. Whereas in Value Discovery Uptrend 2, Bitcoin tends to finish its uptrend between Week 5 & 7,” he defined.

“Week 7 of Value Discovery Uptrend 2 begins tomorrow.”

An accompanying chart exhibits the varied up and down phases of the present bull market, measured from Bitcoin’s 2024 block subsidy halving. The chart offers a near-term goal of slightly below $160,000.

Persevering with the most recent uptrend into an eighth week would place it within the high phase of historical past, echoing the 2017 bull market.

Bitcoin’s first main correction of 2025, which adopted the tip of the primary uptrend, noticed a 30% drawdown and native lows of slightly below $75,000.

Coinbase premium divergence raises eyebrows

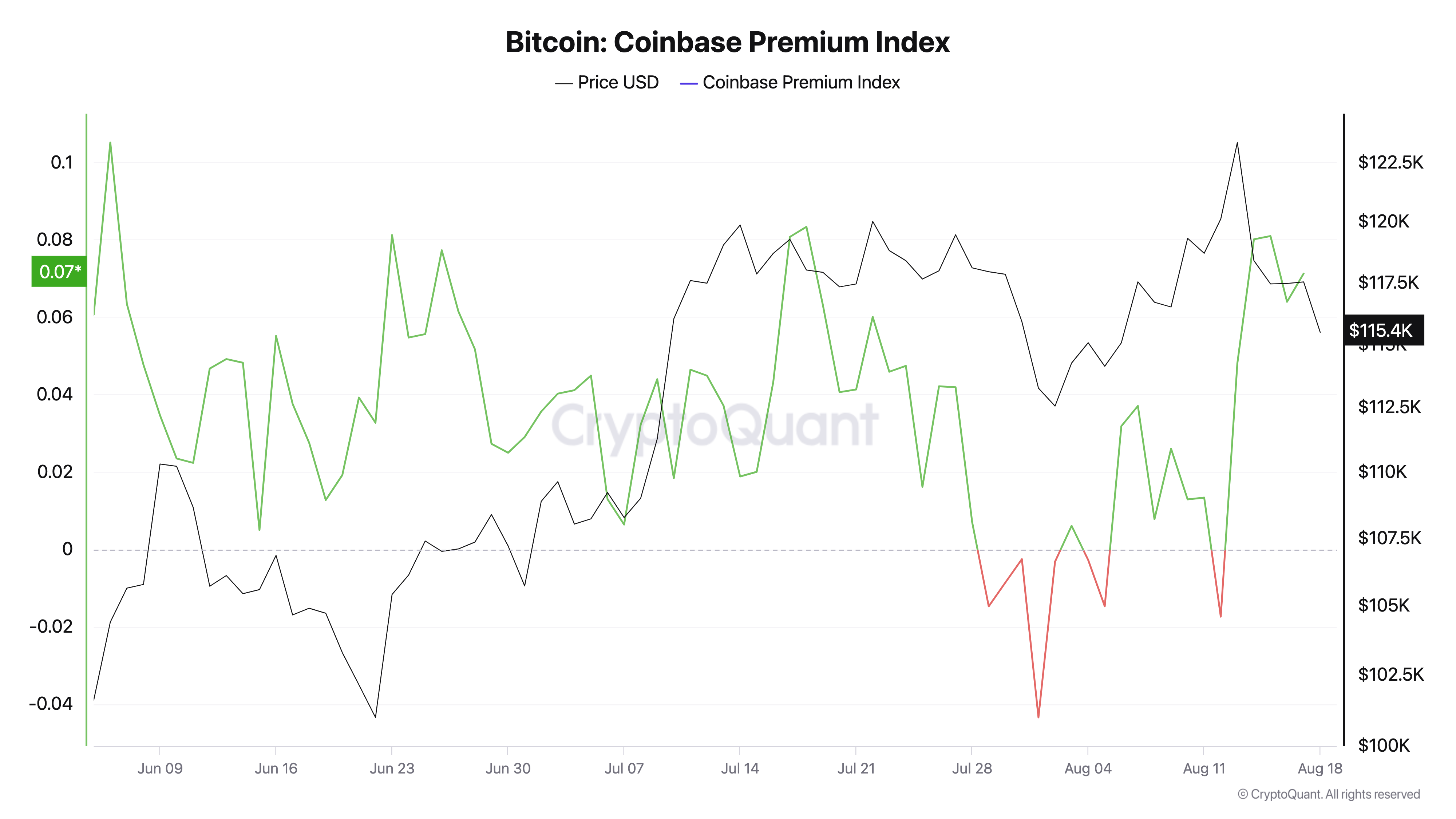

Regardless of the most recent value drawdown, a well-liked US demand metric means that market momentum stays intact.

Associated: Coinbase requires ‘full-scale’ alt season, Ether eyes $6K: Hodler’s Digest, Aug. 10 – 16

The Coinbase Premium, which measures the distinction in BTC costs between the Coinbase BTC/USD and Binance BTC/USDT pairs, is in constructive territory this week.

A constructive premium implies that Coinbase investor demand is making a value hole with the most important international alternate, Binance — an encouraging signal for US demand trajectory.

The final time the premium dipped beneath impartial into the pink was on Aug. 12. BTC/USD made a recent all-time excessive the day after, however whereas value failed to carry, the premium has stayed buoyant.

“After few days of damaging premium, the Coinbase Premium is displaying energy once more,” onchain analytics platform CryptoQuant summarized in one among its “Quicktake” weblog posts Monday.

“Is that this the beginning of a brand new leg?”

Contemplating the curious divergence between value and the premium, well-liked dealer Cas Abbe nonetheless described the scenario as “unusual.”

“Coinbase Bitcoin Premium is at its highest stage in a month, and BTC goes down. Now this might imply 2 issues,” he prompt to X followers.

“Both the client is Saylor solely, who has been twapping for days. Or, some huge entities are accumulating in silence earlier than an enormous occasion. Possibly somebody is aware of about Russia-Ukraine peace deal.”

Abbe referred to Michael Saylor, CEO of expertise agency Technique, which has been including BTC to its company treasury nearly weekly all through 2025. “TWAP,” or time-weighted common value, is a type of funding technique the place a big order is stuffed in a number of small batches at common intervals, serving to to reduce market slippage.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.