Ark Make investments stated it purchased greater than 2.5 million shares of crypto platform Bullish (BLSH) on the day of the corporate’s explosive debut on the New York Inventory Trade, securing a stake valued at greater than $170 million by the top of the day.

Shares of the corporate, which owns CoinDesk, surged to as excessive as $102 from the $37 IPO pricing, earlier than closing at $68, an 84% acquire. The corporate offered 20.3 million shares for its preliminary public providing, which had additionally attracted curiosity from BlackRock (BLK), in accordance with a submitting with the SEC.

Ark added 1,714,522 BLSH shares to its flagship ARK Innovation ETF (ARKK), 545,416 shares to the ARK Subsequent Technology Web ETF (ARKW) and 272,755 shares to the ARK Fintech Innovation ETF (ARKF).

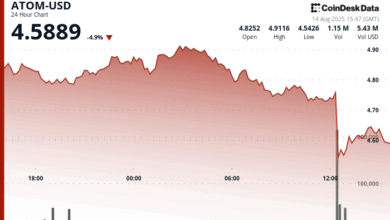

Bullish’s rally prolonged into Thursday, not too long ago buying and selling 15% greater. That efficiency comes because the broader crypto market slipped, erasing a part of the prior day’s positive aspects when bitcoin

hit a document excessive of $124,000. The CoinDesk 20 Index is down about 2.1% over the previous 24 hours.

Different not too long ago listed crypto-related shares fell. Circle (CRCL), which went public in June, fell about 2% Thursday, whereas buying and selling platform eToro (ETOR) dropped practically 3%.

Wooden has a observe document of creating sizable early strikes in newly public crypto companies. Upon Circle’s IPO, Ark bought about 4.5 million shares, valued at roughly $373 million on the time.

These shares at the moment are price about $675 million. Her stake in eToro is smaller — round 140,000 shares — at the moment valued at $6.5 million.

Bullish’s sturdy debut and Ark’s fast allocation throughout a number of ETFs spotlight rising investor curiosity in publicly traded crypto infrastructure firms, whilst market volatility stays excessive.