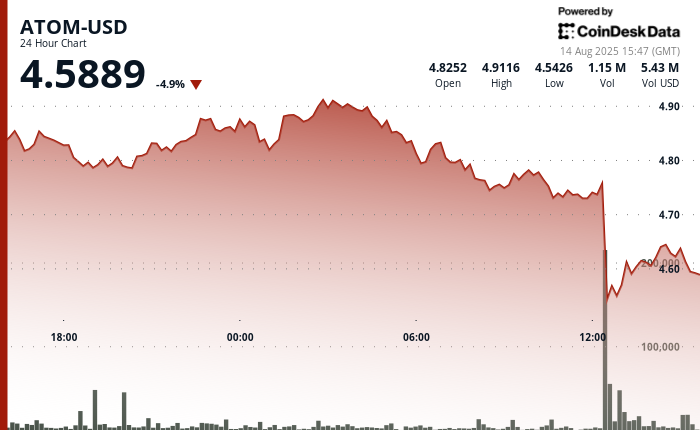

ATOM-USD noticed sharp volatility between 13 August 15:00 and 14 August 14:00, buying and selling between $4.49 and $4.91 with quantity spiking to five.62M items—over 322% above common. After holding within the $4.82–$4.85 vary and briefly hitting $4.91, the asset confronted an aggressive selloff from 06:00 on 14 August, bottoming at $4.53 at 12:00 on heavy quantity, signaling potential capitulation.

Patrons rapidly stepped in, establishing recent assist close to $4.60 and restoring confidence within the Cosmos ecosystem. This value stage turned a key threshold as promoting stress eased and buying and selling stabilized.

In the course of the 60-minute restoration window from 13:20 to 14:19 on 14 August, ATOM rose from $4.60 to $4.61, peaking at $4.64 earlier than consolidating in a good $4.59–$4.62 vary. This confirmed $4.60 as a assist base, suggesting a possible launch level for future beneficial properties.

Whereas resilience is clear, resistance at $4.91 stays untested. Holding $4.60 can be essential for sustaining bullish momentum, with any breakdown risking renewed draw back stress.

Technical Indicators Level to Consolidation

- Worth vary of $0.42 representing 9% volatility between $4.91 most and $4.49 minimal.

- Quantity spike to five.62 million items, exceeding 24-hour common of 1.33 million by 322%.

- Resistance stage established at $4.91 throughout early morning hours of 14 August.

- Help base formation round $4.60 following restoration from $4.53 low.

- Consolidation sample between $4.59-$4.62 vary indicating potential stabilization.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.