Right this moment in crypto, Kraken pauses deposits for Monero, Gemini has filed to record on Nasdaq beneath ticker GEMI, revealing steepening losses forward of its IPO. In the meantime, merchants are displaying better hesitation to purchase the dip in Ether in comparison with Bitcoin.

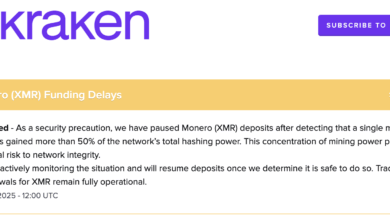

Kraken briefly halts Monero (XMR) deposits after 51% takeover

Kraken, a crypto trade, introduced the non permanent suspension of Monero (XMR) deposits on Friday, following a 51% assault on the community by a single mining pool.

Qubic, an AI layer-1 blockchain, mentioned that it achieved dominance over the Monero community on Monday by commanding a majority of the community’s hashrate, the overall quantity of computing energy devoted to securing a blockchain community. Kraken wrote:

“As a safety precaution, we’ve paused Monero deposits after detecting {that a} single mining pool has gained greater than 50% of the community’s complete hashing energy. This focus of mining energy poses a possible danger to community integrity.”

The 51% assault despatched shockwaves by the Monero neighborhood, sparking a web-based debate about community incentives and safety.

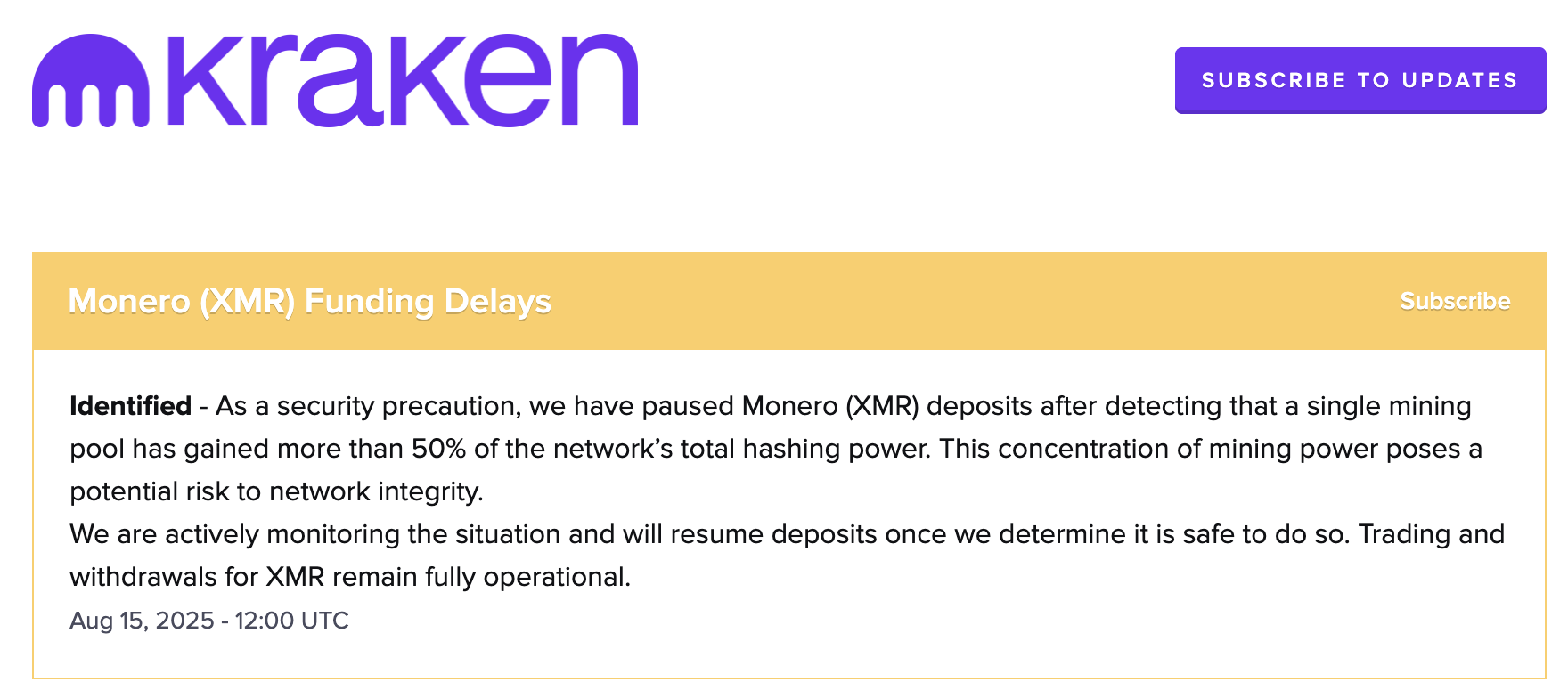

Winklevoss’ Gemini recordsdata for Nasdaq itemizing after sturdy Bullish debut

Gemini Area Station, the crypto trade and custodian based by Cameron and Tyler Winklevoss, has filed with the US Securities and Change Fee to record its Class A standard inventory on the Nasdaq International Choose Market beneath the ticker GEMI.

Based in 2014, Gemini operates a regulated crypto trade, custody service, and a spread of blockchain-based merchandise, together with the US dollar-backed Gemini Greenback (GUSD) stablecoin and a crypto-rewards bank card, the platform mentioned within the submitting submitted on Friday.

In keeping with its submitting, the IPO will mark the primary time its shares are publicly traded, with pricing anticipated between an undisclosed vary. The providing will likely be led by a syndicate of main banks, together with Goldman Sachs, Morgan Stanley, Citigroup and others.

Put up-offering, Gemini may have a dual-class share construction, together with Class A inventory carrying one vote per share and Class B inventory carrying ten votes. The Winklevoss twins will retain all Class B shares, making certain majority voting management and qualifying Gemini as a “managed firm” beneath Nasdaq guidelines.

Ether has ‘barely extra bullish path’ than Bitcoin: Santiment

Ether holds a slight edge over Bitcoin within the short-term as social media chatter across the cryptocurrency is much less overheated, says sentiment platform Santiment.

“The $ETH crowd hasn’t proven practically as a lot bullishness regardless of considerably higher efficiency over the previous 3 months,” Santiment mentioned in an X put up on Friday amid the ETH/BTC ratio, which measures Ether’s relative power in opposition to Bitcoin being up 32.90% over the previous 30 days, in accordance to TradingView.

Each Bitcoin and Ether have pulled again since Thursday, when Bitcoin reached a brand new all-time excessive of $124,128 and Ether got here near reclaiming its 2021 all-time excessive of $4,878.