Technical Evaluation Overview

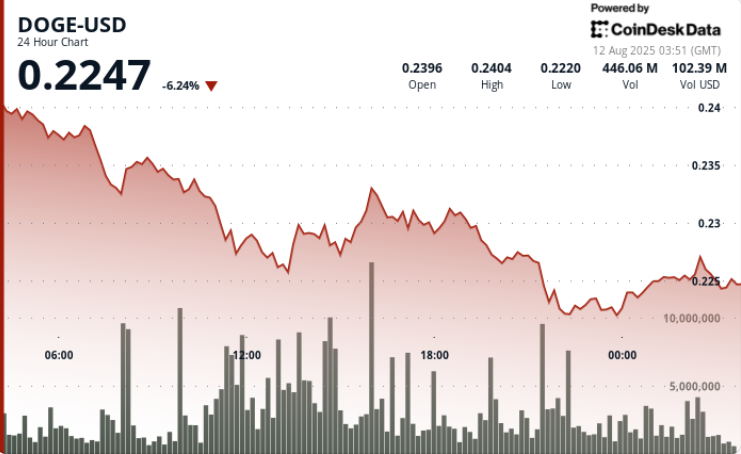

DOGE falls 6.88% within the 24-hour interval ending August 12, dropping from $0.24 to $0.22 as sellers overwhelm bid-side liquidity. The heaviest strain hits at 07:00 on August 11, with worth sliding from $0.238 to $0.233 on 485.69M quantity — 31% above the day by day common of 371.45M. This establishes $0.238 as a significant resistance stage.

Patrons step in at $0.226 throughout the 11:00 session, producing 793.38M in quantity. Secondary resistance types at $0.231 as a number of rally makes an attempt fail. Last-hour commerce sees DOGE range-bound between $0.2247-$0.2253 with quantity compression, suggesting potential vendor exhaustion.

Information Background

The selloff comes amid broader weak point in digital belongings, with regulatory uncertainty and international commerce tensions weighing on threat sentiment. Main economies are escalating tariff disputes, pressuring multinational provide chains, whereas central banks sign potential coverage shifts — a combination that has prompted institutional de-risking throughout crypto holdings.

Worth Motion Abstract

• DOGE declines 6.88% from $0.24 to $0.22 in August 11 01:00–August 12 00:00 window

• $0.238 resistance locked in after 07:00 promoting climax on 485.69M quantity

• $0.226 help sees 793.38M in buy-side flows; $0.231 secondary resistance caps rebounds

• Last hour trades in tight $0.2247-$0.2253 vary with falling quantity

Market Evaluation and Financial Components

Whale and institutional profit-taking at $0.238 resistance set the tone for the session, triggering a breakdown under $0.23 and forcing retests of $0.226. Assist shopping for was evident on two main quantity spikes (11:00 and 21:00), however repeated rejections close to $0.231 stored DOGE pinned.

With quantity thinning at session lows, the construction hints at attainable base-building — although macro headwinds may see $0.22 examined once more.

Technical Indicators Evaluation

• Resistance: $0.238 (high-volume rejection), $0.231 (secondary cap)

• Assist: $0.226 preliminary protection, $0.2247-$0.2249 intraday ground

• 24-hour vary: $0.019 (7.89% volatility)

• Quantity compression close to lows indicators attainable vendor fatigue

• A number of failed breakouts above $0.231 affirm provide zone overhead

What Merchants Are Watching

• Retest of $0.22 and whether or not purchaser flows reappear at key help

• Breakout makes an attempt above $0.231 as a primary step towards restoration

• Affect of macro headlines on broader meme coin sentiment

• Indicators of renewed whale accumulation after promoting climax