Bitcoin

hovered close to $118,348 on Sunday, up 0.39% in 24 hours, as two analysts outlined paths that would check merchants’ nerves: a dip towards $108K–$112K or a drawn-out vary with room for altcoins.

Lark Davis argues that if bitcoin continues to slip, the more than likely touchdown zone is $108,000–$112,000. That vary served as a ceiling earlier this yr when bitcoin’s rally stalled, and in market psychology, ranges that when blocked value typically flip into help when revisited.

He emphasizes that this space additionally aligns with two basic pullback checkpoints often called the 50% and 61.8% Fibonacci retracements. These measures, drawn from the scale of bitcoin’s final rally, are extensively watched as a result of they typically mark the place profit-taking slows and new shopping for emerges. Whereas Fibonacci ratios sound mathematical, in observe they work as self-fulfilling markers since many merchants plan entries there.

Davis additionally factors to the 20-week exponential transferring common, a pattern line that updates rapidly with latest value motion. When this line is rising into the identical $108K–$112K space, it strengthens the case for help, as a result of technical merchants see each historical past and momentum assembly in a single zone.

When a number of indicators cluster like this — resistance turned help, Fibonacci checkpoints and a rising common —merchants name it “confluence,” and confluence zones typically act like magnets for value checks.

In different phrases, Davis isn’t predicting collapse however a wholesome reset. His framework means that if bitcoin dips, patrons may step in round that band and gasoline the following leg larger.

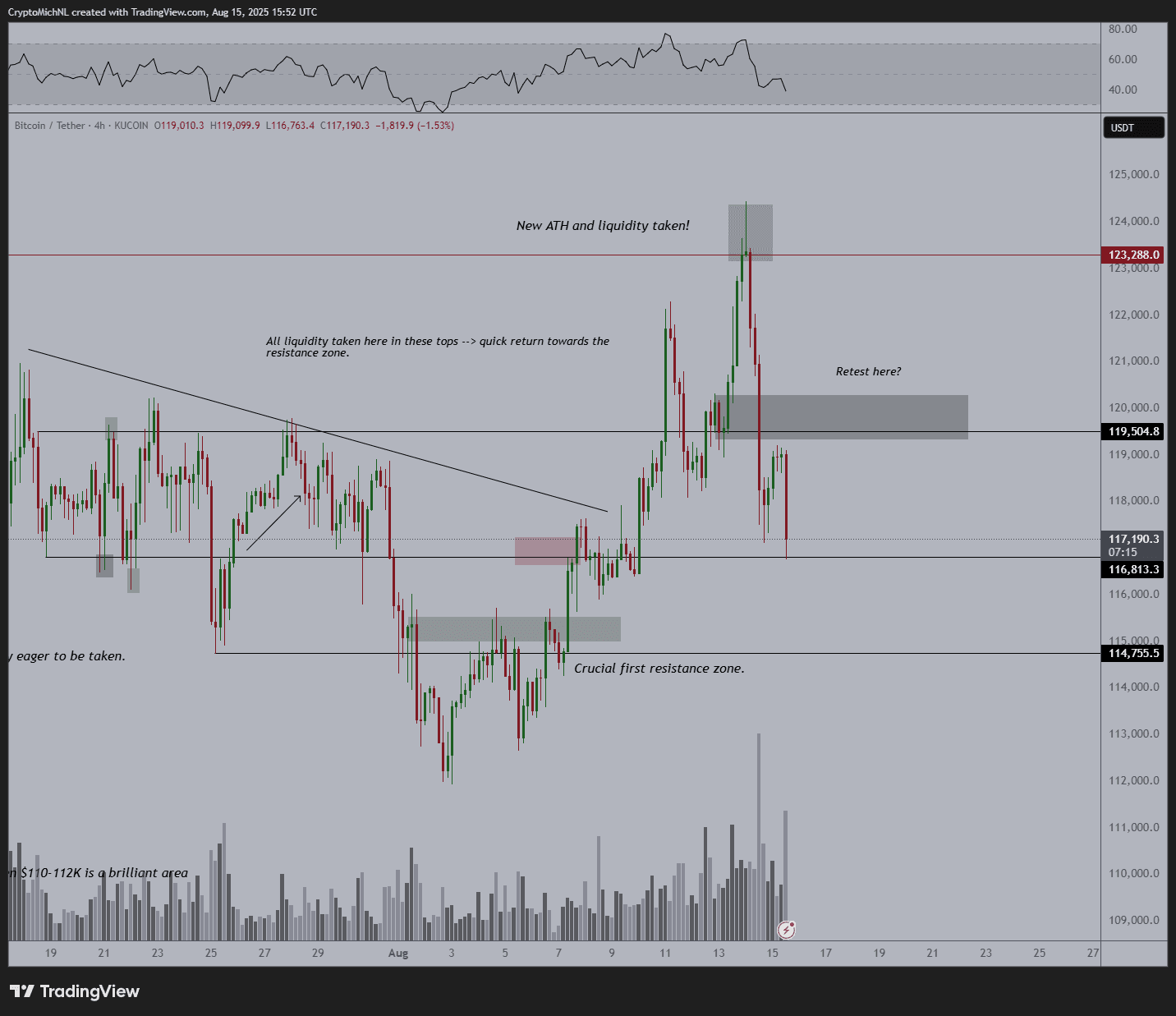

Michaël van de Poppe takes a special angle, noting that bitcoin was simply rejected at a key resistance degree close to its latest highs. A rejection means sellers absorbed demand as the value tried to interrupt out, a standard sign that momentum wants to chill off earlier than the following push. He expects the market to consolidate quite than pattern, with bitcoin transferring sideways between a flooring and a ceiling whereas leverage resets.

The TradingView chart he shared underscores this. It confirmed bitcoin making repeated makes an attempt on the high of its vary however failing to carry above resistance. The candles fashioned wicks —value spikes that rapidly pale — suggesting promoting strain was lively close to the highs. Beneath, the chart marked a zone of potential help, the place Van de Poppe believes bitcoin may discover a base earlier than one other breakout try.

For van de Poppe, the message just isn’t about deep retracement however time. A sideways vary would give the market respiratory room, filter out overextended positions, and set the stage for the following transfer up. It will additionally open the door to rotation into altcoins, which frequently outperform when bitcoin stops trending.

That rotation, he suggests, may already be brewing. As soon as bitcoin stabilizes, merchants sometimes search larger returns in massive altcoins like ether earlier than spreading to smaller tokens. Altcoin rallies not often begin whereas bitcoin is in freefall, however they typically acquire momentum when BTC ranges and volatility cools.

In plain phrases, the 2 analysts are describing totally different however suitable playbooks. Davis favors a deeper pullback right into a help cluster that would refresh the uptrend, whereas van de Poppe sees a range-bound pause with potential for altcoins to shine.

For on a regular basis readers, the guidelines is easy: watch whether or not bitcoin trades sideways or dips to the $108K–$112K zone. In both case, analysts agree the broader bull market framework stays intact, however the path ahead may look very totally different relying on how help and resistance play out within the weeks forward.

Technical evaluation highlights

- Based on CoinDesk Analysis’s technical evaluation information mannequin, Bitcoin confirmed bullish power within the 24-hour window from Aug. 16, 15:00 UTC to Aug. 17, 14:00 UTC, rising from $117,847.02 to $118,485.32, a 1% acquire.

- Help fashioned close to $117,261.72 early on Aug. 17, adopted by a break above $118,000 with higher-than-average quantity of two,848.15 BTC throughout rallies at 04:00, 08:00, 09:00, and 13:00 UTC.

- Within the ultimate hour from Aug. 17, 13:17–14:16 UTC, bitcoin climbed from $118,165.31 to $118,397.67, together with a pointy transfer at 13:51–13:52 UTC when value spiked from $118,417.23 to $118,604.10 on 679.81 BTC of quantity.

- The transfer set short-term resistance round $118,600 earlier than consolidating close to $118,400, leaving potential for additional upside after cooling.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.