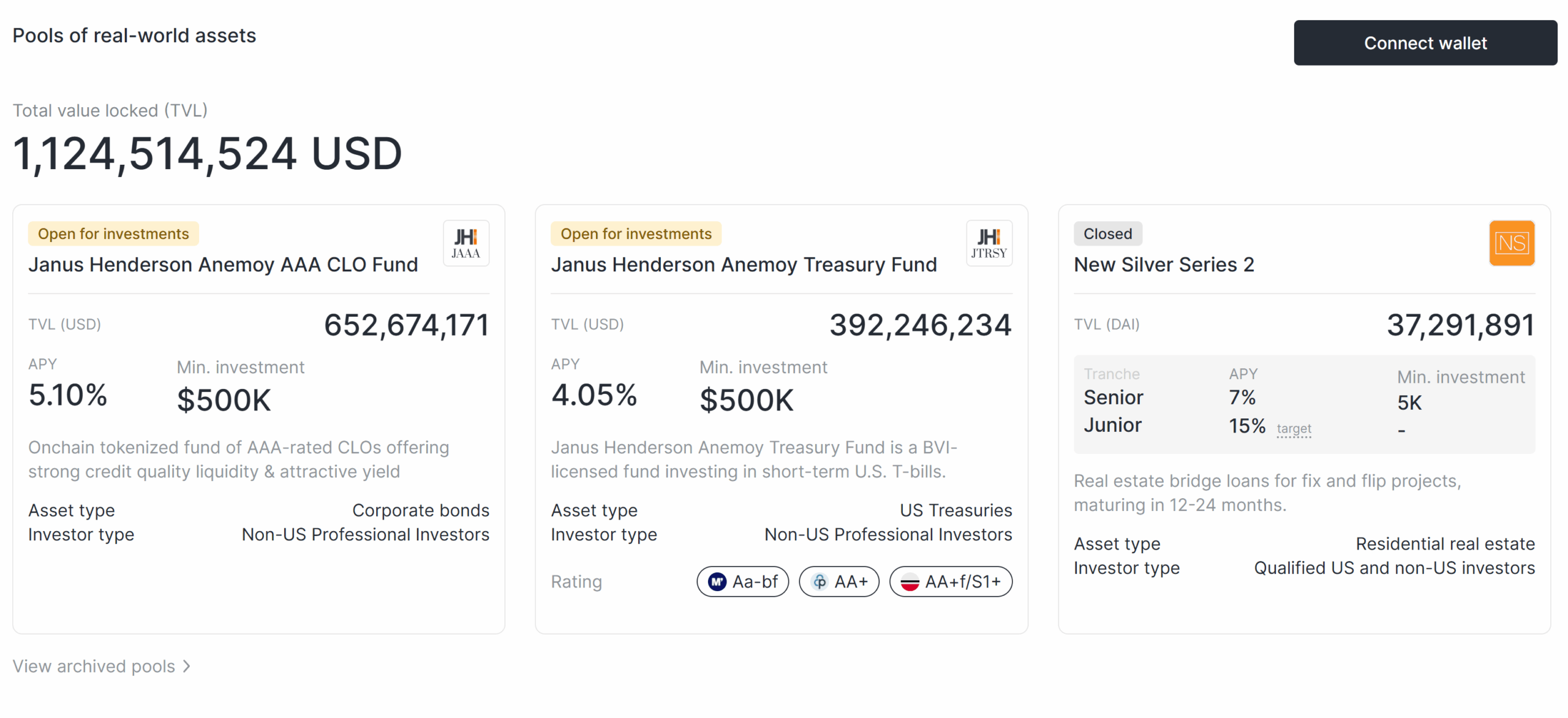

Blockchain infrastructure platform Centrifuge has crossed $1 billion in whole worth locked (TVL), becoming a member of the ranks of BlackRock’s BUIDL fund and Ondo Finance as the one real-world asset (RWA) platforms to surpass the milestone.

Centrifuge CEO Bhaji Illuminati attributed the milestone to establishments transferring from pilots to “actual deployments,” alongside sturdy onchain allocator demand.

“Markets want greater than T-bills,” Illuminati informed Cointelegraph, pointing to JAAA, an onchain model of Janus Henderson’s AAA-rated collateralized mortgage obligation (CLO) funding fund, as a pure subsequent step for establishments looking for increased yields than risk-free charges.

Illuminati mentioned that US Treasurys stay the dominant entry level for onchain allocators, however the JAAA product is the fastest-growing tokenized fund within the phase. “We’re additionally seeing rising curiosity in non-public credit score as establishments search for differentiated yield, with extra information coming quickly on that entrance,” he added.

Associated: GENIUS Act yield ban might push trillions into tokenized belongings — ex-bank exec

Robust demand for tokenized S&P 500

In early July, Centrifuge unveiled a tokenized S&P 500 product as a part of a partnership with S&P Dow Jones Indices (S&P DJI). The product is structured as a regulated skilled fund within the British Virgin Islands.

In keeping with Illuminati, demand has been “very sturdy” forward of its official rollout within the coming weeks. The launch can be supported by an anchor pool of capital to make sure broad accessibility from day one.

Illuminati added that the S&P 500 is simply the start, with plans to convey sector-specific and thematic indexes onchain within the close to future. “We see sturdy potential for sector and thematic index merchandise to return onchain subsequent,” he mentioned.

Centrifuge’s pipeline is cut up between conventional asset managers utilizing Web3 native asset supervisor Anemoy and onchain-native managers leveraging its RWA Launchpad. On the demand aspect, stablecoins and yield merchandise are the largest patrons, utilizing RWAs to set a “yield flooring” for reserves.

Associated: eToro to tokenize 100 hottest US shares on Ethereum

deRWA to convey tokenized belongings to retail

Illuminati highlighted plans to open tokenized belongings to retail traders by main exchanges, wallets, lending protocols and DeFi integrations by the deRWA initiative. deRWA, as utilized in DeFi, stands for tokenized RWAs which might be engineered for composability and liquidity inside DeFi.

As reported, S&P Dow Jones Indices (S&P DJI) can also be in discussions with main exchanges, custodians and DeFi protocols to license and listing tokenized variations of its benchmarks, in line with Stephanie Rowton, the agency’s director of US equities.

“By establishing these kinds of relationships, we hope we will work collectively to take part in a strong infrastructure that helps the buying and selling and accessibility of tokenized variations of our indexes, in the end enhancing the investor expertise,” Rowton mentioned.

Wanting forward, Illuminati expects public market RWAs reminiscent of Treasurys and equities to steer adoption within the brief time period resulting from liquidity and familiarity. Nevertheless, he believes non-public markets will ultimately dominate, as blockchain removes inefficiencies and unlocks hidden worth.

In a report earlier this month, Boston Consulting Group and Ripple estimated that tokenized real-world belongings may exceed $18 trillion by 2033, with a compound annual development charge of 53%.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inside story