News

Markets At present: Bitcoin, Ether Maintain Positive aspects as Ethena Hits $11.9B TVL, Pudgy Penguins Race to F1

The worldwide crypto market cap rose 2% previously 24 hours to $4.03 trillion as main cryptocurrencies posted beneficial properties.

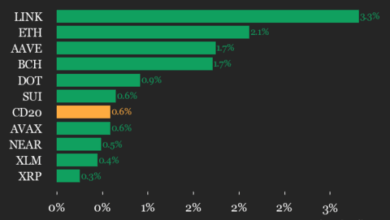

Bitcoin (BTC) added 2.3% to $118,527, ether rose 0.7% to $4,293. Solana and XRP every superior 4.4% whereas Dogecoin gained 4.7%.

The rallies got here alongside heavy brief liquidations, with danger sentiment enhancing after a comparatively calm macro session.

Derivatives Positioning

- Futures open curiosity (OI) in main tokens decreased over the previous 24 hours, indicating a capital outflow. It's additionally suggestive of value losses being pushed by the unwinding of lengthy positions relatively than outright brief gross sales.

- XMR's perpetual futures seem overheated, with annualized funding charges exceeding 200%. The extraordinarily excessive determine could immediate arbitrageurs to take a simultaneous lengthy place within the spot market and a brief place in futures, permitting them to pocket the funding safely.

- Funding charges for different main tokens stay pinned at round 10%, reflecting a reasonably bullish bias.

- On the CME, open curiosity in ETH futures rose to 1.70 million from 1.51 million ETH.

- BTC open curiosity remained regular close to 138K BTC, the bottom since April.

- On Deribit, BTC choices out to August expiry present a slight bias towards put, or protecting, choices. ETH choices confirmed a bullish bias throughout all tenors.

- ETH's implied volatility (IV) time period construction steepened whereas BTC's stay unchanged. Flows at OTC desk Paradigm featured an extended place within the BTC $115K put expiring on Aug. 13 and demand for $150K calls expiring in September.

- Volumes have been substantial, with $3.3 billion traded at Paradigm.

Token Speak

- Ethena surpassed $11.89B in TVL, turning into the sixth DeFi protocol to cross $10B and the second non-staking mannequin after Aave to take action. The sUSDe APY sits at 4.72%, attracting yield-focused buyers.

- The protocol’s scale underscores rising urge for food for non-staking DeFi fashions and will affect future designs. Market response has been broadly constructive, with trade figures noting the milestone’s significance.

- USDe maintains a $1 peg with a $10.48B market cap and $371.97M in 24-hour quantity.

- Polymarket will transition UMA’s oracle from OOV2 to MOOV2 after governance approval, proscribing market decision proposals to a whitelist of vetted members.

- The change goals to cut back disputes and market manipulation by guaranteeing proposals are submitted by skilled customers, whereas protecting dispute rights open to all.

- The preliminary whitelist consists of 37 addresses, with the shift framed as transferring from open debates to a extra managed council-style decision course of.

- Pudgy Penguins secured System 1 branding on the Singapore Grand Prix after successful Kraken’s memecoin buying and selling contest. PENGU branding will seem on Williams Racing’s FW47 automotive.

- The token gained 55.1% over the previous 30 days whereas dipping 11.8% in 24 hours, partially rebounding with a 1.4% intraday acquire.

- The publicity is predicted to spice up visibility amongst mainstream audiences and strengthen Kraken’s push into sports-linked crypto promotions.