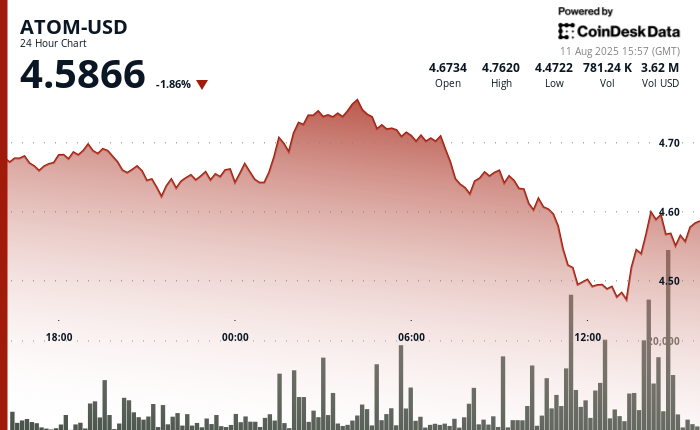

ATOM skilled sharp volatility over a 23-hour buying and selling interval from August 10 at 15:00 to August 11 at 14:00, swinging 6.20% between its $4.77 session excessive and $4.48 low. The token rallied early on August 11, climbing from $4.66 to $4.75 at 02:00 amid a surge in buying and selling quantity of 1.465 million models, establishing help close to $4.69. Nonetheless, heavy promoting strain emerged at 07:00, driving ATOM all the way down to $4.48 on 1.984 million models traded, with resistance forming round $4.71 as institutional promoting intensified.

Regardless of the sharp decline, ATOM confirmed resilience within the remaining hour of the session. From 13:07 to 14:06, the token gained 1.68%, transferring from $4.49 to $4.56 as consumers overcame resistance at $4.50 and $4.53. A burst of buying and selling exercise, together with a 60,000-unit spike between 13:46 and 13:47, helped solidify $4.54 as a brand new help degree. This late-session rebound hinted at renewed institutional curiosity following the morning’s selloff.

Market sentiment towards the Cosmos ecosystem obtained a lift through the session after Coinbase introduced help for dYdX (COSMOSDYDX), a decentralized finance platform constructed on the Cosmos blockchain. The itemizing underscored rising alternate integration with Cosmos-based initiatives, bolstering confidence amongst traders and probably influencing short-term value motion for ATOM.

ATOM’s risky buying and selling highlights the push and pull between institutional profit-taking and opportunistic shopping for at technical help ranges. Whereas the preliminary selloff mirrored broader uncertainty in digital asset markets, the fast restoration means that some institutional gamers are positioning for potential upside because the Cosmos community continues to develop its partnerships and infrastructure footprint.

Technical Indicators Spotlight Key Ranges

- Buying and selling vary of $0.29 representing 6% volatility between $4.77 most and $4.48 minimal ranges.

- Quantity help established round $4.69 with 1.465 million models throughout early session rally.

- Quantity resistance created close to $4.71 with 1.984 million models throughout institutional promoting.

- New help degree established at $4.54 following restoration momentum and purchaser curiosity.

- A number of resistance ranges damaged at $4.50 and $4.53 throughout late-session institutional shopping for.

Disclaimer: Components of this text had been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.