Bitcoin

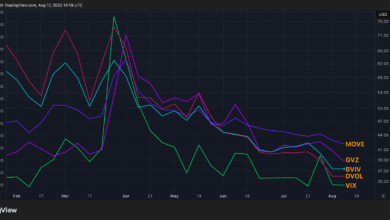

mining profitability elevated 2% in July as the worth of the world’s largest cryptocurrency rose 7% whereas the community hashrate jumped 5%, funding financial institution Jefferies mentioned in a analysis report on Friday.

“We see constructive BTC value momentum as most favorable for Galaxy’s (GLXY) digital belongings enterprise, whereas miners struggle a rising community hashrate,” analyst Jonathan Petersen wrote.

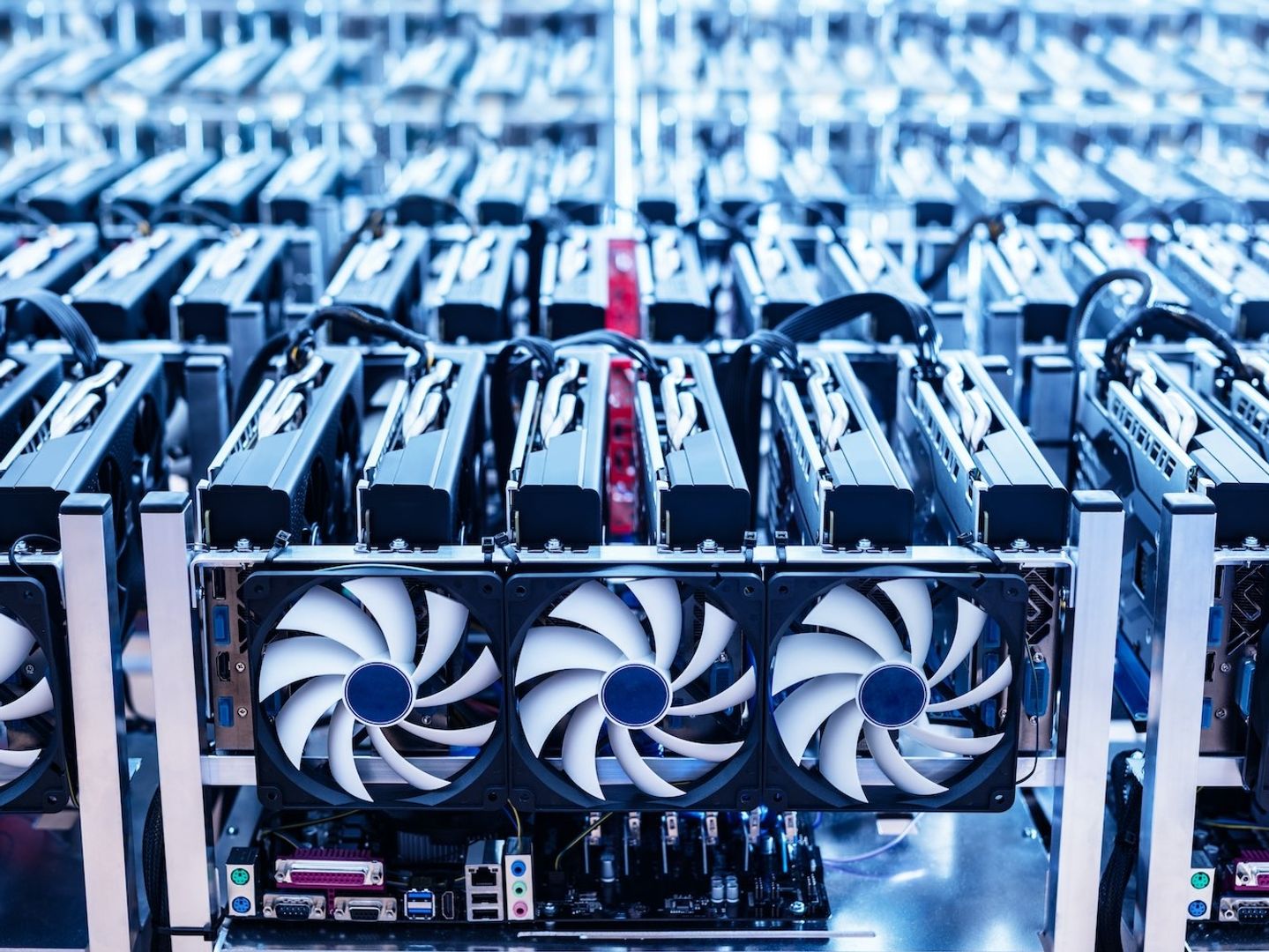

The hashrate refers back to the complete mixed computational energy used to mine and course of transactions on a proof-of-work blockchain, and is a proxy for competitors within the trade and mining issue. It’s measured in exahashes per second (EH/s).

U.S.-listed mining corporations mined 3,622 bitcoin in July, versus 3,379 cash the month earlier than, the report mentioned, and these corporations accounted for 26% of the whole community in comparison with 25% in June.

IREN (IREN) mined essentially the most bitcoin, with 728 tokens, adopted by MARA Holdings (MARA) with 703 BTC, the financial institution famous.

Jefferies mentioned MARA’s energized hashrate stays the biggest of the sector, at 58.9 EH/s on the finish of July, with CleanSpark (CLSK) second with 50 EH/s.

Income per exahash/second additionally elevated. “A hypothetical one EH/s fleet of BTC miners would have generated ~$57k/day in income throughout July, vs ~$56k/day in June and ~$50k a 12 months in the past,” the analyst wrote.

Learn extra: Bitcoin Miner MARA Steps Into HPC With Majority Stake in EDF Subsidiary: H.C. Wainwright