The neighborhood for Qubic, the AI-focused blockchain venture that executed a 51% assault on Monero this week and gained majority management of the community’s computing energy, has voted to focus on Dogecoin (DOGE) subsequent.

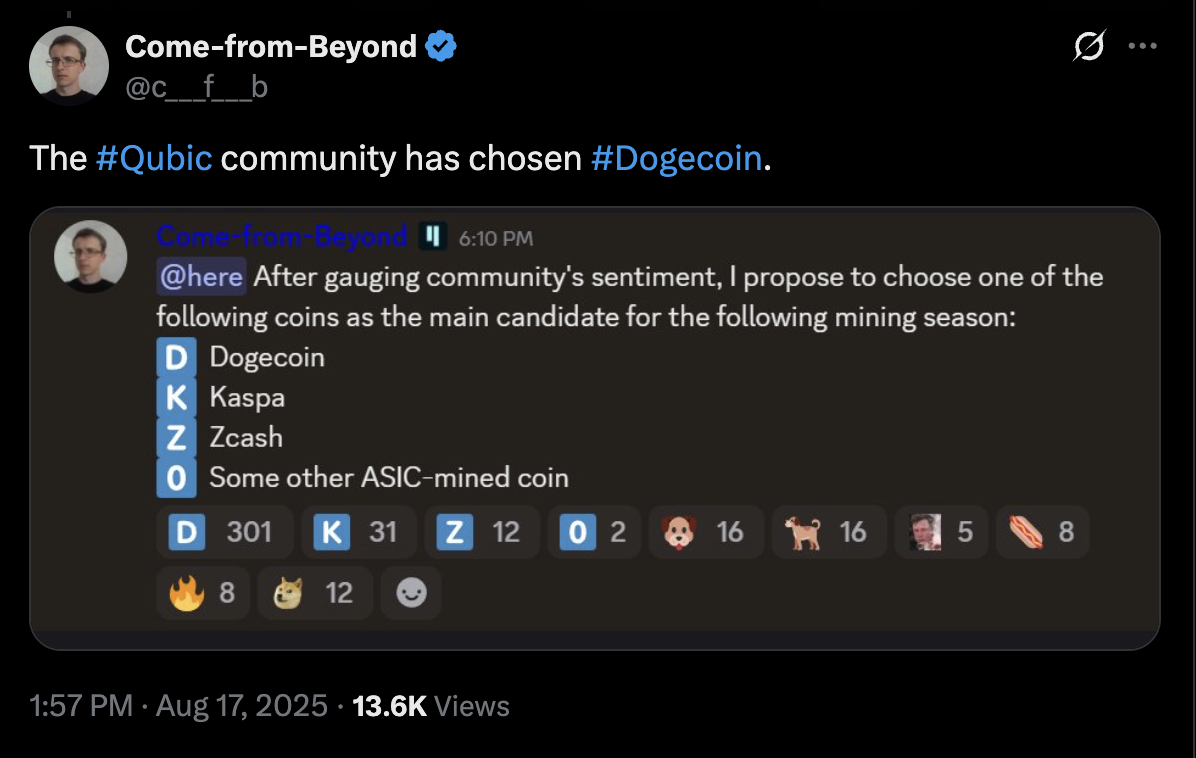

Sergey Ivancheglo, the founding father of the Qubic community, requested the Qubic neighborhood which application-specific built-in circuit (ASIC)-enabled, proof-of-work blockchain the group ought to goal with its subsequent 51% assault, together with DOGE, Kaspa (KAS), and Zcash (ZEC).

“The Qubic neighborhood has chosen Dogecoin,” Ivancheglo, who goes by the web deal with Come-from-Past, wrote in a Sunday X submit saying the outcomes of the vote.

Dogecoin, which has a market cap of over $35 billion, obtained over 300 votes, greater than all the opposite networks mixed.

Qubic’s profitable 51% assault on Monero, a privateness blockchain, took the crypto neighborhood without warning, and the AI-focused community concentrating on one other proof-of-work cryptocurrency may sign troubling implications for digital asset blockchains reliant on mining.

Associated: Monero ‘financial assault’ receives robust neighborhood response

Qubic efficiently positive aspects hashrate dominance over the Monero community

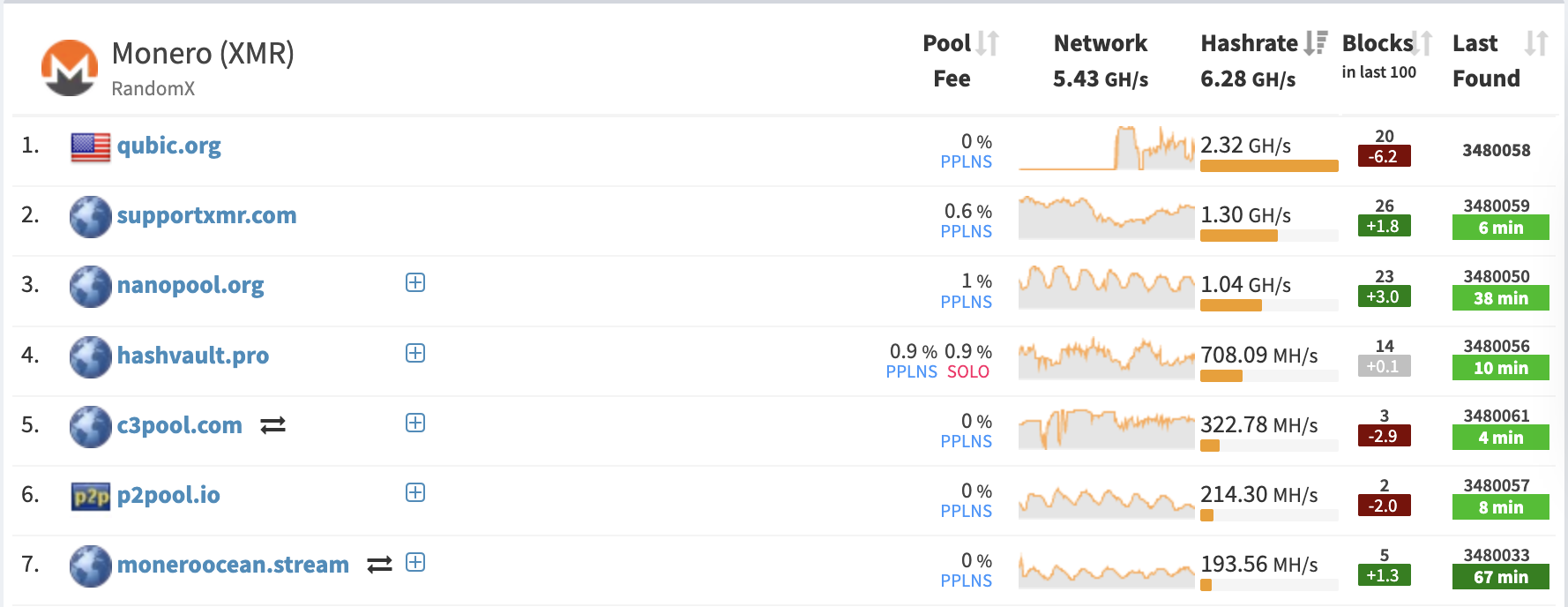

The Qubic workforce introduced that it gained majority management over the computing energy used to safe the Monero community on Monday.

Qubic’s mining pool efficiently reorganized six blocks following a month-long battle with different Monero miners for management of the community’s hashrate.

The Qubic mining pool instructions a hashrate of about 2.32 gigahashes per second (GH/s) on the time of this writing, in response to MiningPoolStats.

“The Monero community’s core performance stays intact. Its privateness, velocity, and usefulness haven’t been compromised,” the Qubic workforce wrote on Tuesday following the takeover.

“Nonetheless, the top aim is for the Monero protocol’s safety to be offered by Qubic’s miners,” the workforce continued.

Following the assault, crypto trade Kraken quickly suspended Monero (XMR) deposits on the platform, citing the “potential threat to community integrity” from the 51% takeover of Monero by a single miner.

Regardless of the non permanent pause on Monero deposits, the trade is protecting XMR withdrawals and buying and selling open and informed customers that XMR deposits will return as soon as the trade deems it “secure,” in response to an announcement from the corporate.

Journal: AI could already use extra energy than Bitcoin — and it threatens Bitcoin mining