BONK began the week on a risky notice, with the Solana-based memecoin climbing to an August excessive of $0.00002841 earlier than sliding 8%.

The advance marked certainly one of its strongest ranges in current weeks, and was met with swift institutional buying and selling that erased a lot of the early positive aspects, in line with CoinDesk Analysis’s technical evaluation information mannequin.

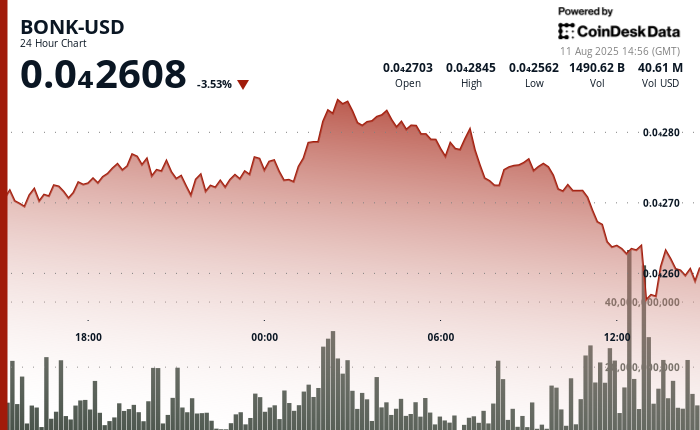

Promoting stress accelerated between 11:00 and 13:00 UTC, when buying and selling volumes surged to between 1.12 trillion and a pair of.16 trillion tokens. This might have been right down to coordinated profit-taking, with massive holders rotating out of positions. The sell-off drove BONK down 8% to a low of $0.00002554, a transfer that examined the important thing technical help close to $0.00002620.

The token noticed a short restoration at round 13:00 UTC following information a publicly traded firm gave the impression to be planning on constructing a BONK treasury. Nasdaq-listed well being beverage firm Security Shot (SHOT) agreed to buy $25 million value of the memecoin in trade for providing $35 million of SHOT shares to BONK’s founding contributors.

Whereas overhead resistance at $0.00002854 stays the first technical barrier, BONK’s means to carry help and recuperate from heavy promoting might present the muse for renewed upside momentum if constructive market sentiment continues.

Technical Evaluation

- Worth Vary: $0.00002554 to $0.00002841 over 24 hours (12% volatility).

- Resistance: $0.00002854 stage confirmed as promote zone.

- Help: Essential $0.00002620 stage held throughout sell-off.

- Quantity Spikes: 1.12–2.16 trillion tokens traded throughout liquidation.

- Restoration Channel: Larger lows at $0.00002565, $0.00002572, $0.00002570.

- Breakout Set off: $0.00002632 stage cleared on 49.5B token surge.

- Pattern Sign: 8% drop adopted by 2% rebound suggests potential base constructing.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.