ETH Led Altcoins in Driving Crypto Market Larger With Stablecoins, Tokenized Shares in July: Binance Analysis

The crypto market grew 13% in worth in July, fueled by a rotation from bitcoin

into altcoins, in keeping with Binance Analysis’s “Month-to-month Market Insights” report for August.

Ether (ETH) was the standout, rallying 48% as one other 24 corporations added the asset to their steadiness sheets, lifting company holdings by 128% to 2.7 million ETH. That is practically half the quantity held by ETFs. Binance attributed the development to staking yield, ETH’s deflationary provide and rising consolation amongst corporations to carry cryptocurrencies immediately .

Bitcoin

dominance fell 5.2 proportion factors to 60.6%, pushed by expectations of Federal Reserve interest-rate cuts and U.S. regulatory readability from the passage of three main crypto payments, together with the GENIUS Act on totally reserved stablecoins .

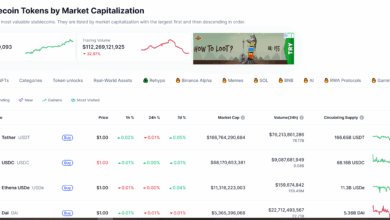

Stablecoin switch volumes held close to $2.1 trillion, outpacing Visa once more, as they’ve carried out since late 2024. JPMorgan expanded its deposit-token pilot, Citi explored tokenized deposits for cross-border settlements and Visa reaffirmed stablecoins as complementary to its community .

The report additionally highlights a 220% month-on-month soar available in the market cap of broadly traded tokenized shares reminiscent of Tesla (TSLA). The corporate excluded Exodus Motion (EXOD) shares issued through Securitize from its calculations, saying they skewed the calculation.

Tokenization is the method of representing real-world property (RWAs) reminiscent of shares as digital equivalents that may be traded on blockchains. As of June this 12 months, the RWA tokenization market reached $24 billion in worth.

Energetic on-chain addresses for tokenized shares soared to 90,000 from 1,600, whereas centralized exchanges facilitated over 70 instances extra quantity than on-chain venues. Binance likened the expansion of the sector to DeFi’s 2020-2021 increase and estimated that tokenizing simply 1% of worldwide equities may create a $1.3 trillion market.

NFT gross sales rebounded practically 50% in July, led by a 393% soar in CryptoPunks transactions, whereas Bitcoin NFTs noticed a 28% rise. Nonetheless, volumes stay beneath prior-cycle peaks.

The report means that if macroeconomic tailwinds maintain, the capital rotation into altcoins, coupled with the regulatory inexperienced mild for stablecoins and tokenized property, may speed up crypto’s integration into mainstream finance.