At this time in crypto, Japan’s FSA is about to approve JPYC because the nation’s first yen-pegged stablecoin, Galaxy’s Mike Novogratz warns {that a} $1 million Bitcoin value in 2026 wouldn’t be a optimistic signal for the financial system. In the meantime, Kraken pauses deposits for Monero.

Japan to approve first yen-backed stablecoins this fall

Japan’s Monetary Companies Company (FSA) is getting ready to approve the issuance of yen-denominated stablecoins as early as this fall, marking the primary time the nation will enable a home fiat-pegged digital foreign money.

Tokyo-based fintech agency JPYC will register as a cash switch enterprise inside the month and can lead the rollout, Japanese information outlet The Nihon Keizai Shimbun reported on Sunday.

JPYC is designed to keep up a hard and fast worth of 1 JPY = 1 yen, backed by extremely liquid property comparable to financial institution deposits and Japanese authorities bonds. After buy purposes from people or companies, the tokens are issued by way of financial institution switch to digital wallets.

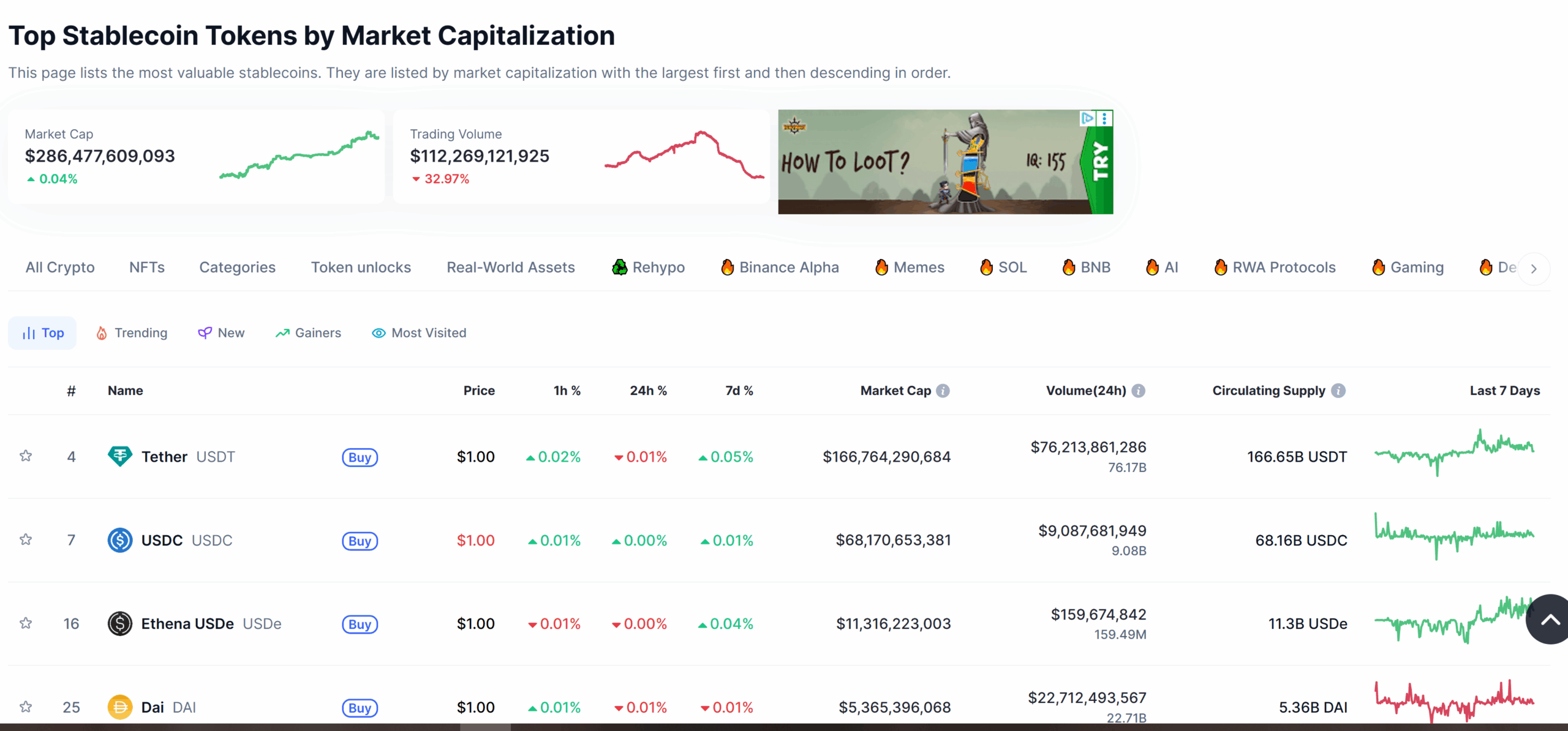

The approval comes as the worldwide stablecoin market, dominated by dollar-pegged property like USDt (USDT) and Circle’s USDC (USDC), has expanded to greater than $286 billion. Whereas US greenback stablecoins have already got a foothold in Japan, this would be the nation’s first yen-based providing.

$1M Bitcoin in 2026 would sign hassle: Galaxy’s Mike Novogratz

Galaxy Digital CEO Mike Novogratz says a million-dollar Bitcoin subsequent yr wouldn’t be a victory however somewhat an indication that the US financial system is in deep trouble.

“Individuals who cheer for the million-dollar Bitcoin value subsequent yr, I used to be like, Guys, it solely will get there if we’re in such a shitty place domestically,” Novogratz advised Natalie Brunell on the Coin Tales podcast on Wednesday.

“I’d somewhat have a decrease Bitcoin value in a extra secure United States than the alternative,” Novogratz stated, explaining that extreme foreign money devaluations typically come on the expense of civil society.

When a nationwide foreign money falls, buyers typically search different secure havens to guard their wealth, and Bitcoin is often known as digital gold.

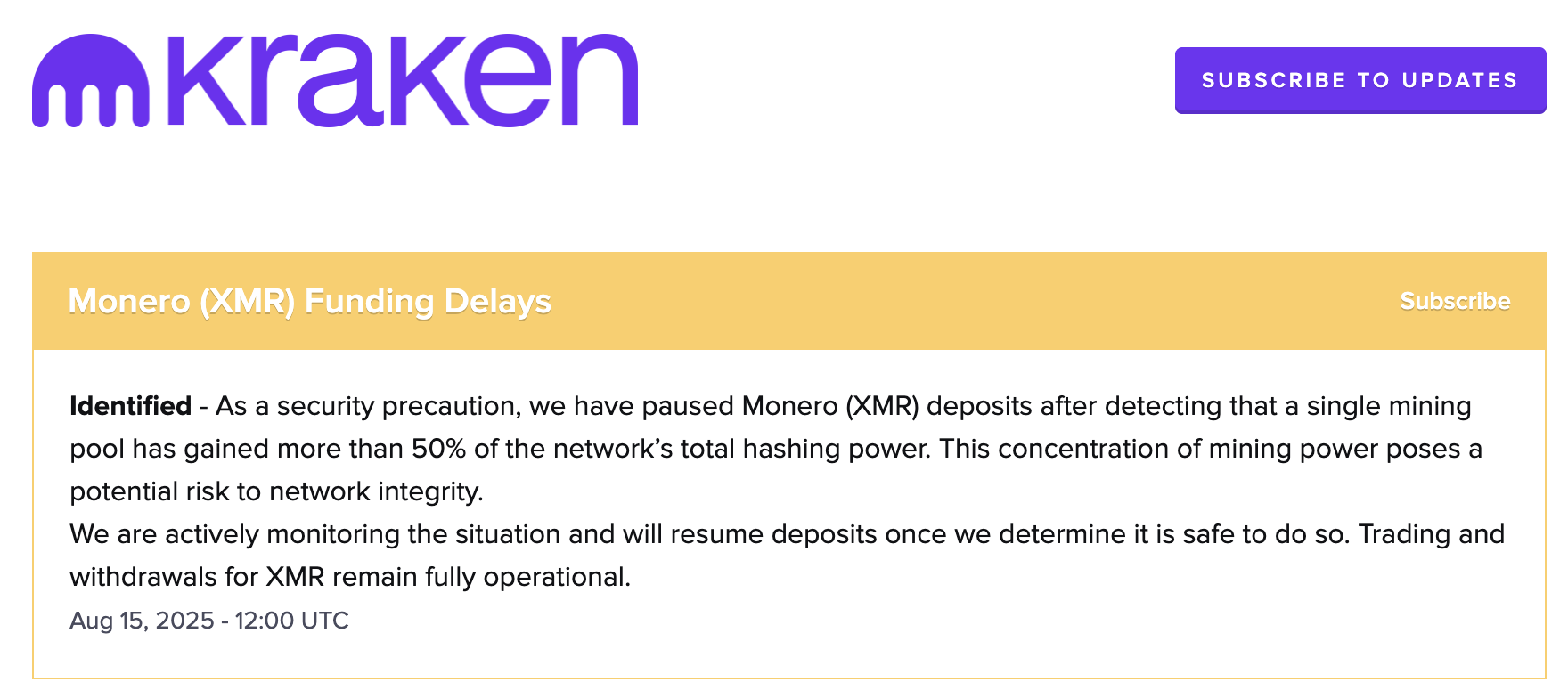

Kraken briefly halts Monero (XMR) deposits after 51% takeover

Kraken, a crypto alternate, introduced the non permanent suspension of Monero (XMR) deposits on Friday, following a 51% assault on the community by a single mining pool.

Qubic, an AI layer-1 blockchain, stated that it achieved dominance over the Monero community on Monday by commanding a majority of the community’s hashrate, the overall quantity of computing energy devoted to securing a blockchain community. Kraken wrote:

“As a safety precaution, now we have paused Monero deposits after detecting {that a} single mining pool has gained greater than 50% of the community’s complete hashing energy. This focus of mining energy poses a possible threat to community integrity.”

The 51% assault despatched shockwaves by way of the Monero group, sparking a web based debate about community incentives and safety.