Key takeaways:

-

China’s central financial institution stimulus might redirect liquidity into cryptocurrencies.

-

Rising US Treasury yields recommend decrease danger aversion, supporting potential restoration in altcoin markets.

Central banks stimulate development by decreasing rates of interest or enabling particular financing circumstances, successfully growing the cash provide. This dynamic advantages danger belongings resembling shares and cryptocurrencies.

Merchants now query if the Chinese language central financial institution’s subsequent transfer will present the liquidity enhance that lastly drives altcoins past their earlier all-time highs.

Financial stimulus is helpful for the cryptocurrency market

A March 2025 21Shares report highlighted a hanging 94% correlation between Bitcoin’s (BTC) value and international liquidity, surpassing each the S&P 500 and gold.

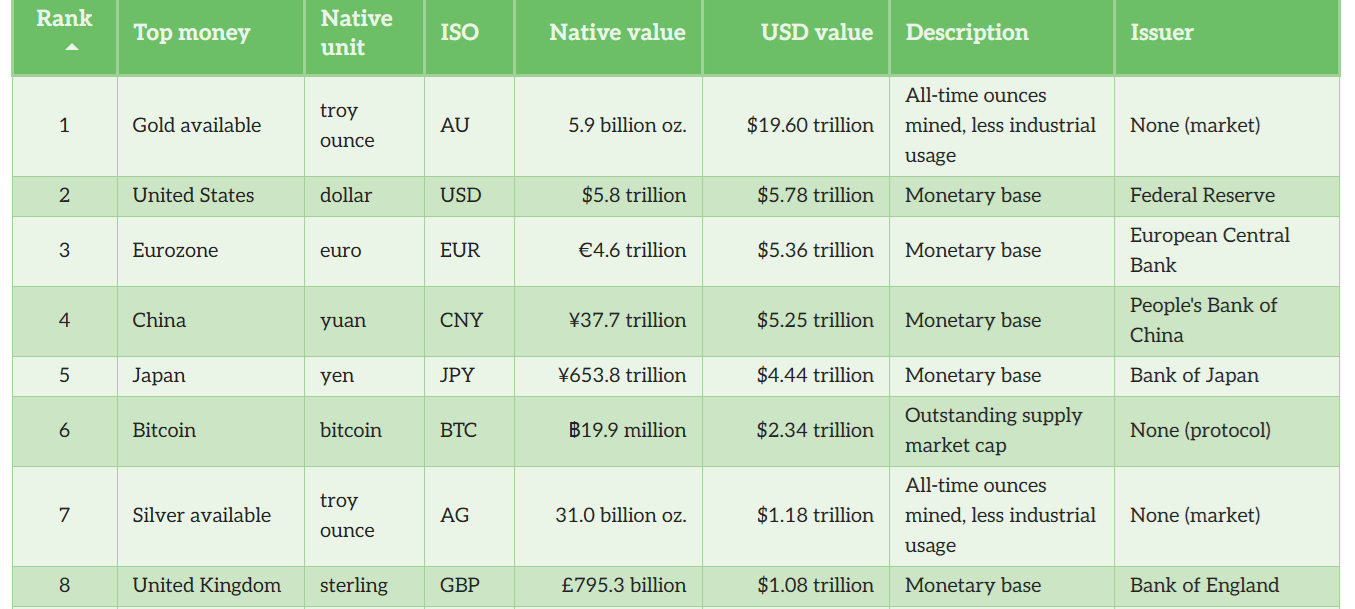

At the moment, the US M0 financial base is $5.8 trillion, adopted by $5.4 trillion within the eurozone, $5.2 trillion in China, and $4.4 trillion in Japan, in response to Porkopolis Economics. With China accounting for 19.5% of world home product, its financial coverage choices stay essential, even when the US Federal Reserve dominates headlines.

On Thursday, China reported a 0.1% decline in July retail gross sales in contrast with the prior month. Goldman Sachs estimates present that in July alone, investments in fastened belongings fell 5.3% year-over-year, the steepest contraction since March 2020. In the meantime, industrial manufacturing rose by simply 0.4% in the course of the month. China’s survey-based city unemployment fee additionally climbed to five.2% in July, up from 5% in June.

Bloomberg Economics analysts Chang Shu and Eric Zhu famous that the Folks’s Financial institution of China (PBOC) might introduce stimulus measures “as quickly as September.” Equally, economists at Nomura and Commerzbank argued that it is just a matter of time earlier than stronger help insurance policies arrive.

Nonetheless, even when the PBOC adopts a extra expansionist stance, cryptocurrency buyers might hesitate if international recession fears intensify.

US client sentiment deteriorates, however merchants are usually not fearful

The College of Michigan’s client survey, launched on Friday, confirmed that 60% of People anticipate unemployment to worsen over the following 12 months, a sentiment final recorded in the course of the 2008–09 monetary disaster. But markets have remained resilient. The S&P 500 closed at a brand new all-time excessive, whereas yields on 5-year Treasurys additionally moved larger, suggesting buyers nonetheless lean towards optimism.

Associated: Bitcoin’s all-time excessive positive aspects vanished hours later: Right here’s why

When recession fears rise, demand usually will increase for belongings backed by the US authorities, permitting buyers to simply accept decrease yields. After dropping to three.74% on Aug. 4, the bottom stage in additional than three months, 5-year Treasury yields rebounded to three.83% on Friday. The transfer signifies merchants have gotten much less risk-averse, opening house for a rebound in altcoin market capitalization.

If China follows by with stronger stimulus, that added liquidity may very well be the catalyst for a broad rotation into danger belongings. In such a situation, the push from the PBOC could also be sufficient to propel cryptocurrencies to contemporary all-time highs.

This text is for normal data functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don’t essentially mirror or symbolize the views and opinions of Cointelegraph.