What’s hodling crypto?

Hodling crypto means holding onto cryptocurrency long-term as a substitute of promoting, no matter market volatility.

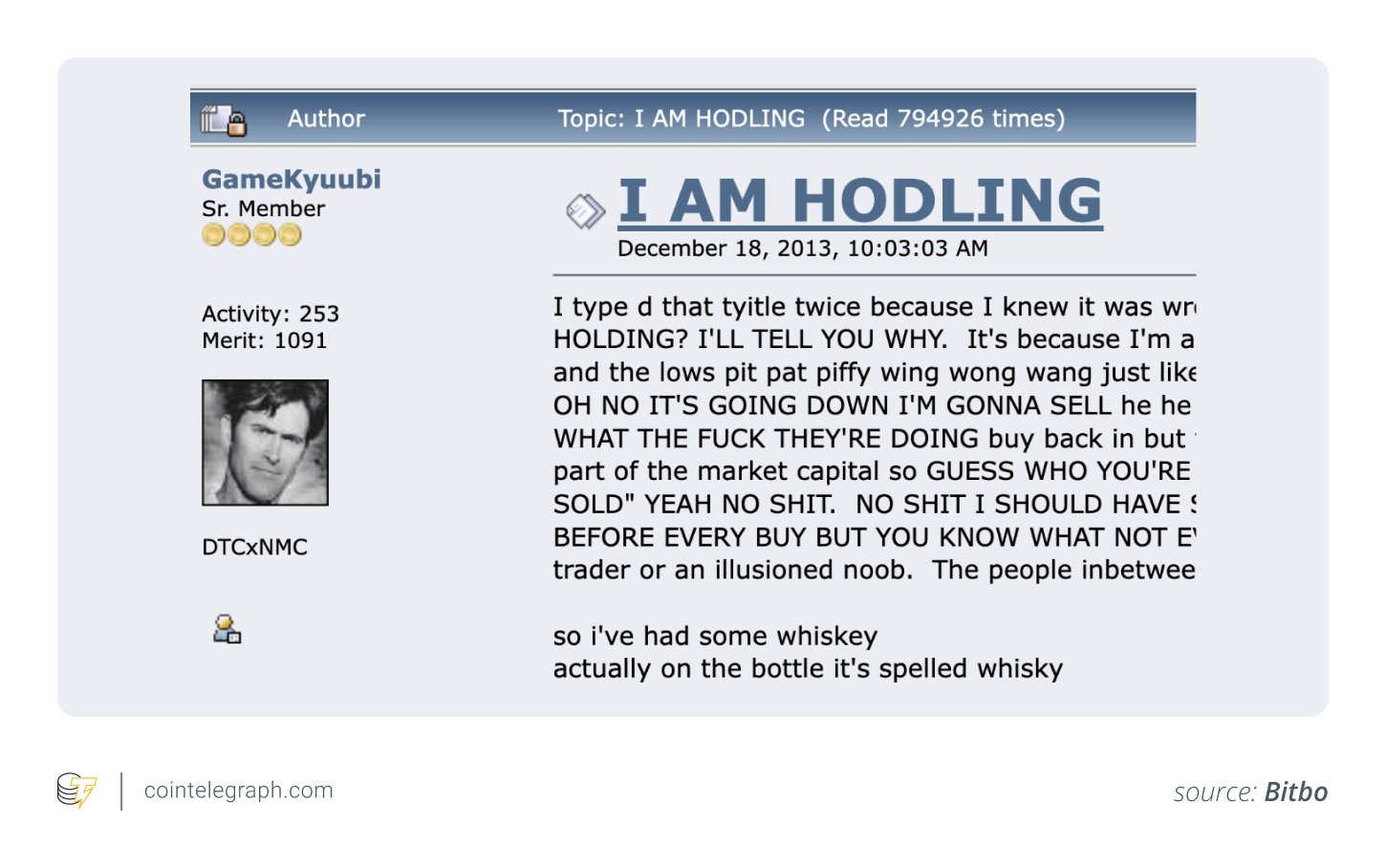

In 2013, a late-night discussion board publish on Bitcointalk was titled “I AM HODLING.”

The person, clearly annoyed with market swings and possibly just a few drinks in, meant to say “holding.”

However, the typo caught. Within the years that adopted, “HODL” went from meme to mindset.

In an area that thrives on hype cycles, FOMO trades and 100x gambles, hodling supplied a radically easy thought: Purchase Bitcoin and don’t contact it. No day buying and selling. No panic promoting. Simply conviction.

Now, in 2025, the world seems very completely different, however hodling continues to be right here. It’s the technique behind lots of Bitcoin’s largest success tales, particularly as extra long-term buyers step into the market.

Central banks are nonetheless combating inflation, establishments are stacking sats, and Bitcoin (BTC) has matured right into a macro asset. In that sort of atmosphere, sitting tight has paid off.

So, what’s hodling in crypto at the moment? It’s a long-term Bitcoin technique that’s nonetheless related, nonetheless working and arguably extra validated than ever.

Do you know? The unique “HODL” publish was written in response to a 39% Bitcoin worth crash in someday (Dec. 18, 2013). The person, GameKyuubi, admitted he was ingesting whiskey and “unhealthy at buying and selling” however determined to carry anyway. That uncooked honesty helped the publish go viral.

Concepts behind hodling Bitcoin in 2025

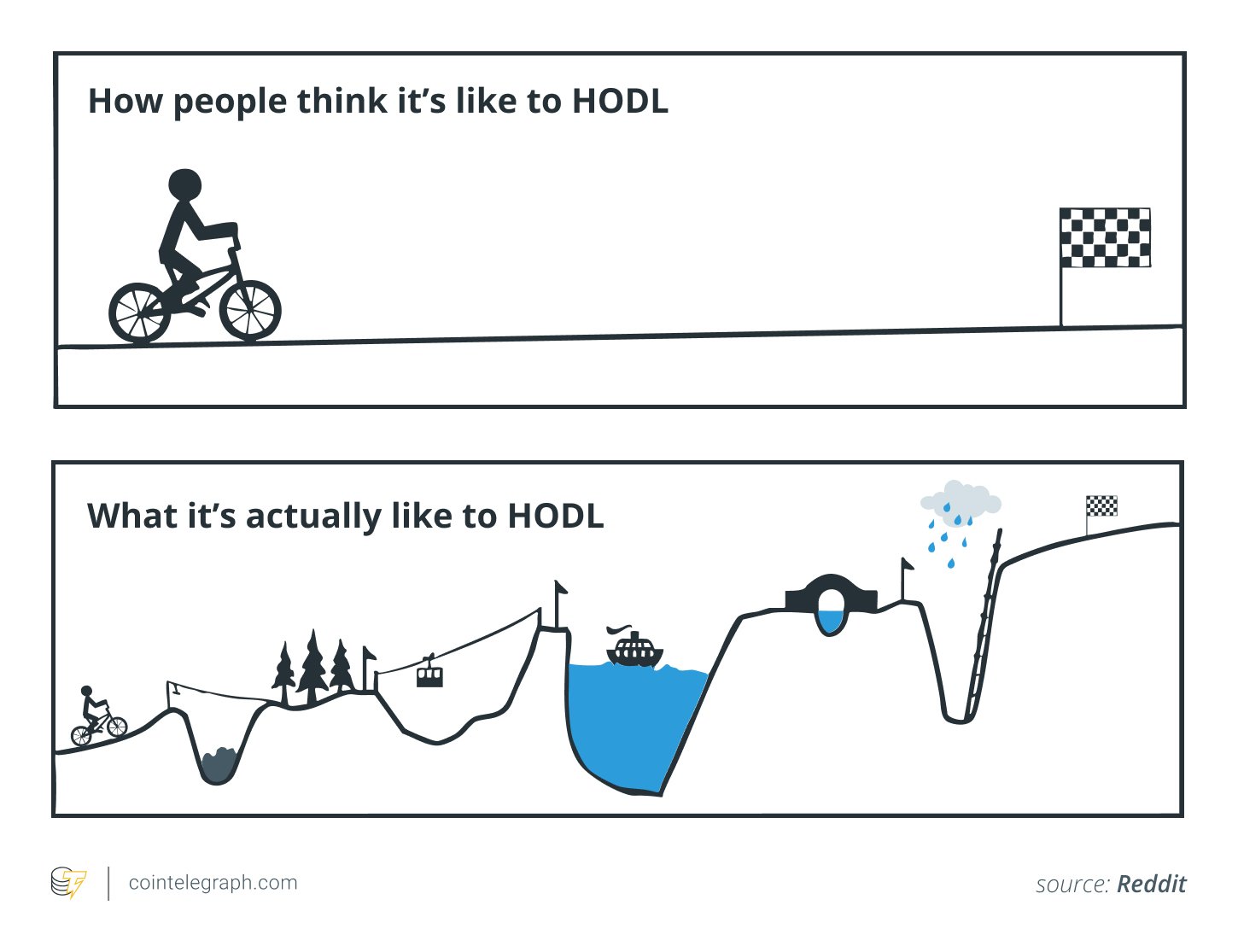

Hodling will be thought of as a psychological protection mechanism towards probably the most risky markets in historical past.

On the core of this mindset is loss aversion, a well-documented precept in behavioral finance.

In keeping with analysis by Nobel laureate Daniel Kahneman, individuals really feel the ache of losses about twice as strongly because the pleasure of equal good points.

In crypto, the place 20% day by day swings aren’t uncommon, this emotional bias can drive irrational choices: panic promoting on the backside or FOMO shopping for close to the highest.

Hodlers reject that impulse. They subscribe to what the crypto neighborhood calls “diamond fingers,” a dedication to long-term conviction, even when the market turns pink. It’s not about timing tops and bottoms; it’s about not flinching when others do.

This mentality aligns intently with how Bitcoin is more and more positioned in 2025: as a retailer of worth. Constancy, BlackRock and different main establishments now describe Bitcoin alongside gold in asset allocation reviews.

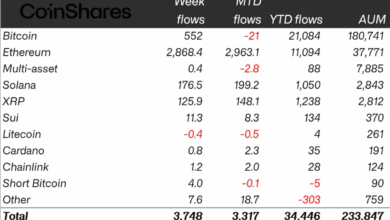

In keeping with CoinShares, over 70% of Bitcoin’s circulating provide hasn’t moved in additional than a 12 months — the best stage ever recorded. That’s intentional holding by long-term buyers, together with exchange-traded funds (ETFs), pension funds and sovereign wealth automobiles.

In brief, hodling is stoicism meets finance.

Do you know? In 2025, over 94% of Bitcoin’s complete provide has already been mined. That leaves lower than 1.05 million BTC left to be created — ever — with a sort of mathematical completion anticipated by the 12 months 2140.

2025 market context: Must you hodl Bitcoin?

In case you’ve been holding Bitcoin (BTC) over the previous few years, you’ve lived by means of rather a lot: the fallout from FTX, a brutal bear market, world inflation spikes and nonstop regulation speak. And but, right here you’re in 2025, and Bitcoin’s nonetheless standing — stronger, arguably, than ever.

Again in 2020, Bitcoin was buying and selling underneath $10,000. Quick ahead to Could 2025, and it has reached new heights, hitting an all-time excessive of practically $112,000.

Institutional curiosity has performed a big function on this progress. BlackRock’s iShares Bitcoin Belief (IBIT) has seen spectacular inflows, with practically $7 billion added in 2025 alone, marking a 16-day streak of constructive inflows. Constancy and ARK Make investments have additionally contributed to this pattern, with their respective ETFs attracting substantial investments. Collectively, US spot Bitcoin ETFs have amassed over $94.17 billion in property underneath administration.

As of Could 27, 2025, Bitcoin is firmly in a bull market and continues to climb.

In fact, it’s not going to be clean crusing forward. Regulation is heating up. Whereas Bitcoin has largely dodged the worst of it, the broader crypto crackdown means it’s by no means completely out of the firing line. Some nations are already speaking about capital controls on crypto to handle outflows, particularly throughout instances of forex stress.

Then there’s the rise of central financial institution digital currencies (CBDCs) rolling out in all places from the EU to Asia. They’re marketed as “protected digital cash,” and whereas they’re not competing with Bitcoin straight, they’re shaping the best way governments take into consideration financial management onchain. With tokenized US Treasurys now providing yields above 5% onchain, the panorama for digital worth is increasing; Bitcoin is not the one recreation on the town.

Power can be again within the dialog. Environmental, social and governance (ESG) stress isn’t going away, regardless that over half of Bitcoin mining is now powered by renewables, in response to the Bitcoin Mining Council. Nonetheless, political narratives don’t at all times care about information.

So… is it nonetheless value hodling?

Loads of individuals assume so. The stock-to-flow mannequin, although not excellent, nonetheless places long-term worth targets within the six-figure vary. ARK Make investments has modeled a possible Bitcoin worth of over $1 million by 2030 in its bull case, whereas Constancy has projected robust long-term progress primarily based on community adoption.

Bitcoin for long-term: Instruments and platforms in 2025

Hodling in 2025 doesn’t imply burying your seed phrase within the yard and praying for the most effective. At this time, there’s a whole stack of instruments constructed particularly for long-term holders.

Chilly vs. scorching: How hodlers retailer their Bitcoin

On the most simple stage, hodlers nonetheless select between scorching wallets (linked to the web) and chilly wallets (offline storage).

Chilly wallets — like Ledger, Trezor, or air-gapped gadgets just like the Ellipal Titan — stay the go-to for critical long-term storage. They’re more durable to hack, simpler to manage and ultimate for individuals who don’t plan to the touch their cash for years.

For individuals who desire accessibility, scorching wallets like Sparrow, BlueWallet and even browser-based wallets on Nostr purchasers have improved dramatically in safety.

Many now combine with multisig setups or faucet into decentralized identification programs for restoration, making them extra user-friendly than they had been only a few years in the past.

Institutional-grade custody and yield choices

Extra hands-off hodlers — particularly high-net-worth people and establishments — are turning to certified custodians.

Platforms like Constancy Digital Belongings, Coinbase Custody and BitGo provide safe vaulting options with compliance baked in. These companies usually include extra perks, like portfolio insurance coverage, automated rebalancing or integration with belief and property planning.

However it’s not nearly storage anymore. In 2025, a rising variety of hodlers are placing their BTC to work:

- Lido, finest identified for Ether staking, has expanded into Bitcoin staking derivatives, letting customers earn yield on wrapped BTC positions with out shedding custody.

- Platforms like Liquid and Babylon are experimenting with Bitcoin-native staking fashions, permitting BTC to safe sidechains or earn validator-like rewards with out being rehypothecated.

- Tokenized T-bill vaults and BTC-backed stablecoins now permit customers to generate yield whereas sustaining Bitcoin publicity. (Consider it as DeFi’s model of a long-term financial savings account.)

Automation instruments

Hodling at the moment can be automated. Providers like Swan Bitcoin and River Monetary let customers arrange recurring buys — primarily automated dollar-cost averaging — and auto-withdraw to chilly storage. In the meantime, platforms like Casa and Unchained Capital provide multisig setups with built-in inheritance planning and emergency restoration workflows.

There are additionally instruments like Zaprite or Timechain Calendar that assist hodlers observe portfolio progress with out connecting on to wallets, a super choice for many who need visibility with out publicity.