Capital necessities for banks from by the Basel Committee on Banking Supervision (BCBS), which crafts banking requirements, create a “chokepoint,” designed to throttle the expansion of the crypto business, in response to Chris Perkins, president of funding agency CoinFund.

The present capital guidelines decrease a financial institution’s return on fairness (ROE), a essential profitability metric in banking, by forcing larger reserve necessities for holding crypto, making crypto-related actions too costly for banks, Perkins informed Cointelegraph.

“It is a completely different kind of chokepoint, in that it isn’t direct. It is a very nuanced means of suppressing exercise by making it so costly for the financial institution to do actions that they’re identical to, ‘I can not,’” he added.

If I’ve a certain quantity of capital I need to make investments, I will make investments it in excessive ROE companies, not low ROE companies,” he continued.

In April, Perkins criticized the Financial institution for Worldwide Settlements for its proposals to impose know-your-customer necessities (KYC) and different legacy banking rules on decentralized finance (DeFi) protocols and stablecoins, saying that they violate the core rules of permissionless networks.

The true systemic threat to the monetary system comes from the asymmetry of getting on-line, permissionless, 24/7, peer-to-peer, decentralized networks that may shift liquidity in actual time whereas conventional monetary infrastructure closes on nights and weekends and refuses to adapt to altering expertise, Perkins stated.

Associated: New BIS plan may make ‘soiled’ crypto more durable to money out

Financial institution for Worldwide Settlements stays entrenched in opposition to crypto

The Financial institution for Worldwide Settlements (BIS), which acts as a central financial institution for sovereign central banks and organizes the BCBS conferences, launched a report in April claiming that crypto may destabilize the monetary system.

The authors of the report additionally argued that the expansion of the crypto market exacerbates the wealth hole and urged stricter authorities regulation in response.

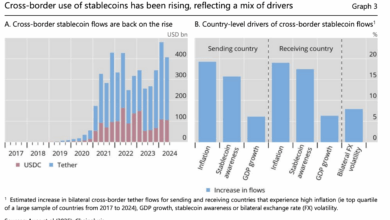

In June, the BIS launched a follow-up report titled “Stablecoin progress: Coverage Challenges and Approaches,” which claimed that stablecoins fail as cash and will create systemic dangers within the monetary system.

“Stablecoins’ rising market capitalization and rising interconnections with the normal monetary system have reached a stage the place potential spillovers to that system can not be dominated out,” the authors of the report wrote.

The BIS has repeatedly pushed for the adoption of central financial institution digital currencies (CBDCs) and different centralized digital applied sciences as a substitute for privately-issued and decentralized cryptocurrencies.

Journal: DeFi will rise once more after memecoins die down: Sasha Ivanov, X Corridor of Flame