Norway’s sovereign wealth fund, Norges Financial institution Funding Administration (NBIM), has considerably elevated its oblique publicity to Bitcoin this 12 months.

On Aug. 12, Vetle Lunde, a senior analyst at K33 Analysis, reported that the agency’s oblique Bitcoin publicity grew by 192% year-on-year to 7,161 BTC (price roughly $844 million) from the 3821 BTC publicity it had as of the top of 2024.

Which means that NBIM’s publicity elevated by 3,340 BTC through the first half of 2025 alone.

Lunde attributed the surge to heavier positions in core treasury autos akin to Technique (previously MicroStrategy) and Marathon Digital, mixed with sturdy total Bitcoin accumulation amongst main treasury holders.

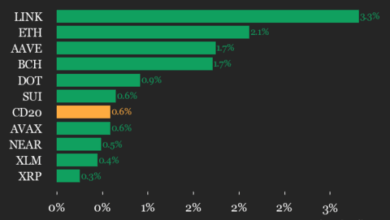

Breaking down the contributors, Technique, the most important company Bitcoin holder, accounted for the most important portion of the expansion, including 3,005.5 BTC to NBIM’s oblique publicity.

Bitcoin miner Marathon Digital contributed 216.4 BTC, whereas Block added 85.1 BTC. Coinbase, the most important US-based change, and Japan-based Metaplanet rounded out the highest 5 with 57.2 BTC and 50.8 BTC, respectively.

Different firms, together with GameStop (GME), Tesla, Mercado Libre, Jasmine, Virtu, and WeMade, added smaller quantities, every beneath 35 BTC.

In Lunde’s view, the pattern highlights how Bitcoin is more and more showing in diversified portfolios, whether or not deliberately or as a byproduct of fairness investments in BTC-heavy firms.