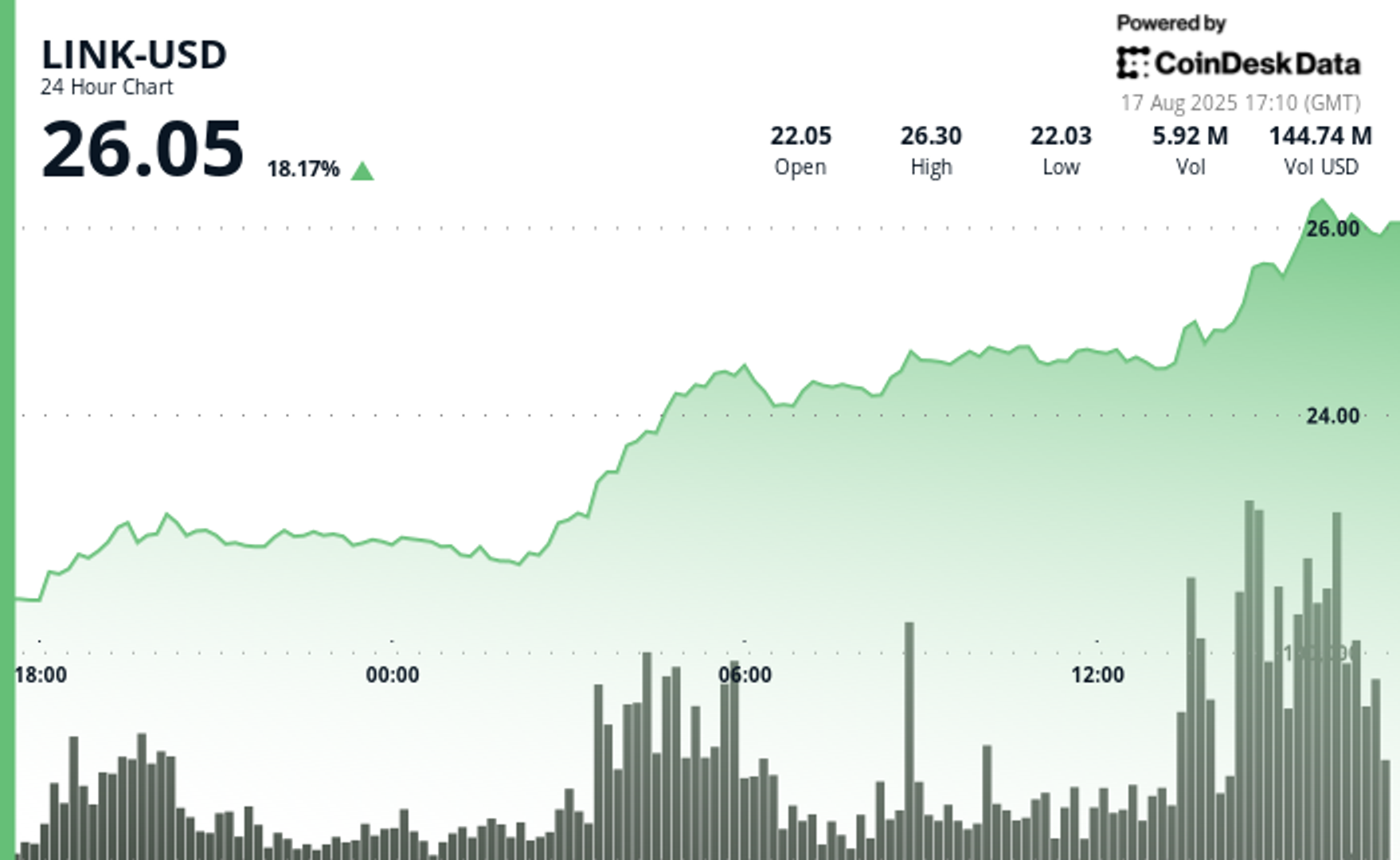

Chainlink’s LINK token jumped 18% to $26.05 on Sunday, based on CoinDesk Knowledge, pacing the highest 50 cryptocurrencies by proportion acquire as analysts and merchants cited momentum and up to date elementary catalysts.

What Analysts Are Saying

Altcoin Sherpa described LINK as “the most effective cash proper now,” pointing to chart energy that might carry towards $30. He defined that round-number ranges like $30 typically act as psychological boundaries the place sellers take earnings, so merchants ought to be cautious about chasing the transfer too late.

Zach Humphries, one other analyst, argued that LINK stays “very undervalued” at present costs. He emphasised that Chainlink underpins a lot of decentralized finance by delivering the worth feeds and cross-chain companies many protocols depend on. From his perspective, the token ought to be handled as a guess on crucial infrastructure slightly than simply one other speculative asset.

Milk Highway highlighted the robust buying and selling backdrop. The publication famous a 66% surge in 24-hour buying and selling quantity and mentioned LINK’s clear breakout above $24.50 added conviction for momentum merchants. They tied the bullish tone again to 2 key August developments: the launch of Chainlink’s new onchain reserve and its information partnership with Intercontinental Trade (ICE).

Chainlink Reserve

On Aug. 7, Chainlink launched the Chainlink Reserve, a sensible contract treasury designed to steadily accumulate LINK over time. The mechanism works by changing the challenge’s income — paid in stablecoins, gasoline tokens, or fiat — into LINK after which locking these tokens onchain for a number of years.

The conversion course of, known as Cost Abstraction, automates this workflow. It makes use of Chainlink’s personal companies — value feeds for truthful conversion charges, automation to set off transactions, and CCIP to consolidate charges from totally different chains — earlier than swapping into LINK through decentralized exchanges.

Chainlink says the Reserve has already amassed greater than $1 million price of LINK, with no withdrawals deliberate for a number of years. It additionally earmarks 50% of charges from staking-secured companies reminiscent of Sensible Worth Recapture to feed the Reserve, making a recurring stream of inflows.

The initiative serves two strategic functions.

First, it strengthens the hyperlink between adoption and token demand by guaranteeing utilization revenues convert straight into LINK.

Second, it gives transparency: anybody can view inflows, balances, and the timelock at reserve.chain.hyperlink.

Chainlink has framed the Reserve as one piece of a broader financial design that features user-fee progress and value reductions through the Chainlink Runtime Atmosphere. For buyers, the sensible takeaway is that community progress can now translate into regular, programmatic accumulation of LINK on the open market.

Chainlink’s dashboard exhibits the reserve now holds about 109,663 LINK tokens, with a market worth of roughly $2.8 million. The information additionally highlights that the common value foundation of those holdings is $19.65 per token, underscoring this system’s early accumulation technique.

ICE Partnership

On Aug. 11, Chainlink introduced a partnership with Intercontinental Trade (ICE), the operator of the New York Inventory Trade. The collaboration integrates ICE’s Consolidated Feed, which gives foreign-exchange and precious-metals charges from greater than 300 venues, into Chainlink Knowledge Streams.

ICE is one in all a number of blue-chip contributors to those datasets, that are aggregated by Chainlink to create quick, tamper-resistant information feeds to be used onchain. By incorporating ICE’s market protection, Chainlink goals to make its feeds extra enticing for banks, asset managers, and builders constructing tokenized belongings or automated settlement techniques.

Chainlink Labs described the combination as a watershed second for institutional adoption. The pondering is that conventional finance gamers want confirmed, high-quality information to work together with blockchain functions, and bringing ICE’s feeds onchain helps meet that commonplace.

The partnership marked one of many clearest examples but of a serious Wall Road market information supplier partaking with blockchain infrastructure. By giving decentralized functions direct entry to ICE’s monetary information, it positioned Chainlink as a bridge between conventional markets and decentralized finance.

Trying Forward

Analysts spotlight LINK’s robust pattern, undervaluation and accelerating momentum, suggesting the token is ready of energy as buyers digest Chainlink’s latest strategic strikes.