Ethereum-focused treasury firms, together with BitMine and SharpLink, point out plans to allocate roughly $27 billion towards extra ETH acquisitions, based on an evaluation by crypto market commentator RiskOnBobby.

The majority of this deliberate funding comes from BitMine Immersion Applied sciences, which on Aug. 12 filed an modification to broaden its at-the-market (ATM) fairness program by $20 billion.

Concurrently, Joseph Lubin-led SharpLink additionally revealed a $900 million capital increase earmarked for additional Ethereum purchases.

These strikes are a part of a broader pattern, with a number of different companies getting ready substantial capital outlays to extend their ETH holdings.

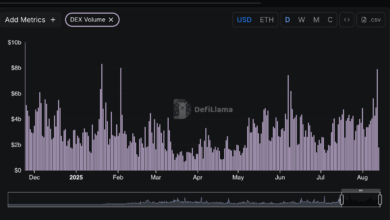

Tom Donleavy, Head of Enterprise at Varys Capital, estimates that such a funding pool might purchase practically 6 million ETH at present market costs. That quantity represents about 5% of Ethereum’s complete provide and roughly one-third of all ETH at present held on exchanges.

In accordance with Strategic ETH Reserve knowledge, 71 ETH-focused treasury companies maintain 3.57 million ETH, valued at $16.68 billion. This represents roughly 2.95% of the whole provide, highlighting how these company and institutional gamers steadily enhance their Ethereum footprints.

So, if the deliberate acquisitions are executed, treasury-owned Ethereum might climb to round 10% of the whole provide.