Dogecoin

nursed losses on Monday because the group behind Qubic, which just lately attacked Monero, voted to focus on the Dogecoin community over Zcash and Kaspa by a giant margin.

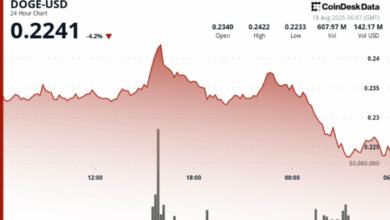

On the time of writing, DOGE traded at over 22 cents, representing a 4% decline on a 24-hour foundation, in keeping with CoinDesk information. The cryptocurrency chalked out a bullish golden crossover final week, however the bullish sample didn’t encourage bullish momentum.

Early Monday, the AI-focused blockchain venture Qubic introduced the group’s intention to focus on Dogecoin on X, stating, “There are ongoing discussions about $DOGE and preparation will take time.”

It added that “questions round blockchain resilience are being raised and we might have instruments to deal with them.”

Sergey Ivancheglo, the founding father of the Qubic community, sought a group vote on which application-specific built-in circuit (ASIC)-enabled proof-of-work (PoW) blockchain must be focused with a 51% assault. From a listing that included Kaspa and Zcash, the group overwhelmingly voted for DOGE.

“The Qubic group has chosen Dogecoin,” Ivancheglo, introduced on X by way of his deal with Come-from-Past.

Qubic just lately launched a profitable 51% assault on Monero, gaining majority management over the computing energy used to safe the privateness community.

DOGE leads CVD decline

DOGE’s futures open-interest-adjusted cumulative quantity delta (CVD) indicator has dropped almost 1% prior to now 24 hours, the biggest among the many high 25 cryptocurrencies by market worth, in keeping with information supply Velo.

CVD, or Cumulative Quantity Delta, is a technical indicator that measures the web shopping for or promoting stress in a market over a particular interval. It’s a working whole of the distinction between shopping for and promoting quantity.

A adverse CVD signifies that promoting stress is extra substantial than shopping for stress. Which means a larger variety of market contributors are promoting a selected asset than shopping for it. It’s typically seen as a bearish sign, suggesting that the value is prone to drop or proceed its decline.

Most cryptocurrencies, together with BTC and ETH, have an identical bearish profile. In the meantime, LINK is the one token, boasting a constructive CVD.

BTC Drops beneath $116K

Bitcoin

, the main cryptocurrency by market worth, fell almost to $115,000 early Monday, extending the decline from Thursday’s file excessive of over $124,000.

The decline follows a hotter-than-expected U.S. producer value inflation on Friday, which weakened the case for a 50-basis-point Fed price lower in September. That mentioned, the central financial institution continues to be anticipated to scale back the borrowing value by 25 foundation factors.

“Given the persistent uncertainty surrounding key financial indicators, the Federal Reserve has up to now maintained a cautious stance on rate of interest cuts. The latest U.S. Producer Value Index (PPI) for July doesn’t make that any simpler,” analysts at Coinbase Institutional mentioned in a weekly report.

“However, we see this as a chance. We expect the Fed’s eventual deal with the broader financial image, together with the labor market, will finally result in 25 bps price cuts in September and October,” analysts added.

Some observers anticipate the Fed Chair Jerome Powell to put the groundwork for the September transfer throughout this speech on the Jackson Gap Symposium later this week.

Learn extra: Asia Morning Briefing: Crypto’s Rising Leverage Trades Present Indicators of Stress, Galaxy Digital Says