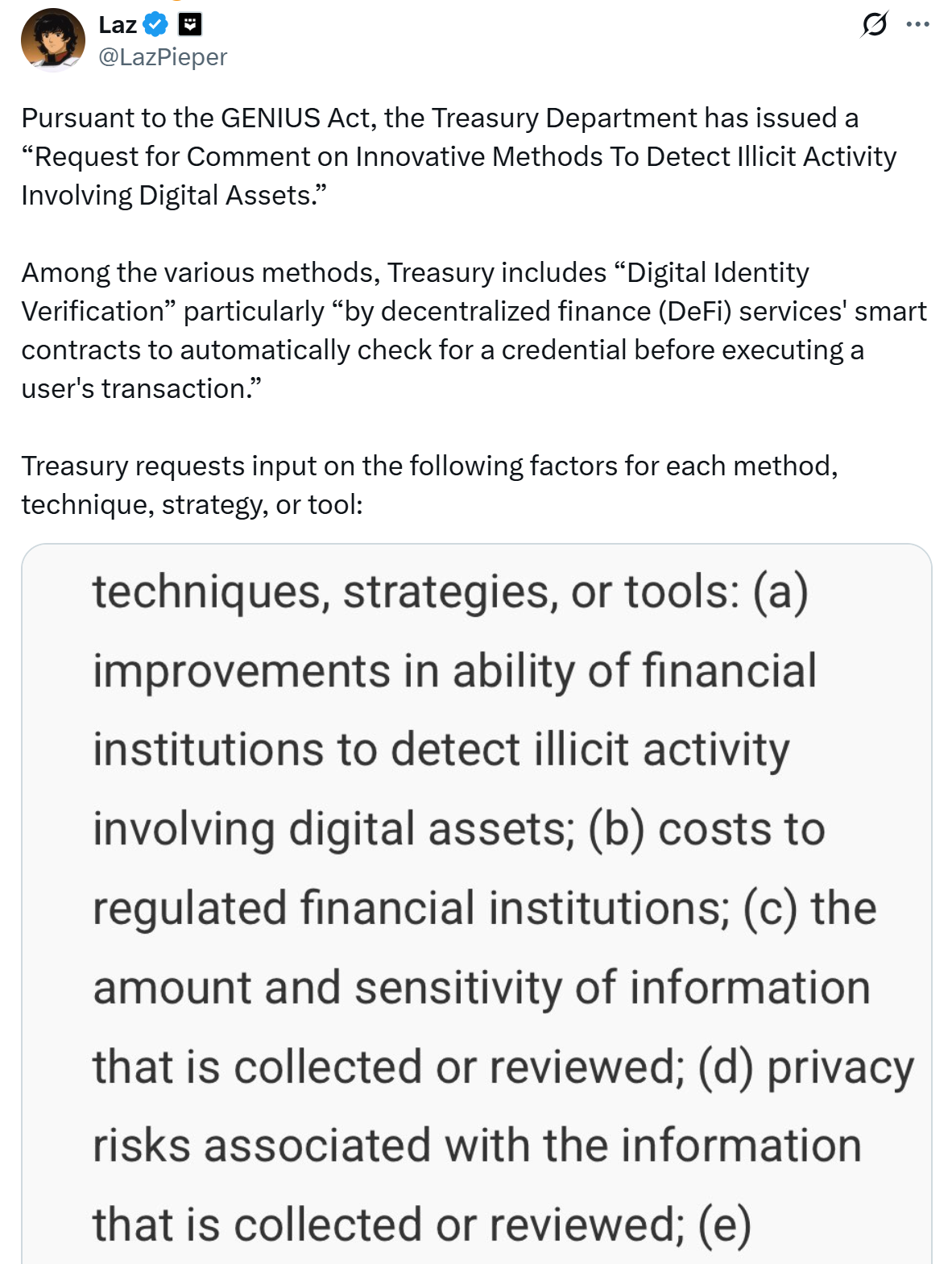

The US Division of the Treasury is in search of public suggestions on how digital identification instruments and different rising applied sciences might be used to combat illicit finance in crypto markets, with one choice being embedding identification checks into decentralized finance (DeFi) sensible contracts.

The session, revealed this week, stems from the newly enacted Guiding and Establishing Nationwide Innovation for US Stablecoins Act (GENIUS Act), signed into regulation in July.

The Act, which units out a regulatory framework for fee stablecoin issuers, directs the Treasury to discover new compliance applied sciences, together with utility programming interfaces (APIs), synthetic intelligence, digital identification verification and blockchain monitoring.

One of many concepts within the request for remark is the potential for DeFi protocols to combine digital identification credentials instantly into their code. Underneath this mannequin, a sensible contract may routinely confirm a person’s credential earlier than executing a transaction, successfully constructing Know Your Buyer (KYC) and Anti-Cash Laundering (AML) safeguards into blockchain infrastructure.

Associated: GENIUS Act to spark wave of ‘killer apps’ and new fee providers: Sygnum

Treasury: digital IDs may minimize compliance prices

In response to Treasury, digital identification options, which can embody authorities IDs, biometrics or transportable credentials, may cut back compliance prices whereas strengthening privateness protections.

They may additionally make it simpler for monetary establishments and DeFi providers to detect cash laundering, terrorist financing, or sanctions evasion earlier than transactions happen.

Treasury additionally acknowledged potential challenges, together with knowledge privateness considerations and the necessity to stability innovation with regulatory oversight. “Treasury welcomes enter on any matter that commenters consider is related to Treasury’s efforts,” the company wrote.

Public feedback are open till Oct. 17, 2025. Following the session, Treasury will submit a report back to Congress and should difficulty steering or suggest new guidelines primarily based on the findings.

Associated: GENIUS Act yield ban could push trillions into tokenized belongings — ex-bank exec

US banks warn in opposition to stablecoin yield loophole

Final week, a number of main US banking teams, led by the Financial institution Coverage Institute (BPI), urged Congress to tighten guidelines beneath the GENIUS Act, warning {that a} loophole may let stablecoin issuers bypass restrictions on paying curiosity.

In a letter despatched Tuesday, BPI mentioned the hole may enable issuers to accomplice with exchanges or associates to supply yields, undermining the intent of the regulation. The group cautioned that unchecked development of yield-bearing stablecoins may set off as much as $6.6 trillion in deposit outflows from conventional banks, threatening credit score entry for companies.

Journal: Bitcoin vs stablecoins showdown looms as GENIUS Act nears