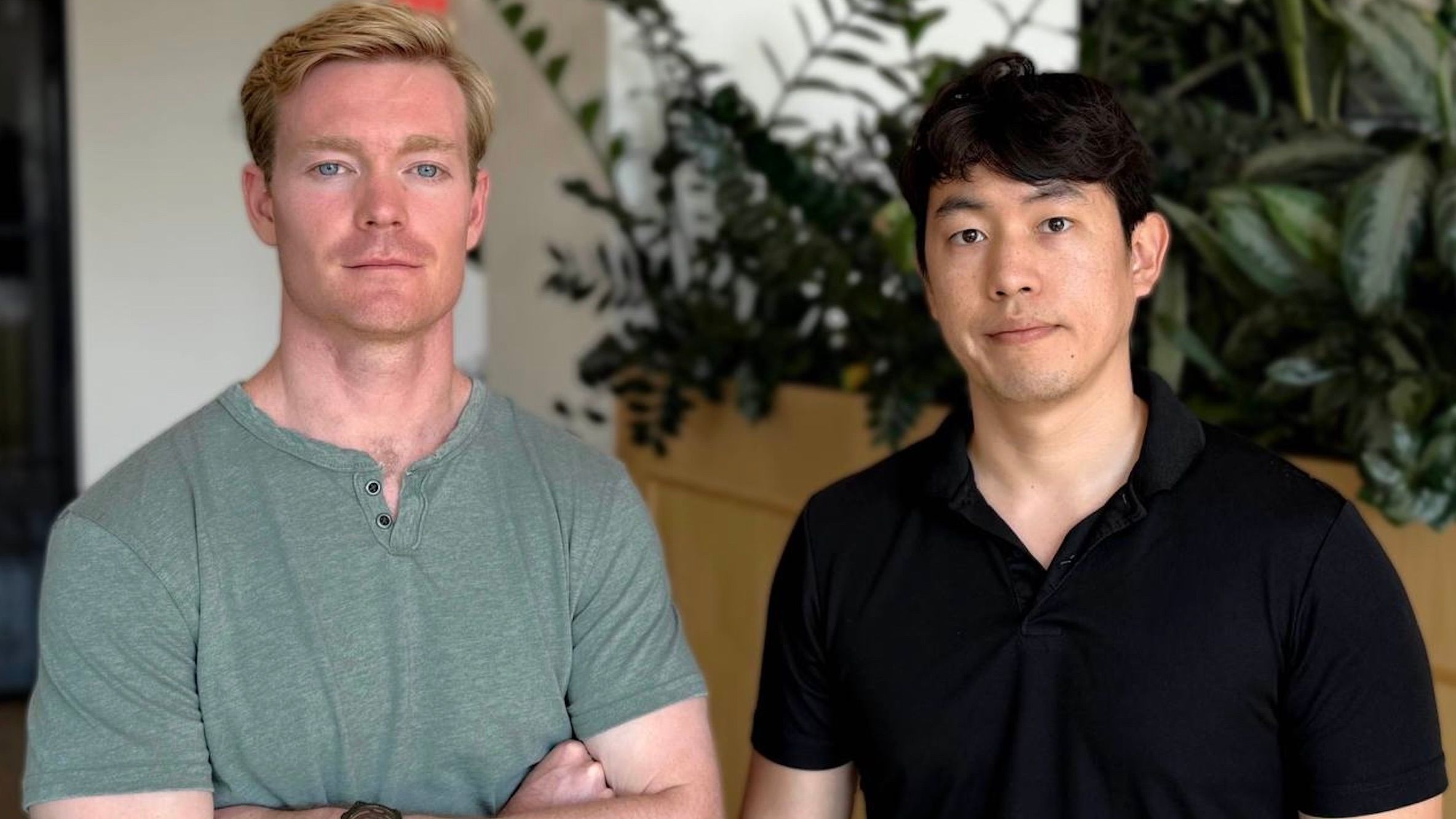

Stablecoin protocol USD.AI, which supplies credit score to synthetic intelligence (AI) firms, has raised $13 million in Sequence A funding led by Framework Ventures.

USD.AI, developed by Permian Labs, points loans to rising AI corporations utilizing graphics processing unit (GPU) {hardware} as collateral, chopping approval occasions by greater than 90% in contrast with conventional lenders. The on-chain system consists of USDai, a dollar-pegged token, and sUSDai, a yield-bearing model backed by income-generating compute property.

GPUs are elementary {hardware} to AI processes by way of performing the numerous calculations without delay required to make the method of coaching and utilizing AI fashions a lot sooner.

CEO David Choi stated USD.AI’s mannequin “treats GPUs like commodities,” enabling quick, programmatic mortgage approvals with out standard gatekeeping, in an announcement shared with CoinDesk on Thursday.

Framework’s Vance Spencer likened AI’s capital calls for to the “oil increase” and stated USD.AI might democratize entry to funding whereas providing traders yield tied to AI sector progress.

With $50 million already in deposits throughout personal beta, USD.AI plans a public launch that includes an ICO and a game-based allocation mannequin.

USD.AI could symbolize the potential of a convergence between stablecoins, which have been on the forefront of the regulatory developments in digital property, and AI which has quickly ascended to mainstream adoption in recent times.

Collectively, the 2 might create a extra clever and environment friendly monetary system. This synergy permits AI brokers to transact autonomously and reliably utilizing a steady foreign money, enhancing monetary automation, safety, and danger administration throughout varied purposes from funds to decentralized finance.