TeraWulf has turn into the most recent cryptocurrency miner to pivot into AI infrastructure internet hosting, reaching a long-term settlement with Fluidstack that’s backstopped by Alphabet’s Google — in a transfer anticipated to considerably improve the corporate’s income run charge.

Throughout its shareholder name on Thursday, the corporate disclosed that it has signed 10-year colocation lease agreements with Fluidstack, an AI infrastructure supplier, value $3.7 billion in contract income. That determine might greater than double if five-year extensions are exercised.

Google’s involvement comes by means of supporting Fluidstack’s $1.8 billion lease obligations with TeraWulf and offering debt financing. In return, Google acquired warrants for roughly 41 million WULF shares, representing about 8% of the corporate.

The deal will develop TeraWulf’s information middle capability in New York by greater than 200 megawatts of IT load.

“Given the anticipated enchancment in our credit score profile, we’ve refined our financing technique to give attention to a sequence of capital markets initiatives […] with the advantage of our new monetary assist from Google and our up to date lease agreements,” TerraWulf Chief Monetary Officer Patrick Fleury informed shareholders.

TeraWulf, based in 2021 as a Bitcoin (BTC) mining firm targeted on environmentally sustainable operations, has confronted mounting challenges within the post-halving surroundings. Within the first quarter, the corporate reported a internet lack of $61.4 million alongside a pointy drop in income.

Companywide financials improved within the second quarter, as TeraWulf returned to profitability and posted greater revenues in contrast with the primary quarter.

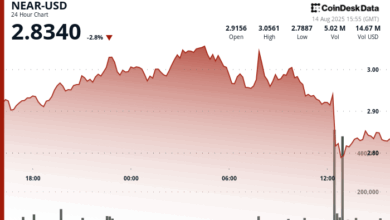

Unstable BTC costs and rising infrastructure prices have made Bitcoin mining economics more and more tough, prompting extra firms to diversify into AI and high-performance computing to stabilize income.

Associated: Jack Dorsey’s Block targets 10-year lifecycle for Bitcoin mining rigs

TeraWulf shares surge on AI pivot information

TeraWulf’s newest enterprise deal sparked a pointy rally in its share worth on Thursday.

WULF shares jumped as a lot as 48% intraday to a excessive of $8.11, with buying and selling quantity greater than quadrupling the every day common, based on Yahoo Finance information.

The inventory final traded round $7.50, up 37% on the day, giving the corporate a market capitalization of practically $3 billion.

The rebound has pushed WULF again into constructive territory for the 12 months.

Whereas TeraWulf is pivoting into AI infrastructure, it stays, for now, a crypto proxy inventory — a standing underscored by its continued mining operations. Within the second quarter, the corporate self-mined 485 BTC, down from 699 in the identical interval a 12 months earlier.

On the finish of Q2, TeraWulf held $90 million in money, money equivalents and Bitcoin.

Associated: Bitcoin Power Worth metric says ‘truthful’ BTC worth is as a lot as $167K